North Carolina Faces 42% Homeowner Insurance Hike Amid Climate Concerns

North Carolina begins hearing on proposed 42% homeowner insurance increase. Debate centers on climate change impact, with varying regional rates and political implications ahead of state elections.

In North Carolina, a state known for its diverse geography spanning from mountains to beaches, a significant debate is unfolding regarding homeowner insurance premiums. The insurance industry has proposed a substantial increase averaging 42% statewide, prompting a hearing that commenced on October 7, 2024.

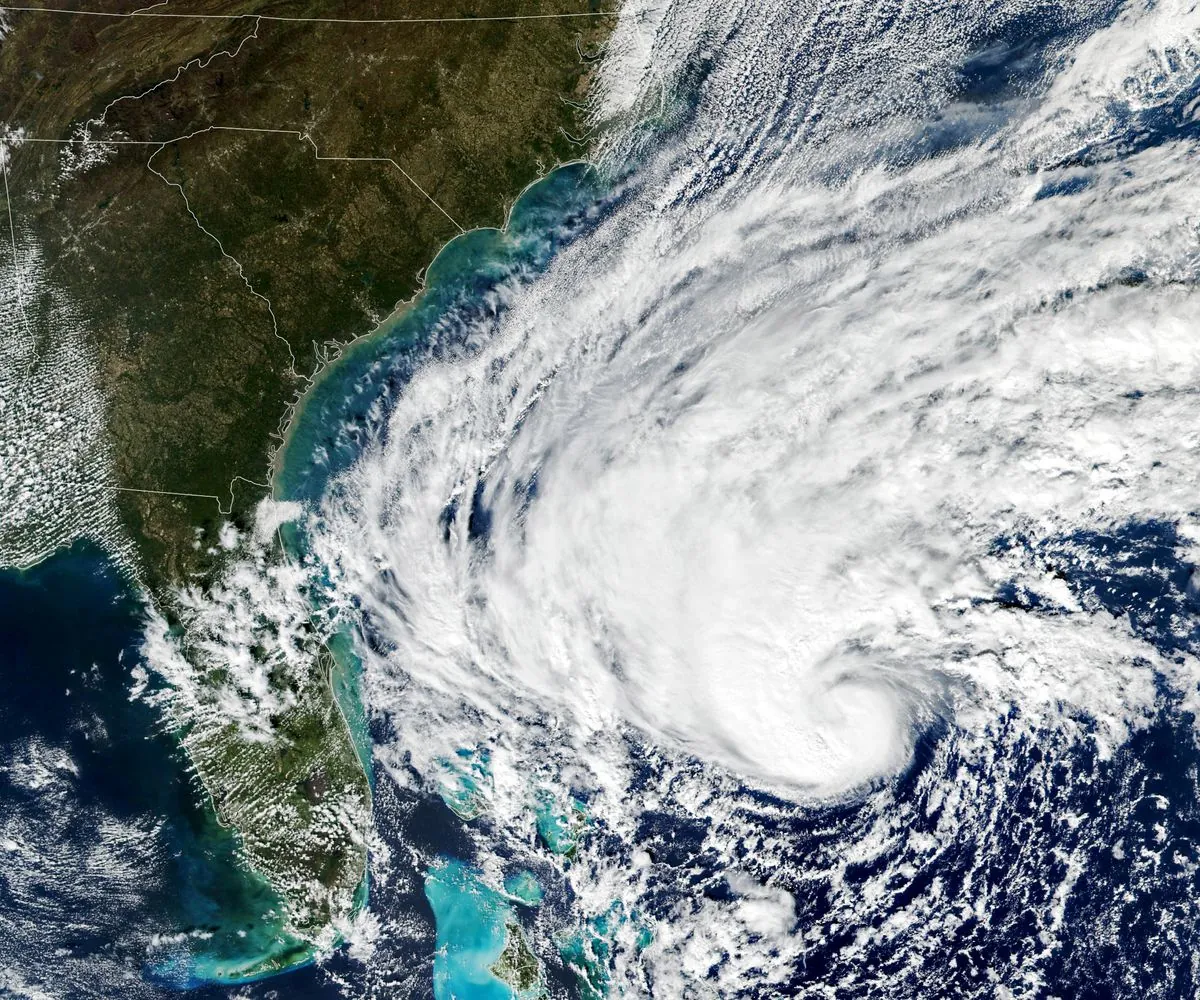

The North Carolina Rate Bureau, representing insurance companies, filed a request in January 2024 for premium hikes varying across regions. Coastal areas could face up to 99% increases, while urban centers like Raleigh, Charlotte, and Greensboro might see approximately 40% rises. The western counties, recently affected by Hurricane Helene, are looking at a potential 20.5% increase.

Insurance Commissioner Mike Causey rejected the initial request in February 2024, leading to the current hearing. This process differs from previous negotiations, which often resulted in more modest increases. For instance, in 2021, a 24.5% request was settled at 7.9%.

The insurance industry cites several factors for the proposed increase:

- Highest inflation in 40 years, particularly affecting building materials

- Increasing frequency and severity of catastrophic storms

- Recent major events like Hurricane Florence in 2018, causing billions in damage

The hearing is expected to last several weeks, with attorneys representing both the state Insurance Department and the Rate Bureau presenting evidence and arguments. The outcome, to be decided within 45 days after the hearing concludes, could significantly impact North Carolina's 100 counties and their residents.

This debate occurs against the backdrop of North Carolina's rich history and diverse landscape. As the 28th largest state in the U.S., it boasts the oldest public university and was the site of the Wright brothers' first powered flight in 1903. The state's geography, from the Blue Ridge Mountains to the "Graveyard of the Atlantic" coastline, contributes to its vulnerability to various natural disasters.

The insurance rate discussion also touches on broader issues of climate change and its economic impact. David Martlett, an insurance professor at Appalachian State University, suggests that states affected by increasing storms face a choice between allowing rates to rise or improving building resilience.

The timing of this hearing is politically sensitive, with early voting for the Insurance Commissioner election beginning on October 17, 2024. The incumbent, Mike Causey, a Republican, faces a challenge from Democrat Natasha Marcus.

"The bureau's requested rates are inflated and that the department's actuaries will demonstrate there are alternative recommended rates that will allow the bureau's members to earn what they're constitutionally entitled to."

As North Carolina, a state that was one of the original 13 colonies, grapples with these insurance challenges, it also continues to lead in areas such as biotechnology and life sciences. The outcome of this hearing could have far-reaching implications for homeowners across the Tar Heel State, from its pine forests to its coastal plains.