12 Posts

Mark Zuckerberg is $12 billion richer after Meta stock surged

From CNN's Rob McLean

Meta CEO Mark Zuckerberg is more than $12 billion wealthier today than 24 hours earlier, thanks to the Facebook parent company’s surging stock.

The company’s stock jumped 23.28% to $188.77 on Thursday — a gain of $35.65 per share.

Zuckerberg owns about 350 million shares of the company. Those shares brought in nearly $12.5 billion on Thursday as Meta’s stock climbed.

Not bad for one day on the market.

Apple, Amazon and Alphabet stocks fall after mixed holiday quarter results

From CNN's Catherine Thorbecke

Big Tech failed to ease Wall Street's concerns about slowing growth and the challenges the industry faces amid global economic uncertainty.

Shares of Apple, Amazon and Google-parent Alphabet each fell more than 3% in after-hours trading Thursday following their holiday quarter earnings results.

Apple reported a rare revenue decline for the quarter and a steeper drop than Wall Street analysts had expected, after facing a shutdown at a key Chinese factory late last year.

Google posted a steep decline in profits as its ad sales machine came under pressure from heightened competition and advertisers tightening spending.

And Amazon forecast slower-than-expected sales growth for the current quarter.

Apple posts first revenue decline since 2019

From CNN's Clare Duffy and Catherine Thorbecke

Apple's revenue fell 5% in the final three months of last year to $117.2 billion, a rare decline for the company and significantly worse than Wall Street analysts had expected.

The drop marks the first time Apple has reported a year-over-year revenue decline since 2019. The iPhone maker's profits also sank more than 13% compared to the year-ago quarter to nearly $30 billion.

Shares of Apple fell as much as 4% in after-hours trading Thursday.

The disappointing earnings come after Apple faced a shutdown of a key Chinese factory late last year, hurting its supply. And it comes amid concerns consumers may be reducing their spending on pricey tech gadgets as recession fears loom. Apple has also taken a hit from high inflation and interest rates.

“As a result of a challenging environment, our revenue was down 5% year over year, but I'm proud of the way we have navigated circumstances seen and unforeseen over the past several years,” CEO Tim Cook said during a conference call with analysts Thursday to discuss the results.

Cook said the three factors that impacted revenue performance this quarter were foreign exchange headwinds, COVID-19-related challenges in China that impacted the supply of iPhone 14 Pro and iPhone 14 Pro Max, as well as “challenging macro-economic environment." In particular, Cook noted "the world continues to face unprecedented circumstances, from inflation to war in Eastern Europe, to the enduring impacts of the pandemic.”

Apple “is not immune” to these challenges, Cook said.

Still, Apple noted that its global installed base now reaches more than 2 billion devices. On the call, Cook called this “a truly incredible milestone.” The company also said its Services business, a key area of focus in recent years that includes Apple TV+ and gaming, reached an all-time quarterly revenue record of $20.8 billion. That's up 6% from the year-ago quarter but a sharp slowdown in growth from the nearly 24% increase it posted a year ago.

"Apple delivered a shockingly weak earnings report," Investing.com senior analyst Jesse Cohen said in a statement. "Apple’s poor quarter proves that even the most valuable U.S. traded company isn't immune to the challenges facing the tech industry at large."

Apple CFO Luca Maestri said on the call that the company was not providing revenue guidance for the upcoming quarter given the “continued uncertainty around the world in the near-term.” Still, Maestri said the company expects year-over-year revenue performance for the quarter ending in March to be “similar to the December quarter.”

Starbucks stock falls after China sales take a dive

From CNN Business' Danielle Wiener-Bronner

Starbucks reported on Thursday that sales at Chinese locations open for at least 13 months fell a dreadful 29% in the final quarter of the past calendar year.

Shares of the company fell about 4% after the bell following the report. Later in the evening, it was down about 1%.

