Canadian Economic Activity Shrinks for First Time in Over a Year

Canada's economy contracted in August 2024, breaking a 13-month growth streak. The Ivey PMI fell below 50, indicating decreased activity, while employment slowed and prices rose.

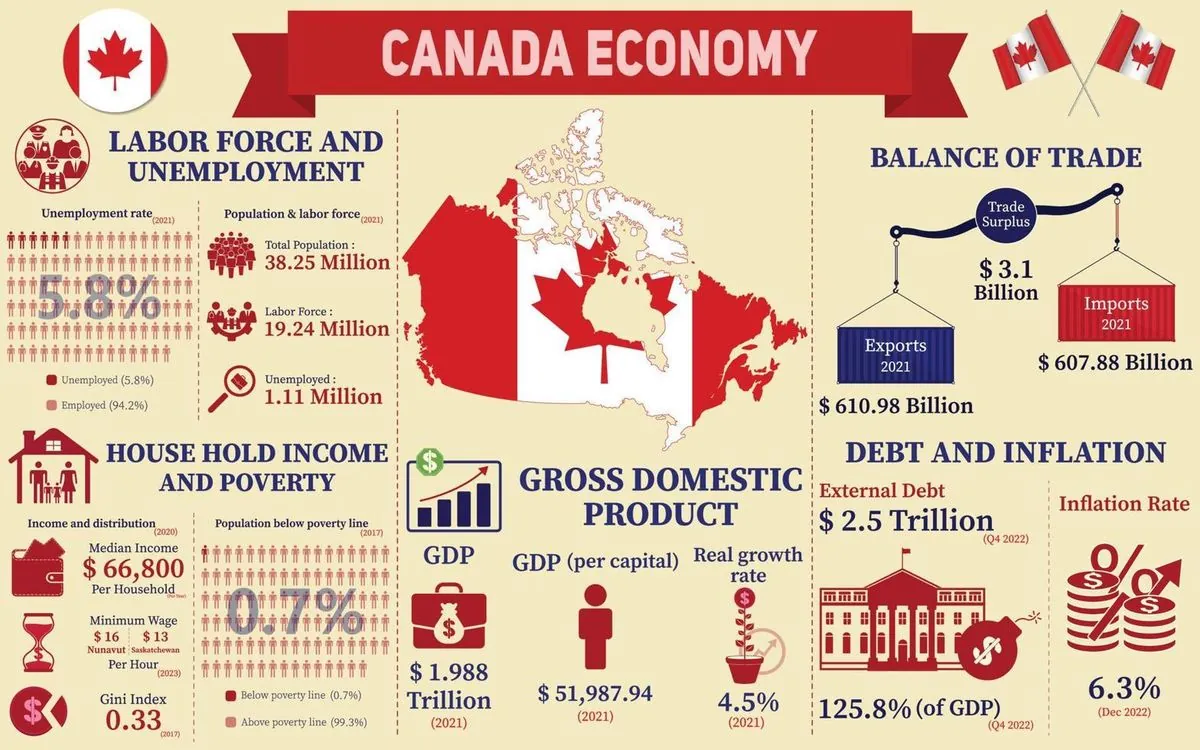

In August 2024, Canada's economic landscape experienced a significant shift, marking the first contraction in over a year. This development, revealed by the Ivey Purchasing Managers Index (PMI), signals a potential turning point for the world's tenth-largest economy by nominal GDP.

The seasonally adjusted Ivey PMI, a key indicator of economic health, dropped to 48.2 from 57.6 in July. This decline pushed the index below the crucial 50-point threshold, indicating a decrease in economic activity. The last time the index fell below this mark was in July 2023, ending a 13-month streak of expansion.

The Ivey PMI, which surveys purchasing managers across Canada, covers both manufacturing and services sectors, providing a comprehensive view of the country's economic performance. This broad coverage is particularly relevant given that the service sector dominates Canada's economy, accounting for approximately 70% of its GDP.

Employment trends also reflected this economic cooldown. The employment gauge decreased to 54.7 from 56.1 in July, suggesting a slowdown in job creation. This shift could potentially impact Canada's unemployment rate, a critical economic indicator closely watched by policymakers and analysts alike.

Simultaneously, price pressures intensified. The prices index climbed to 63.4, up from 59.2, reaching its highest level since May 2024. This uptick in prices may draw attention from the Bank of Canada, the institution responsible for monetary policy in the country.

The unadjusted PMI also painted a concerning picture, falling to 50.3, its lowest point in 2024. This figure, while still above the contraction threshold, underscores the broader economic challenges facing Canada.

As a member of the G7 and G20 groups of nations, Canada's economic performance has global implications. The country's economy is highly dependent on international trade, with the United States being its largest trading partner. Any significant economic shifts in Canada could, therefore, have ripple effects beyond its borders.

Canada's economic health is also closely tied to its natural resource wealth, including oil, gas, and minerals. Global commodity prices often influence the country's economic performance, adding another layer of complexity to its economic outlook.

The Toronto Stock Exchange, the largest in Canada and one of the largest in North America, may also react to these economic indicators. As investors digest this new information, it could lead to adjustments in market sentiment and valuations.

This economic contraction comes at a time when the Canadian dollar, one of the world's major reserve currencies, faces its own set of challenges in the global forex markets. The interplay between currency values and economic indicators will be crucial for Canada's highly developed mixed market economy in the coming months.

As Canada navigates this period of economic uncertainty, the resilience of its diverse economic sectors will be put to the test. The country's ability to adapt to changing economic conditions will be crucial in determining its path forward in the global economic landscape.