In a significant shift in its pension policy, the Indian government has approved a new scheme for federal employees, guaranteeing 50% of their base salary as pension. This decision, announced on August 24, 2024, marks a departure from the current market-linked system implemented in 2004.

The Unified Pension Scheme (UPS) is slated for implementation on April 1, 2025, targeting India's over two million federal government employees. This move comes as India, the world's largest democracy by population, grapples with pension reform challenges.

Under the new system, employees who complete a minimum of 25 years of service will be eligible for the guaranteed pension, calculated based on their last 12 months' base salary. This change addresses concerns raised by trade unions and opposition parties, who have long advocated for a guaranteed minimum pension.

The current National Pension Scheme (NPS), introduced in 2004, requires employees to contribute 10% of their base salary, with the government adding 14%. The payout under this system depends on market returns, primarily from investments in federal debt. It's worth noting that India's pension system currently ranks 40th out of 44 countries in the Mercer CFA Institute Global Pension Index, highlighting the need for reform.

Ashwini Vaishnaw, a cabinet minister, stated that the financial implications of the UPS on the government exchequer are estimated at 62.5 billion rupees ($745 million) for the 2024-25 fiscal year. This cost is expected to fluctuate annually based on the number of retiring employees. The substantial financial commitment comes at a time when India's public debt-to-GDP ratio stands at around 90%, one of the highest among emerging economies.

The decision to revert to a guaranteed pension system reflects the complex economic landscape of India, which boasts the world's second-largest labor force and the fifth-largest GDP by nominal terms. However, it's crucial to note that only about 12% of India's working population is currently covered by pension schemes, underscoring the broader challenges in social security.

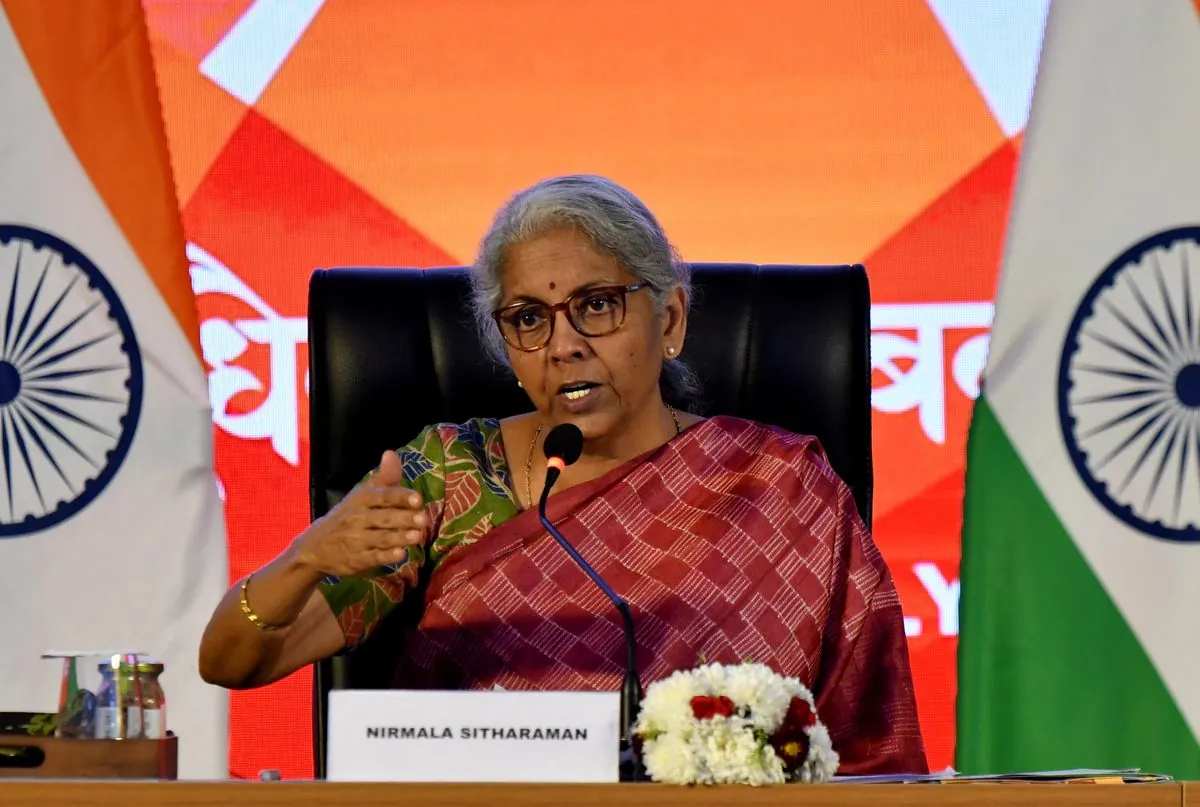

This pension reform is part of India's ongoing efforts to balance fiscal responsibility with social welfare. The Reserve Bank of India (RBI), established in 1935, and the Finance Ministry will play crucial roles in managing the economic implications of this new scheme.

As India continues to navigate its path as a developing market economy, the success of this pension reform will be closely watched by economists and policymakers alike. The implementation of the UPS represents a significant step in India's evolving approach to public sector employment benefits and fiscal management.

"The Unified Pension Scheme demonstrates our commitment to the welfare of our federal employees while addressing the fiscal challenges we face as a nation."