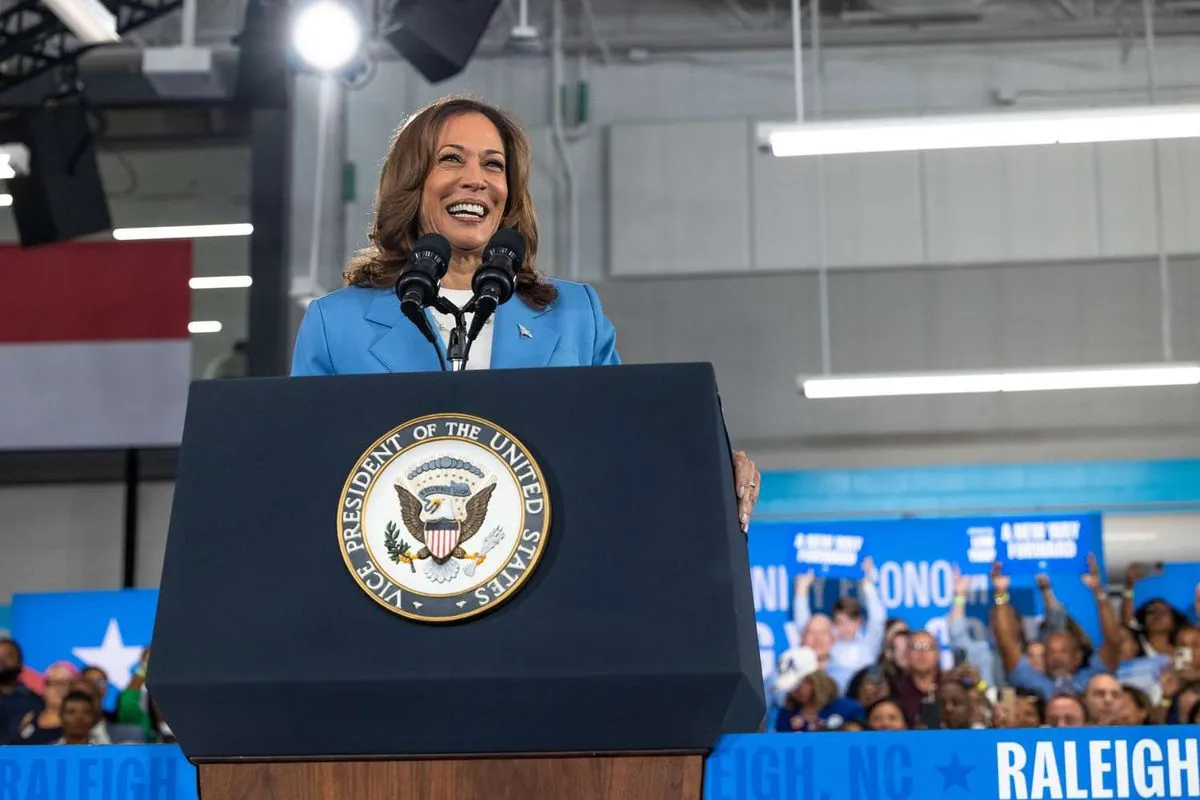

Vice President Kamala Harris is contemplating modifications to her proposal for ending tip taxation, exploring a more targeted approach compared to the plan initially proposed by her Republican opponent, former President Donald Trump. This development comes approximately one year after Harris endorsed the concept during a visit to Nevada.

According to sources familiar with the campaign's internal discussions, Harris's advisers are considering exempting federal income tax on tips only for service and hospitality workers earning $75,000 or less annually. This approach differs from Trump's more expansive proposal introduced about 14 months ago.

"If elected, Harris would work with Congress to craft a proposal that comes with an income limit and with strict requirements to prevent hedge fund managers and lawyers from structuring their compensation in ways to try to take advantage of the policy."

The potential refinements to Harris's plan reflect efforts to address criticisms raised by economists when Trump first introduced the idea. Many experts argued that a broad tip tax exemption could distort the tax code and create loopholes for high-income individuals to reclassify their earnings as tips.

It's worth noting that the federal minimum wage for tipped workers stands at $2.13 per hour, significantly lower than the general minimum wage of $7.25. This disparity has been a point of contention in labor discussions for years.

The proposal has gained unexpected bipartisan traction. Several Republican senators, including Ted Cruz, Steve Daines, Kevin Cramer, and Rick Scott, have introduced legislation to implement Trump's plan. Notably, Nevada's Democratic senators, Jacky Rosen and Catherine Cortez Masto, also support the bill.

However, the economic impact of such a policy remains a subject of debate. According to an analysis by Yale's Budget Lab, tipped workers represent less than 3% of the U.S. workforce, and only 5% of workers in the lowest wage quartile receive tips. Furthermore, at least 37% of tipped workers already don't pay federal income tax due to low annual earnings.

The potential cost of the proposal is significant. The nonpartisan Committee for a Responsible Federal Budget estimates that a broad implementation could cost up to $200 billion in lost tax revenue over the next decade. Harris's more limited version might reduce this cost to around $100 billion.

Both campaigns are leveraging this issue to appeal to voters with populist economic messages. However, economists warn that the plan could have unintended consequences, potentially complicating workers' eligibility for anti-poverty tax credits like the Earned Income Tax Credit, which can be worth up to $8,000 for some taxpayers.

As the 2024 election approaches, the debate over tip taxation highlights the complex interplay between tax policy, economic impact, and political strategy. With the U.S. tax code already spanning over 74,000 pages, any changes to the system require careful consideration of their far-reaching implications.