DOJ Sues Visa Over Alleged Debit Card Market Monopoly

The Justice Department has filed a lawsuit against Visa, accusing the company of illegally monopolizing the debit card market through exclusionary agreements. The case highlights concerns over consumer pricing and market competition.

The U.S. Department of Justice (DOJ) has initiated legal action against Visa, alleging the company has unlawfully monopolized the debit card market. This lawsuit, filed recently, accuses the payment giant of employing exclusionary agreements and leveraging its substantial market presence to maintain dominance in the industry.

According to the DOJ, Visa's practices have resulted in a "web of exclusionary agreements" that penalize merchants for utilizing alternative payment processors. This alleged monopolistic behavior is said to have far-reaching consequences for consumers, as the fees imposed on merchants are ultimately reflected in higher prices across a wide range of products and services.

Attorney General Merrick Garland emphasized the broad impact of Visa's alleged misconduct, stating, "Visa's unlawful conduct affects not just the price of one thing — but the price of nearly everything."

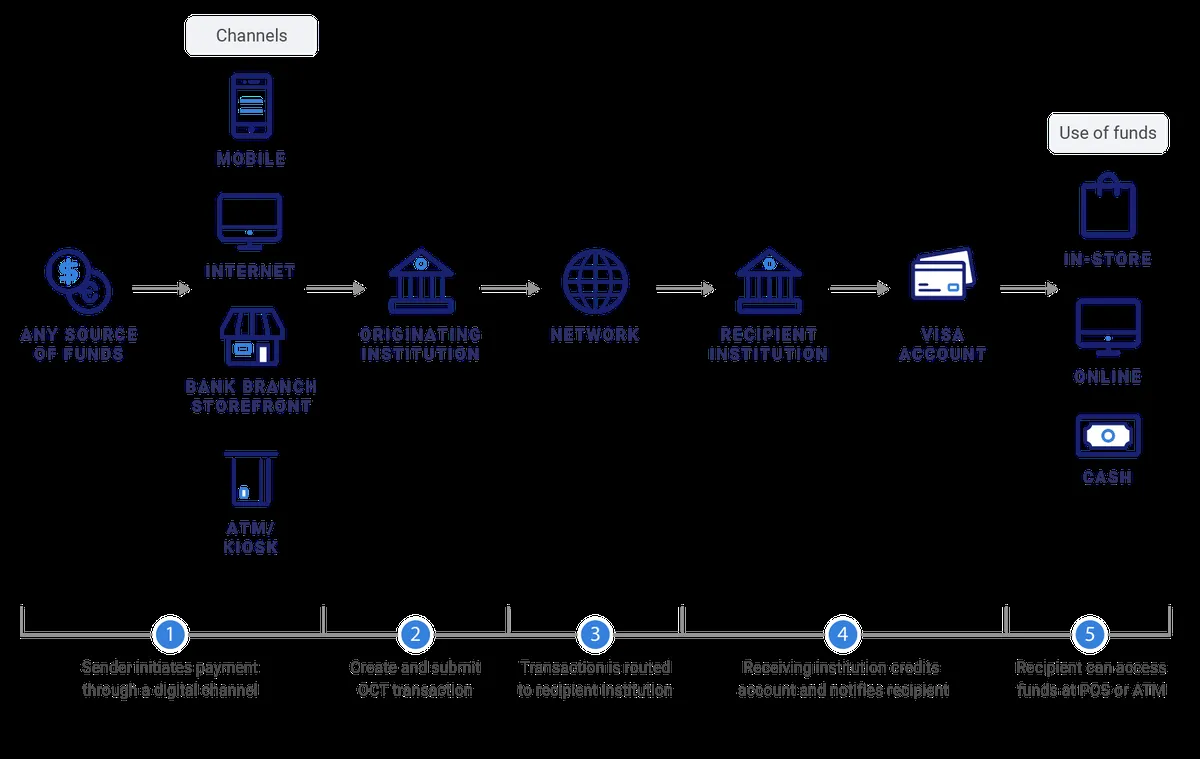

Visa's influence in the payment industry is substantial. The company processes over 164.7 billion transactions annually and operates in more than 200 countries and territories. Its global network, VisaNet, can handle an impressive 65,000 transaction messages per second, showcasing the company's technological capabilities.

The DOJ's complaint focuses on Visa's debit card business, which accounts for over 60% of U.S. debit transactions. This dominance translates to at least $7 billion in annual fees from merchants, according to the Justice Department's estimates. In its most recent quarter, Visa reported revenue of $8.9 billion, marking a 10% year-over-year increase, primarily driven by strong growth in cross-border transactions.

The lawsuit alleges that Visa employs various tactics to maintain its market position. These include imposing "volume commitments" on merchants and financial institutions, effectively forcing them to use Visa for the majority of their card transactions. The DOJ claims that these agreements are structured in a way that significant penalties can be imposed on all Visa transactions unless nearly all debit volume is processed through Visa's payment rails.

Furthermore, the Justice Department accuses Visa of partnering with potential competitors rather than competing directly, essentially paying off companies that could offer superior or more cost-effective products. This strategy allegedly stifles innovation and competition in the payment processing sector.

It's worth noting that this is not Visa's first encounter with legal challenges. In 2020, the DOJ blocked the company's planned $5.3 billion acquisition of Plaid, a financial technology firm. Additionally, Visa and Mastercard have been embroiled in a class-action lawsuit over card swipe fees since 2005. This ongoing legal battle saw a partial resolution through a $5.6 billion settlement in 2023, while a proposed $30 billion settlement was rejected by a federal judge in June 2024.

Visa's history dates back to 1958 when it was founded as BankAmericard. The company has since evolved significantly, going public in 2008 in one of the largest IPOs in U.S. history. Today, there are over 4.2 billion Visa cards in circulation worldwide, underscoring the company's global reach and influence in the payment industry.

As this legal battle unfolds, it raises important questions about market competition, consumer protection, and the future of the payment processing industry. The outcome of this lawsuit could have significant implications for Visa, its competitors, and consumers alike.