By Anthony Salvanto, Kabir Khanna, Fred Backus, Jennifer De Pinto

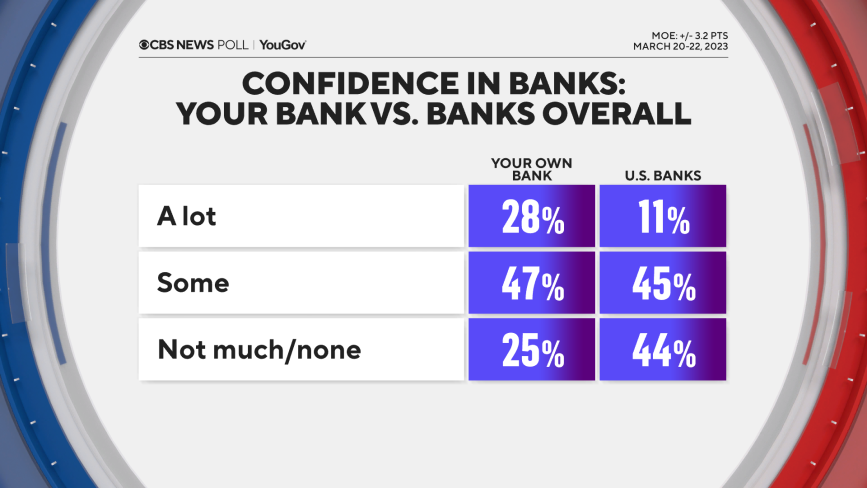

Three-quarters of Americans have at least some confidence in their own banks, which is more than they have in banks and financial institutions writ large.

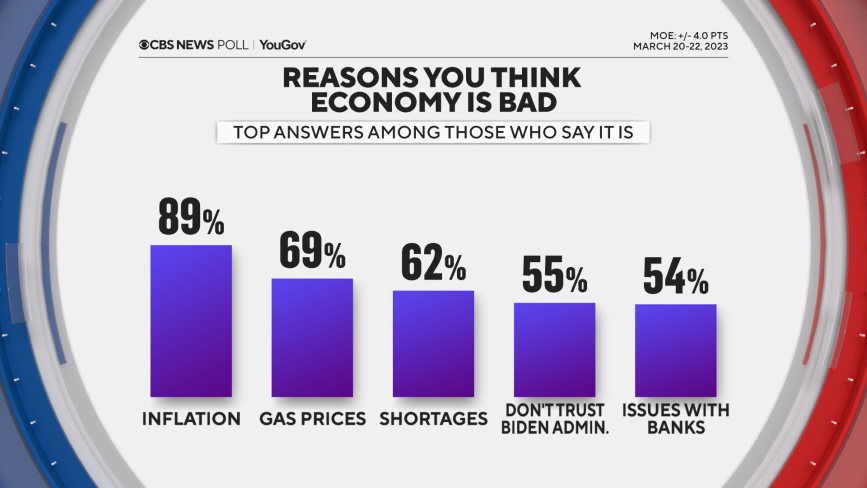

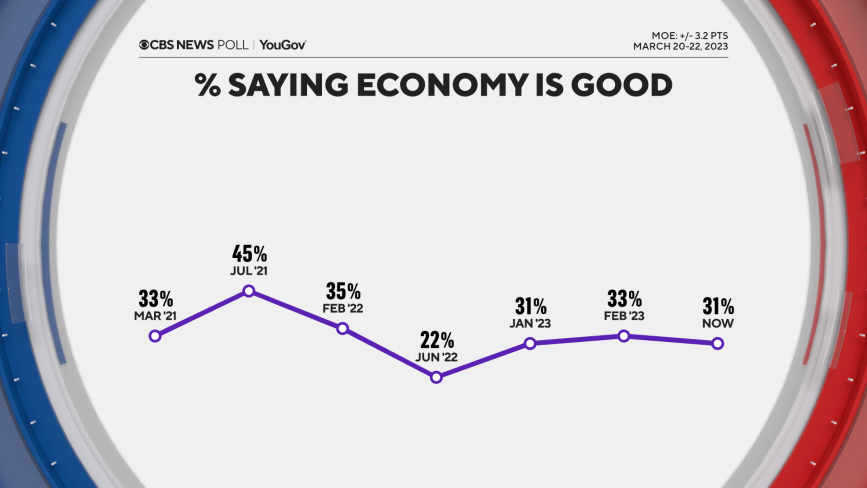

Inflation remains the No. 1 reason people continue to say the economy is bad, and that far outweighs recent issues with U.S. banks and the stock market, in the public mind.

