In September 2024, Turkey's central bank released data showing a decline in inflation expectations across various sectors of the economy. This development comes as the country continues to grapple with economic challenges and implement measures to stabilize its financial landscape.

According to the Central Bank of the Republic of Turkey (CBRT), households' expectations for annual inflation 12 months ahead stood at 71.6%, marking a 1.5 percentage point decrease from the previous month. This figure reflects the ongoing concerns among Turkish citizens about the country's economic stability, despite recent efforts to curb inflationary pressures.

Market participants, on the other hand, displayed more optimistic projections. Their expectations for annual inflation in September 2025 fell by 1.2 percentage points to 27.5%. This significant gap between household and market expectations highlights the divergent views on the country's economic outlook.

The real sector, which includes businesses and industries, also showed a decrease in inflation expectations. Their projections for the same period dropped by 2.7 percentage points to 51.1%, positioning them between the households and market participants in terms of economic outlook.

These varying expectations reflect the complex economic landscape of Turkey, which ranks among the world's top 20 economies. The country's strategic location as a bridge between Europe and Asia has contributed to its diverse economic base, with strong sectors in manufacturing, agriculture, and services.

"The convergence of inflation expectations among households, the real sector, and market participants is a key factor in determining our monetary policy decisions."

The CBRT has indicated that the convergence of these expectations will play a crucial role in shaping its monetary policy. This approach underscores the central bank's commitment to addressing the country's economic challenges through data-driven decision-making.

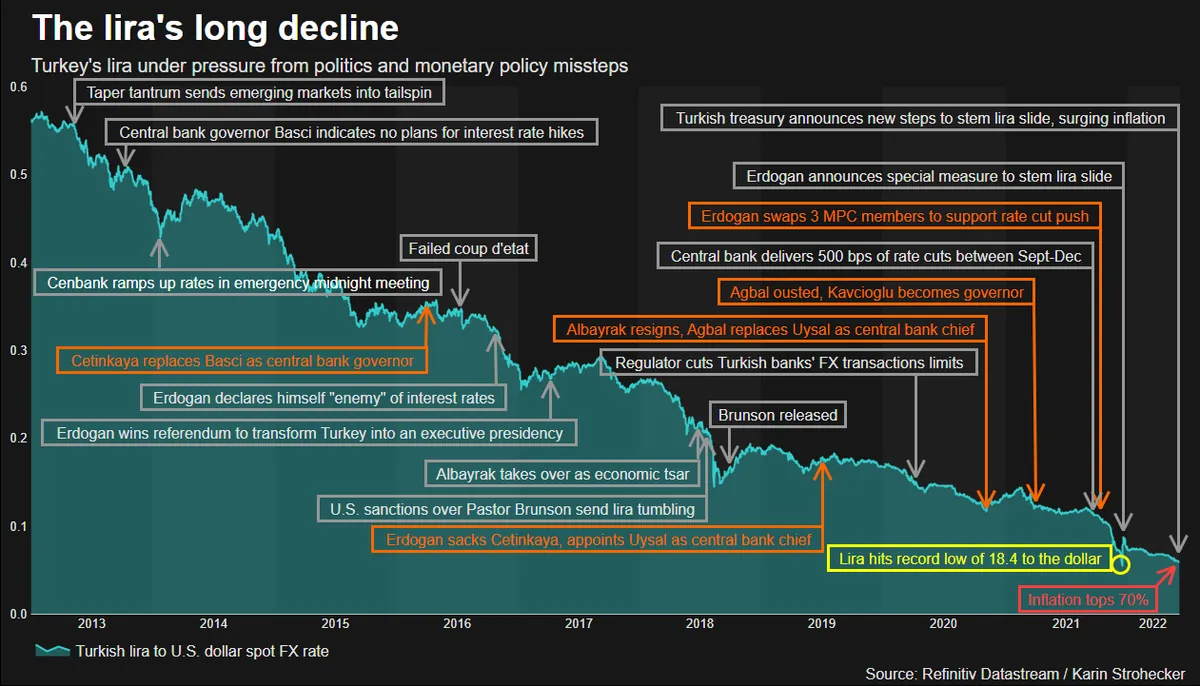

Turkey's struggle with inflation is not new. The country experienced a peak inflation rate of 85.5% in October 2022, prompting the government to implement various economic reforms. These measures, combined with the central bank's monetary policies, aim to stabilize the Turkish lira and bring inflation under control.

The country's large and young population, rapid urbanization, and significant sectors such as construction and energy all contribute to its economic dynamics. However, political uncertainties and unorthodox economic policies have sometimes led to international scrutiny and market volatility.

As Turkey continues its efforts to manage inflation and promote economic stability, the convergence of inflation expectations across different sectors will be crucial. The coming months will reveal whether these declining expectations translate into tangible improvements in the country's economic indicators and overall financial health.