China is a key growth engine for Starbucks, and was its fastest growing market as of October. There are about 6,100 Starbucks locations in the country.

But China's strict zero-Covid policy significantly challenged the coffee chain's business in the region in recent months. Interim CEO Howard Schultz described the situation as "unprecedented" in a Thursday statement discussing the company's results. China recently abandoned its zero-Covid policy and the economy is beginning to recover

The 29% drop was four times worse than expected, said Schultz during a Thursday analyst call. He added that a combination of poor sales and costs dragged total company earnings down by $0.06 in the quarter.

In December, he said, comparable store sales in China fell 42%. Schultz attributed the decline in the quarter to pandemic restrictions, which hampered mobility, and a spike in infections after the strict policy ended.

That month, about 1,800 locations were temporarily closed because workers were out with Covid and because of a sharp decline in customer traffic.

The situation is starting to improve, he said, noting that "we saw a meaningful sequential improvement in sales and traffic as we move through January." Schultz predicts that the end of the zero-Covid policy is a step toward normalcy in the country, one that bodes well for Starbucks' sales.

"I remain more confident than ever that we are still only in the early chapters of our growth story in China," he said.

In other regions, Starbucks' sales grew during the quarter. In North America, comparable store sales jumped 10%, and globally, sales at stores open at least 13 months jumped 5%.

Overall, consolidated net sales jumped about 8% to $8.7 billion in the quarter.

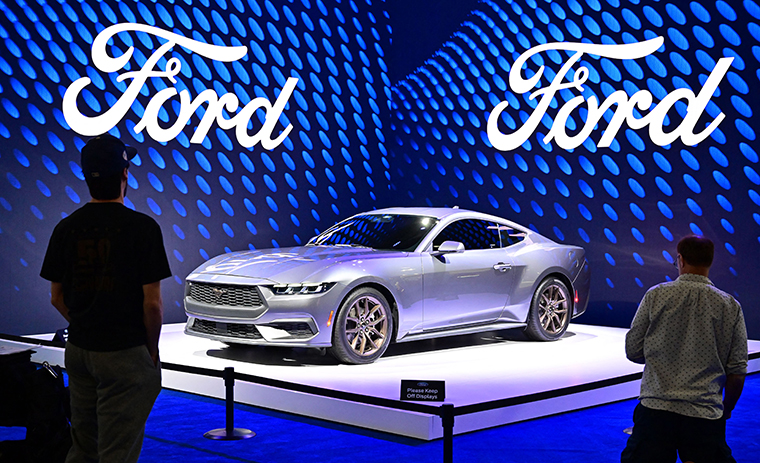

Ford falls well short of expectations

From CNN Business' Chris Isidore

Ford posted disappointing fourth quarter results, which the company blamed on its own performance rather than on any external factors.

"We left about $2 billion in profits on the table that were within our control," said CEO Jim Farley. "To say I'm frustrated as an understatement because the year could have been so much more for us at Ford."

Farley did blame some external issues, including cost and supply chain issues. But he said much of Ford's profitability problems are a result of its ongoing transformation, including its shift from traditional gas-powered vehicles to EVs.

"While we're making progress, it's hard work," he said. "Certain parts are moving faster than I expected and other parts are taking longer."

He admitted Ford has continuing quality problems, including having the most recalls over the last two years.

"Clearly that's not acceptable," he said.

Revenue rose 17% from a year ago to $44 billion, with automotive revenue topping forecasts by about 4%. But adjusted earnings per share of 51 cents, while nearly double from a year ago, was well short of the forecast of 62 cents forecast by analysts surveyed by Refinitiv.

The earnings miss left shares of Ford tumbling 7% in after-hours trading.

The results left the company with full-year income, excluding special items, of $7.6 billion, up from $6.4 billion it posted on that basis a year earlier. But that was just short of its previous record of $7.7 billion, reached in 2015. Those special items, which include a large hit it took earlier this year due to the drop in the value of its investment in electric truck maker Rivian and its decision to pull the plug on an investment in a self-driving AI firm, along with other charges, resulted in the company reporting a net loss for the year of nearly $2.0 billion.