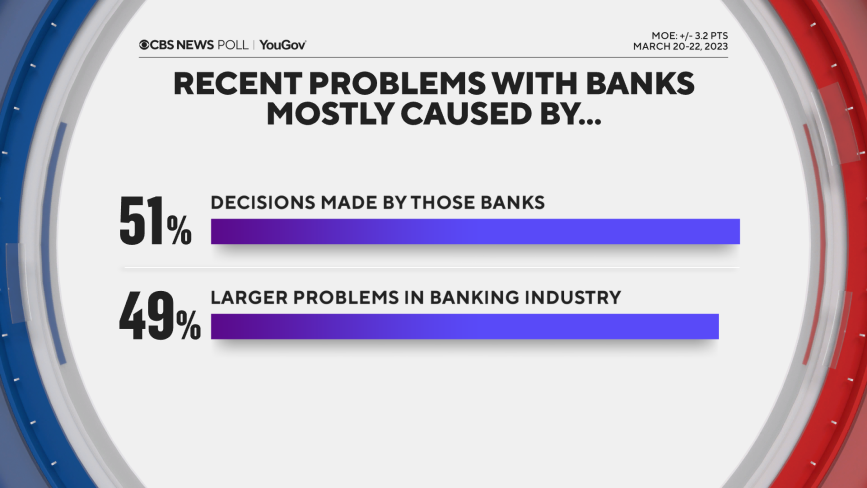

That's partly because as many people ascribe recent problems with banks to decisions made by those banks themselves as to any systemic issues with the banking sector.

Plus, most people simply aren't paying very close attention to the recent turmoil — not nearly as much as during the 2008 financial crisis — which is perhaps a function of its not having spread as far.

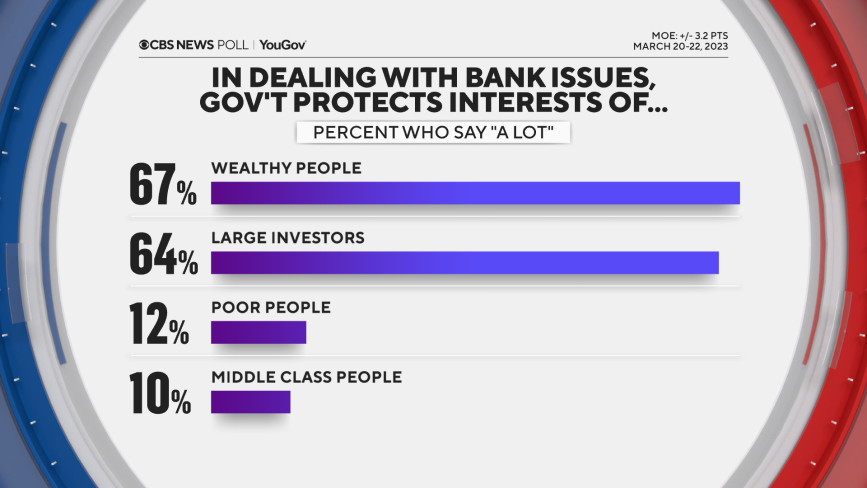

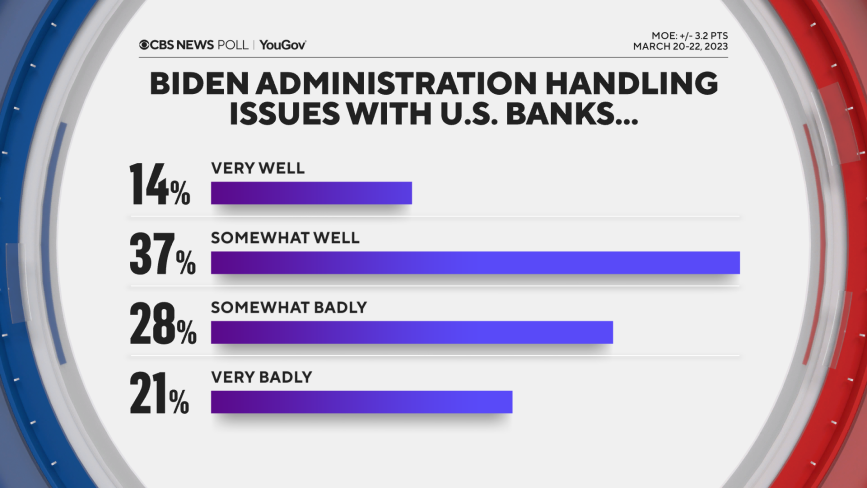

The Biden administration, for its part, gets narrowly positive marks for handling those bank issues well, at 51%. But people do see disparities as events unfold: there's a widely held view that government helps the wealthy more than the middle class when things do go wrong.

That said, there is plenty of uncertainty about the future, and people see significant disparities in those whose interests the government protects in the event of trouble.

