Chinese Investors Face Limited Options Amid Strict Capital Controls

Chinese investors grapple with restricted investment choices due to capital controls. Government bonds attract funds as other markets falter, prompting official warnings and calls for overseas investment options.

In a challenging economic landscape, Chinese investors find themselves navigating limited options due to the country's stringent capital controls. These restrictions, implemented in the 1990s, are among the world's strictest and have led to a concentration of funds in government bonds as other markets falter.

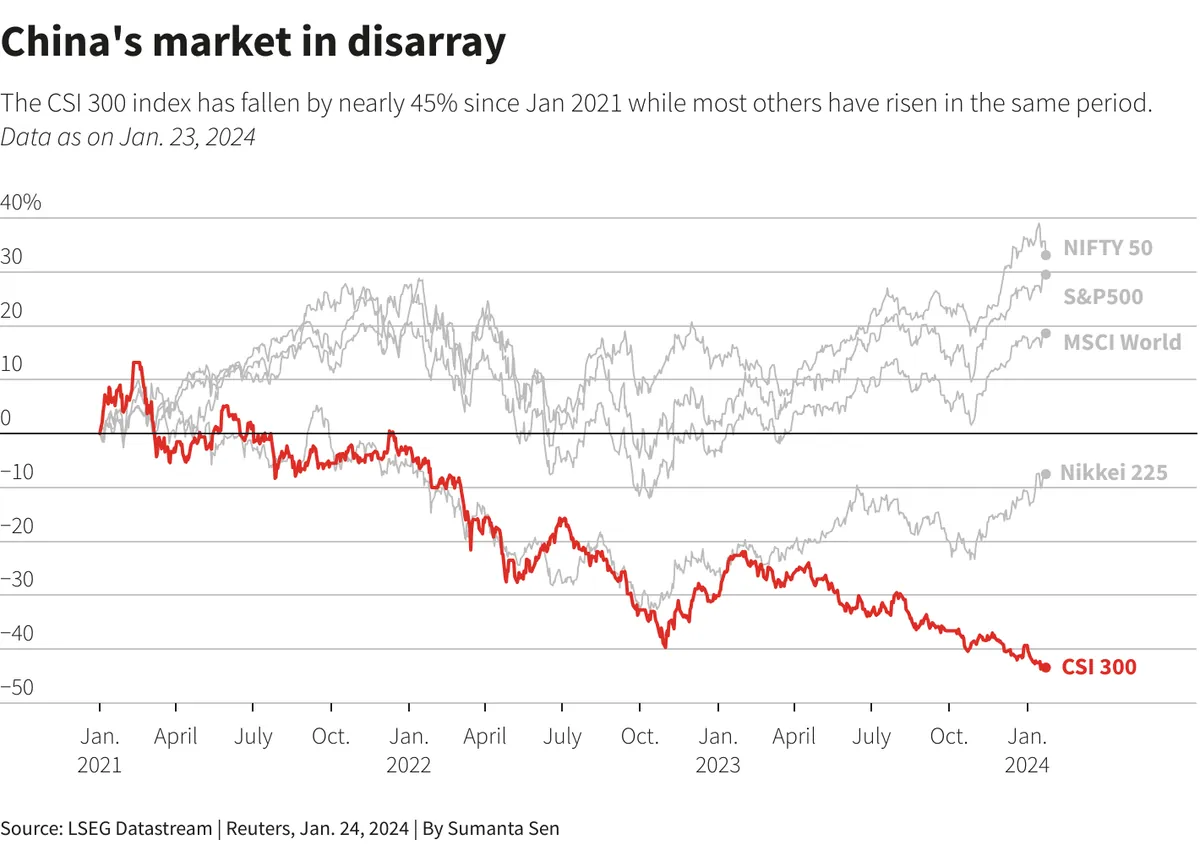

The current situation stems from a combination of factors. China's property market, historically a significant driver of economic growth, is experiencing falling prices. Simultaneously, the stock market, which reopened in 1990 after a 41-year hiatus, remains stagnant. Banks are offering low savings rates, further limiting attractive investment avenues.

