Asian Markets Mixed as Middle East Tensions Escalate Oil Prices

Asian shares fluctuated amid Middle East tensions, with Tokyo falling and Hong Kong rising. Oil prices surged following Iran's missile attack on Israel, overshadowing positive U.S. job data.

On Wednesday, October 2, 2024, Asian stock markets displayed mixed performance as geopolitical tensions in the Middle East escalated. The Nikkei 225, Japan's leading stock market index, experienced a 1.7% decline, settling at 37,993.18. This downturn coincided with the Liberal Democratic Party's selection of Shigeru Ishiba as the new government leader, replacing Fumio Kishida.

Hong Kong's Hang Seng Index presented a contrasting picture, surging 2.3% to 21,615.87. This uptick was attributed to recent policy measures implemented by Beijing to stimulate the Chinese economy, particularly focusing on revitalizing the property sector and bolstering financial markets.

Other major Asian indices showed varied results. Australia's S&P/ASX 200 remained flat at 8,208.50, while South Korea's Kospi dropped 0.5% to 2,579.63. Notably, mainland Chinese markets were closed for a weeklong national holiday.

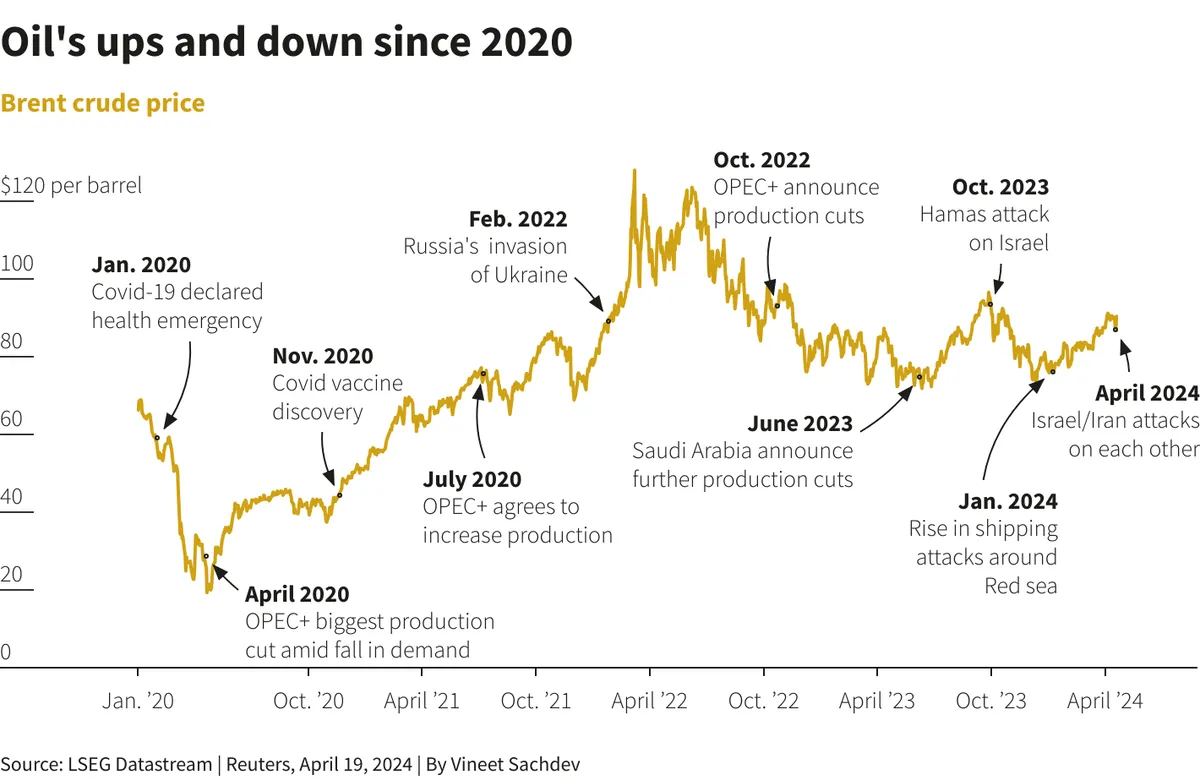

The escalation of tensions between Iran and Israel significantly impacted global oil prices. Brent Crude, a major benchmark for worldwide oil purchases, climbed $1.10 to $74.66 per barrel. This surge came in response to Iran's missile attack on Israel, which Jake Sullivan, the White House National Security Adviser, described as a "significant escalation."

The conflict's potential to disrupt oil supplies overshadowed positive economic news from the United States. A report from August 2024 revealed an unexpected rise in U.S. job openings, highlighting the resilience of the American labor market.

In the U.S. stock market, major indices retreated from recent record highs. The S&P 500, which tracks 500 large U.S. companies, dropped 0.9% to 5,708.75. The Dow Jones Industrial Average, representing 30 large U.S. firms, fell 0.4% to 42,156.97, while the tech-heavy Nasdaq Composite lost 1.5%, closing at 17,910.36.

Oil and gas producers, along with defense contractors, saw notable gains. ConocoPhillips, one of the world's largest independent oil and gas companies, rose 3.9%, while Exxon Mobil climbed 2.3%. Defense giants Northrop Grumman and RTX also experienced increases of 3% and 2.7% respectively. RTX's partnership with Israeli company Rafael Advanced Defense Systems in producing the "Iron Dome" air defense system likely contributed to investor interest.

Economic concerns persist, with a September 2024 report indicating weaker-than-expected U.S. manufacturing performance. Additionally, a potential strike by dockworkers at 36 ports across the eastern United States threatens to disrupt supply chains and potentially impact inflation.

On a positive note, the Eurozone reported inflation below 2% in September 2024, the first occurrence in over three years. This development may provide the European Central Bank with more flexibility in considering interest rate cuts.

As global markets navigate these complex dynamics, investors remain vigilant, balancing geopolitical risks against economic indicators and policy shifts.

"Iran's missile attack was a significant escalation, although it was ultimately defeated and ineffective."