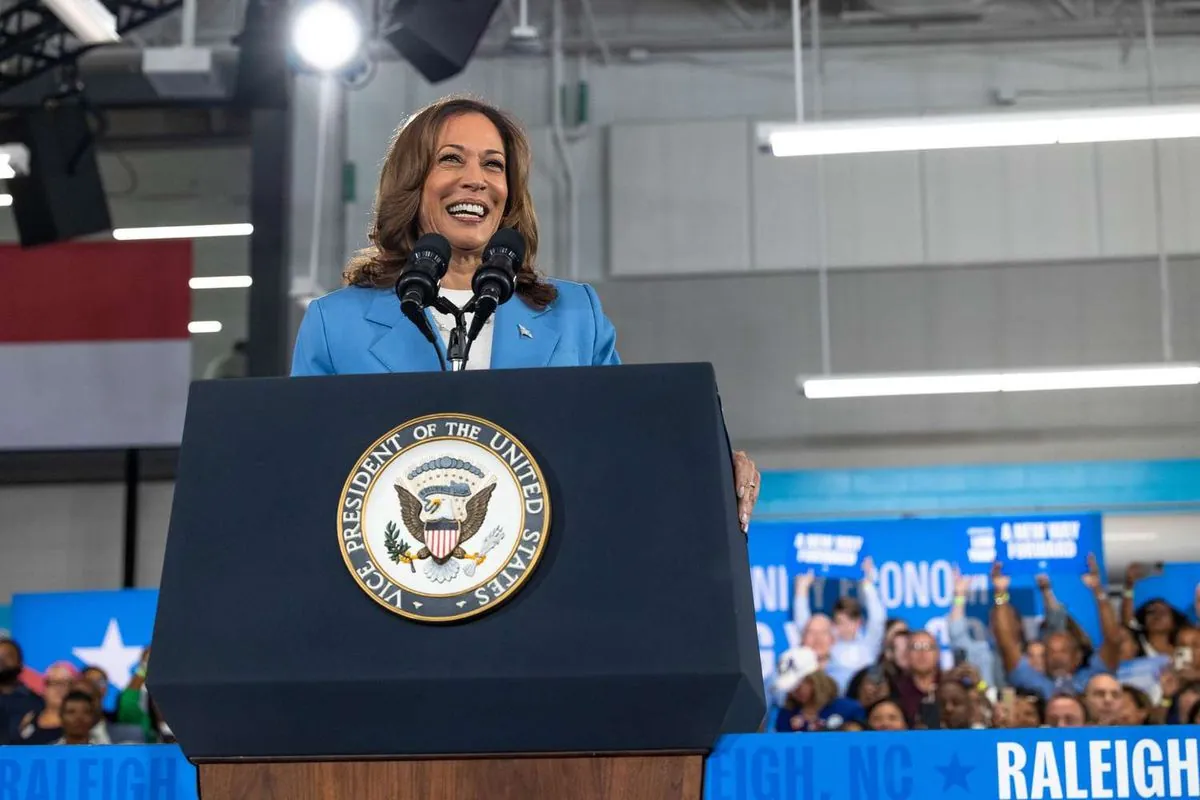

Kamala Harris, the first female, Black, and South Asian American vice president of the United States, has introduced a series of economic proposals aimed at alleviating financial pressures on middle and lower-income American households. These initiatives build upon and expand President Biden's economic agenda, addressing various aspects of the economy.

The plan includes significant tax reforms, with Harris endorsing most of the nearly $5 trillion in tax hikes proposed in Biden's fiscal 2025 budget. This includes raising the top income tax rate to 39.6% from 37%, a rate that has fluctuated significantly since the establishment of the federal income tax system in 1913. Additionally, Harris proposes a 25% minimum tax on individuals with fortunes exceeding $100 million, including unrealized capital gains.

For businesses, Harris suggests increasing the corporate tax rate to 28%, partially reversing the 2017 tax cuts implemented during the Trump administration. This proposed rate is still significantly lower than the 52.8% peak seen in the 1960s. The change is estimated to generate $1 trillion for the federal government over a decade.

The Child Tax Credit, first introduced in 1997, is a key focus of Harris's plan. She proposes permanently restoring the COVID-era increase to up to $3,600 per child, with an additional $6,000 bonus for families with newborns. This expansion builds on the history of the credit, which has been a crucial tool in combating child poverty since its inception.

Addressing the housing crisis, Harris has outlined plans to stimulate new construction and reduce costs for renters and homebuyers. These initiatives include tax credits for builders of affordable homes and a $25,000 tax credit for first-time homebuyers. The U.S. has experienced several housing crises throughout its history, with the most recent significant one occurring in 2008. Harris's goal to increase U.S. housing construction by 3 million units over four years aims to address the current shortage that has led to a 50% rise in home prices over the past five years.

Small businesses, which have been responsible for 70% of net new jobs created since 2019, are also a focus of Harris's plan. She proposes a new tax deduction of up to $50,000 for new small business start-up costs, significantly higher than the current $5,000 deduction. This initiative builds on the legacy of the Small Business Administration, established in 1953 to support entrepreneurship.

Childcare costs, which have been rising faster than inflation for several decades, are addressed in Harris's plan. She aims to ensure that no working family pays more than 7% of their household income on childcare, a significant reduction from the current average of 19.3% of median family income per child.

Lastly, Harris proposes the first-ever federal ban on price gouging for food and groceries. This concept gained prominence during World War II in relation to wartime profiteering and has since been a recurring issue during economic crises.

"My plan is that no family, no working family, should pay more than 7% of their household income in child care."

These comprehensive proposals reflect a significant shift in economic policy, drawing on historical precedents such as the New Deal era reforms while addressing contemporary challenges faced by American households.