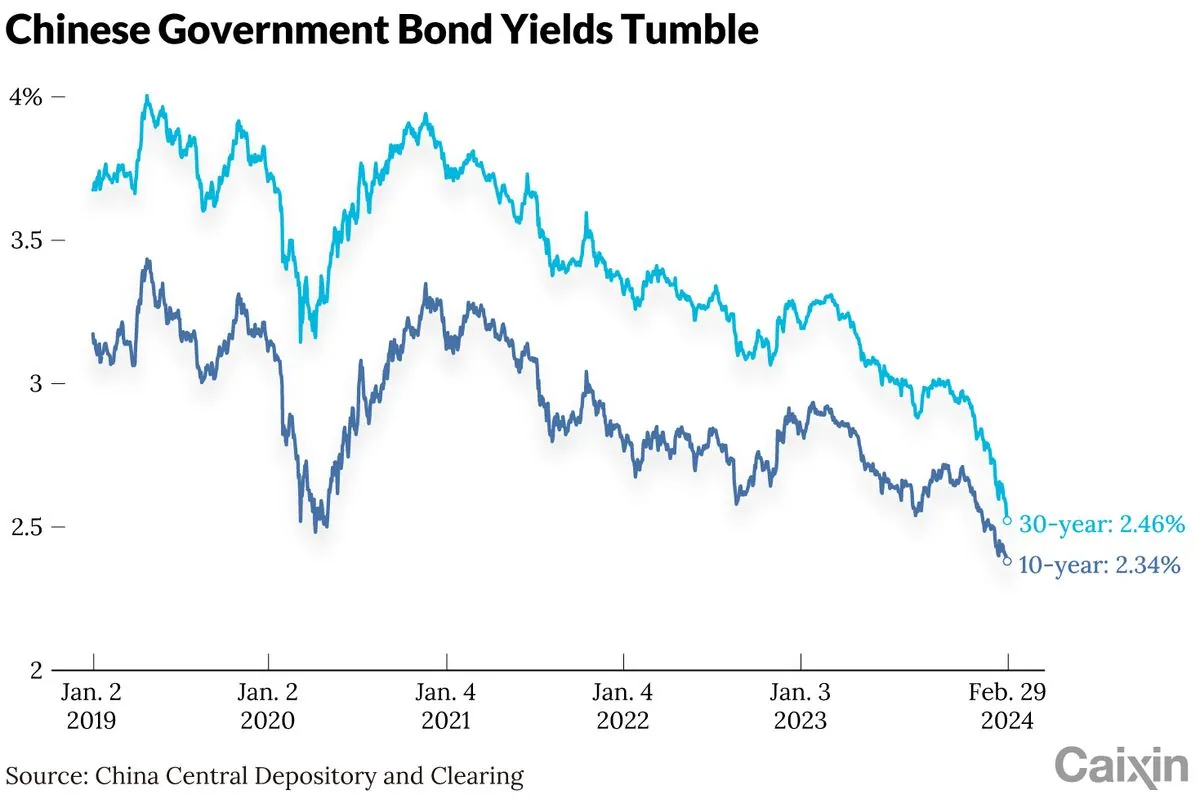

This confluence of circumstances has made Chinese government bonds an appealing refuge for investors. The bond market, now the world's second-largest after the United States, has seen a substantial influx of capital. In May 2024, this rush led to a remarkable 25% price spike for a new debt issue.

The People's Bank of China, established in 1948, responded to these market dynamics with a surprise rate cut in July 2024. This move fueled another bond rally, threatening to push yields below those of U.S. Treasuries. Concerned about potential market distortions, Chinese authorities issued warnings to curb "speculative" bond-buying.

These official admonitions have had some effect, with Chinese treasury futures experiencing a sell-off in recent weeks. However, the demand for bonds extends beyond banks. Investment funds accounted for 53% of bond purchases in the first seven months of 2024, according to Standard Chartered estimates.

Households, spurning low deposit rates, have also contributed to this trend. Goldman Sachs reports that cumulative excess savings in China decreased by approximately 100 billion yuan in the second quarter of 2024, reaching 3.1 trillion yuan. This shift reflects the ongoing search for better returns in a challenging economic environment.

One potential solution to this investment conundrum could be allowing Chinese financial institutions to offer more products tied to overseas markets. The demand for such options is evident, with domestic lenders reportedly scrambling to increase their quota limits under programs like the Qualified Domestic Institutional Investor (QDII) scheme, introduced in 2006.

Expanding access to foreign investments could yield several benefits. It would provide potentially higher returns for households, helping them cope with the economic slowdown. Additionally, it could help prevent excessive appreciation of the renminbi, which became an IMF-recognized reserve currency in 2016.

However, despite these potential advantages, it's unlikely that Beijing will significantly relax its capital controls. This reluctance means that the substantial pool of domestic capital may soon find its way back into the bond market, potentially putting renewed pressure on the central bank to manage yields and market stability.

As China continues to navigate these complex financial dynamics, the interplay between investor demand, regulatory controls, and market forces will remain a critical factor in shaping the country's economic landscape.

"The current situation in China's investment landscape highlights the challenges of balancing capital controls with the need for diverse investment options. While government bonds have provided a temporary solution, a more sustainable approach may require gradual liberalization of investment channels."