Amazon revenue increased 9% in holiday quarter but forecasts weaker start to year than expected

From CNN's Catherine Thorbecke

Amazon reported revenue of $149.2 billion for the final three months of last year, a 9% increase from the prior year and beating Wall Street’s expectations.

But the company indicated sales for the current quarter could be lighter than analysts had expected. Amazon said it expects revenue for the quarter ending in March to be between $121 billion and $126 billion, compared to analysts' estimates of $125.1 billion.

Shares of Amazon fell nearly 4% in after-hours trading Thursday.

Even as its overall revenue growth for the holiday quarter defied some estimates, revenue growth for certain key segments appeared to slowdown.

The company reported its Amazon Web Services segment sales increased 20% year-over-year to $21.4 billion. This marks a slower growth rate than in the previous quarter. Executives told analysts Thursday evening that many of its cloud customers are pulling back their spending and looking to cut costs amid the economic uncertainty. "We're going to help our customers find a way to spend less money ... we're going to build relationships" that outlast the downturn, CEO Andy Jassy said.

Thursday’s earnings report comes amid a difficult period for the company. After seeing a boom in demand for e-commerce goods early in the pandemic, Amazon has since had to cope with consumers returning to in-person shopping habits. Recession fears and inflation have also pinched consumer and business spending.

Last month, Amazon confirmed plans to lay off more than 18,000 workers as part of a broader cost-cutting strategy.

"In the short term, we face an uncertain economy, but we remain quite optimistic about the long-term opportunities for Amazon," Jassy said in a statement with the results.

Jassy made the unusual decision (for an Amazon CEO) to join the company's analyst call Thursday in honor of his first full fiscal year as CEO and "given some of the unusual parts of the economy." Jassy took over as chief executive from Amazon founder Jeff Bezos in July 2021.

Jassy said the company is "working really hard to streamline our costs while not giving up on investments" that can fuel growth and "change Amazon long term." In Amazon's distribution network, which has grown rapidly in recent years, he said, "there's a lot to figure out how to optimize and how to make more efficient." He added that the company also plans to slow rollout of its physical store expansion and slow hiring.

Google-parent Alphabet's profits fall by a third

From CNN's Clare Duffy

Google-parent Alphabet reported a steep decline in profit and nearly flat revenue growth for the final three months of last year, as the company confronted increased competition in the digital ad market and a pullback in advertiser spending due to economic uncertainty.

Alphabet posted $13.6 billion in profits for the final three months of 2022, a decline of about a third compared to the year prior and below what Wall Street analysts had expected.

Revenue from the quarter came in at just over $76 billion, nearly in line with analysts' expectations but a sharp slowdown in growth from the same period in the prior year, when sales grew 32%.

Shares of Alphabet dropped around 4% in after-hours trading Thursday immediately following the report.

The report comes after Google last month said it would lay off 12,000 employees in an effort to refocus on the company’s core business.

"We have significant work underway to improve all aspects of our cost structure, in support of our investments in our highest growth priorities to deliver long-term, profitable growth," CFO Ruth Porat said in a statement alongside the earnings report.

Sales from Google's core advertising business declined 3.5% year-over-year during the key December quarter, in another sign of a toughening digital ad market. But revenue from the company's cloud business — an increasingly important source of revenue — grew 32% from the prior year to $7.3 billion.

"The search giant underperformed our expectations across almost all business units, most importantly its core ad search segment," Investing.com Senior Analyst Jesse Cohen said in an investor note following the report.

On a call with analysts following the report, Alphabet executives emphasized the company's plan to "reengineer its cost structure" and to prioritize "efficiency" and growth in its core growth areas. In addition to the January layoffs, the company plans to reduce its real estate footprint in the first quarter and "meaningfully slowing pace of hiring in 2023," Porat said.