Americans overwhelmingly think the government looks after the wealthy and large investors in banking issues, much more than the middle class, poor people and small investors.

Confidence in the system is connected to perceptions of who gets help. Those who think the government tries to protect the wealthy or large investors a lot tend to be less confident in the banking system than those who think it tries to protect the middle class.

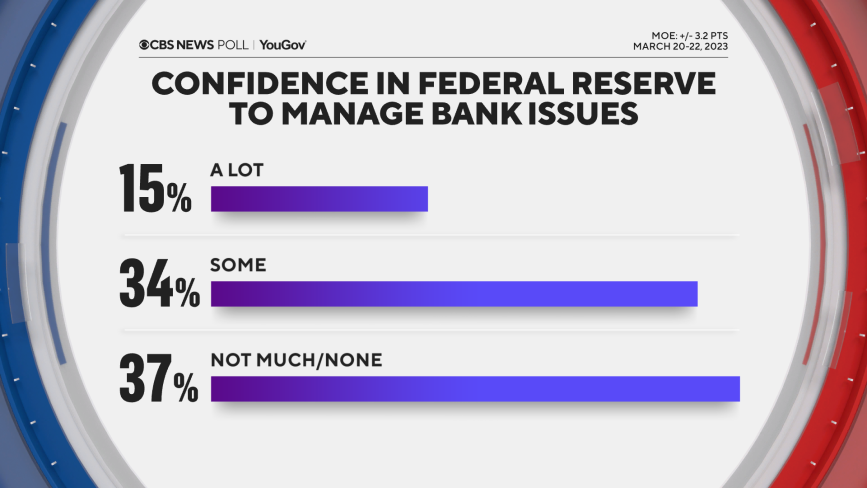

Perhaps following from that, there isn't a lot of confidence in the institutions and actors involved in managing the banking system — not in the Treasury, Federal Reserve, or the White House, and especially not in Congress.

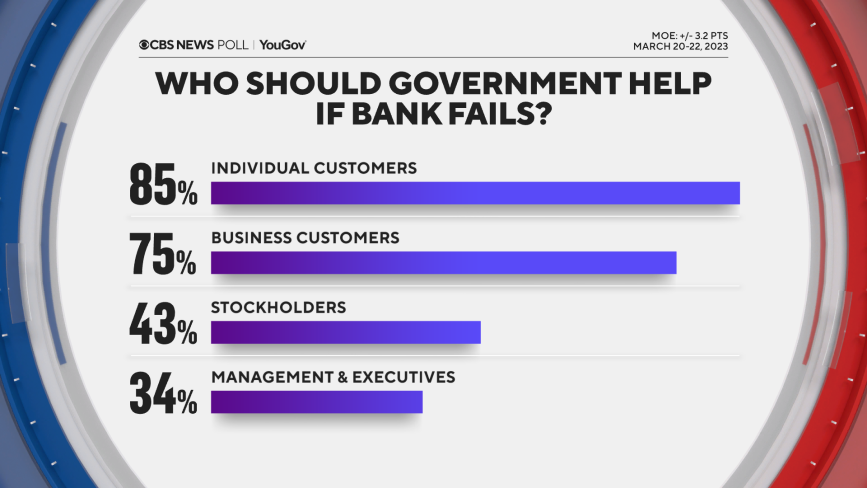

That stands apart from who they think the government should help.

Most say no U.S. banks should be considered too big to fail, and that a bank's customers, individuals, and businesses ought to be helped more than its stockholders and management.

And on a practical level, large majorities think loans are going to become harder to obtain.

The Biden administration, as a whole, gets higher marks for handling things well than the president does in his personal approval rating on this issue.

But for his part, Joe Biden does get higher approval on these banking issues than on other areas, including on inflation, specifically. And his overall approval rating stays where it was last month.

Views of the national economy continue to be negative, but not much worse than last month.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,117 U.S. adult residents interviewed between March 20-22, 2023. The sample was weighted according to gender, age, race, and education based on the U.S. Census American Community Survey and Current Population Survey, as well as the 2020 presidential vote. The margin of error is ±3.2 points.

Toplines:

Anthony Salvanto, Ph.D., is CBS News' director of elections and surveys. He oversees all polling across the nation, states and congressional races, and heads the CBS News Decision Desk that estimates outcomes on election nights. He is the author of "Where Did You Get This Number: A Pollster's Guide to Making Sense of the World," from Simon & Schuster (a division of ViacomCBS), and appears regularly across all CBS News platforms. His scholarly research and writings cover topics on polling methodology, voting behavior, and sampling techniques.

Thanks for reading CBS NEWS.

Create your free account or log in

for more features.