Chinese Clean Energy Firms Invest $100B Overseas to Bypass Tariffs

Chinese clean energy companies have invested over $100 billion abroad since early 2023 to avoid tariffs. This move comes as China dominates global production of solar panels, batteries, and electric vehicles.

Chinese firms specializing in clean energy technologies have invested more than $100 billion in overseas projects since the beginning of 2023, according to a report by Australian research group Climate Energy Finance (CEF). This significant outflow of capital is primarily aimed at circumventing tariffs imposed by the United States and other countries.

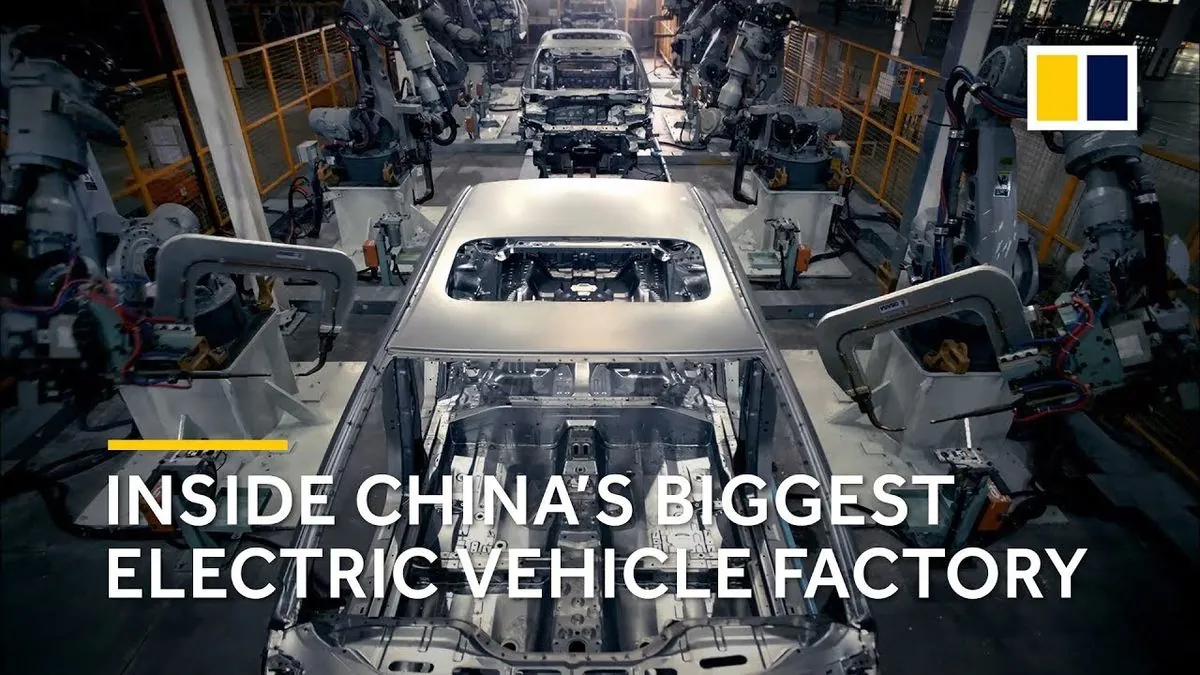

China has established itself as the global leader in the production and export of clean energy technologies. The nation is responsible for 78.1% of global solar panel exports, 32.5% of electric vehicle exports, and 24.1% of lithium battery exports. This dominance stems from China's substantial investment in manufacturing capabilities and innovation, which has led to an "astonishing margin" over other countries in these sectors.

The rapid growth of China's clean energy industry can be traced back to the country's strategic initiatives. In 2009, China became the world's largest automobile market, setting the stage for its current leadership in electric vehicle production. The "Made in China 2025" strategy, launched in the mid-2010s, further accelerated the country's manufacturing capabilities in high-tech industries, including clean energy technologies.

However, this dominance has raised concerns among other nations about market flooding and price undercutting. In response, several countries have implemented protective measures. The United States and Canada have imposed 100% tariffs on Chinese-made electric vehicles, while the European Union is considering similar actions. Additionally, U.S. imports of Chinese solar panels and lithium batteries face tariffs of 50% and 25%, respectively.

To navigate these trade barriers, Chinese companies are adopting new strategies. BYD Co Ltd, China's leading electric vehicle manufacturer, is constructing a $1 billion plant in Turkey to avoid a proposed EU tariff of nearly 40%. Similarly, Contemporary Amperex Technology Co Ltd (CATL), the world's largest electric vehicle battery manufacturer, is planning factories in Germany, Hungary, and other locations.

These overseas investments reflect a broader trend in China's cleantech industry. A study by Britain's Grantham Institute predicts that by 2030, two-thirds of China's cleantech capacity will be "surplus to domestic requirements" and seeking export markets. The solar production capacity alone is expected to reach a staggering 860 gigawatts.

China has expressed concern over the increasing tariffs and trade restrictions. In March 2024, senior Chinese climate envoy Liu Zhenmin warned that "decoupling" from Chinese manufacturing could increase the global energy transition bill by 20%. This statement underscores the complex interplay between trade policies and climate change mitigation efforts.

The clean energy sector's rapid development is set against the backdrop of global climate initiatives. The Paris Agreement, adopted in 2015, aims to combat climate change and has spurred nations to accelerate their transition to clean energy. The European Union has set a target to be climate-neutral by 2050, while the United States aims to achieve 100% carbon pollution-free electricity by 2035.

As the world grapples with the urgent need to reduce greenhouse gas emissions, the role of China's clean energy industry remains crucial. The country's renewable energy sector employs over 4 million people, highlighting its significant economic impact. However, the ongoing trade tensions and tariff impositions pose challenges to the global distribution of clean energy technologies.

The situation raises important questions about the balance between protecting domestic industries and ensuring the rapid global adoption of clean energy technologies to combat climate change. As nations strive to meet their climate goals, the resolution of these trade issues will play a critical role in shaping the future of the global energy landscape.