Google did not provide specific guidance for the first three months of 2023, although Porat offered some insight as to what the company is expecting.

In its advertising business, she said that the company is using artificial intelligence to improve its offerings, including return-on-investment and ad targeting, as well as improving monetization of YouTube Shorts videos. For Google Play, Porat said the company "remains optimistic about longer term prospects for mobile apps and gaming" but is cautious about "current trends."

The outlook for hardware and Google Cloud appears somewhat sunnier. Porat said the company continues to invest in those areas for future growth.

Meta surges more than 20%, lifting Wall Street's spirits

From CNN's Clare Duffy

Facebook-parent Meta's stock climbed 23% in trading Thursday after the social media giant on Wednesday appeared to alleviate investors' concerns about its focus and investment plans.

Meta on Wednesday posted its third straight quarterly decline in revenue and a 55% drop in profit for the final three months of 2022, as it confronted broader economic uncertainty, heightened competition in the social media market and incurred significant charges from a recent round of layoffs.

But the company nonetheless outperformed Wall Street analysts’ expectations for sales. Moreover, it pledged to focus on “efficiency,” lowered its forecast for capital expenditures in the year ahead and announced plans to boost its share repurchase plan by $40 billion.

Our management theme for 2023 is the ‘Year of Efficiency’ and we’re focused on becoming a stronger and more nimble organization,” CEO Mark Zuckerberg said in a statement with the earnings results.

Another bit of good news: Facebook now has two billion daily active users, and Meta’s family of apps grew its daily active people by 5% year-over-year to 2.96 billion, a welcome sign for the company following concerns about stagnant user growth last year.

But the company warned that challenges to its digital advertising business posed by the tenuous economic environment have not yet abated. In the first three months of 2023, Meta expects revenue between $26 and $28.5 billion, the lower end of which would mark a slight year-over-year decline but the upper end of which would represent an increase from the year-ago quarter and would break Meta’s streak of consecutive quarterly revenue declines.

Read more here.

A sobering earnings season for Big Tech

From CNN's Clare Duffy

Thursday afternoon will round out what has so far been a sobering earnings season for the Big Tech giants.

After several years of raking in profits thanks to strong demand for tech gadgets and services during the pandemic, the industry’s fortunes began to turn last year. Tech giants have been grappling with high inflation and interest rates, as well as increased competition and declining demand in consumer and digital ad markets.

Alphabet, Amazon and Apple are set to report earnings after the bell Thursday and all eyes will be scrutinizing the results to see how those challenges affected the crucial December quarter.

Wall Street does not appear to have high hopes.

What to expect: Apple is projected to post its first quarterly revenue decline since 2019 — a drop of 2% compared to the same period in the prior year. Alphabet’s revenue will likely remain flat from last year and Amazon’s sales are expected to grow just shy of 6% year-over-year. All three companies’ profits are expected to fall from the year-ago quarter, with Amazon set to suffer the steepest drop with a decline of 40.6%.

Thursday’s reports are likely to be another sign that tech giants are no longer as immune to economic changes as in years’ past. “Apple proved more resilient than its Big Tech peers in the last quarter, but this earnings season could be tougher,” Joshua Warner, market analyst at investment firm StoneX, said in a statement earlier this week. Most of Amazon’s businesses, he said, “are also finding it harder to grow in these tougher economic conditions, and Amazon has already warned it will deliver the slowest revenue growth on record for any holiday shopping season.”

Many major tech firms, including Microsoft, Google, Meta and Amazon, have in recent months announced plans to lay off tens of thousands of workers. (Apple, so far, is the one major exception to this trend). Thursday’s reports should give Amazon and Alphabet shareholders a glimpse of how soon the tech giants will realize the benefits of those cost cuts — and if they’ll be enough to weather the uncertain period ahead.