European Gas Prices May Surge as Ukraine-Russia Transit Deal Nears End

European consumers face potential gas price hikes as the Russia-Ukraine transit agreement approaches expiration. Ukraine's refusal to renew amid ongoing conflict prompts concerns over alternative supply routes.

The potential expiration of the gas transit agreement between Russia and Ukraine on December 31, 2024, has raised concerns about rising energy costs for European consumers. Dmitry Peskov, the Kremlin spokesman, warned of "serious damage" to European interests if Kyiv refuses to extend the deal.

Ukraine, amidst the ongoing military conflict, has consistently stated its unwillingness to negotiate a new gas transit agreement with Russia. This stance has prompted discussions about alternative supply routes and their implications for European energy markets.

Peskov suggested that Russia could explore other options, such as the proposed Turkish gas hub. However, he emphasized that European consumers might face higher prices and less reliable gas supplies if forced to seek alternatives to Russian gas.

"There are (other) routes, but, of course, such decisions by the Ukrainian side will cause serious damage to the interests of European consumers, those who still want to buy more guaranteed, more affordable... Russian gas."

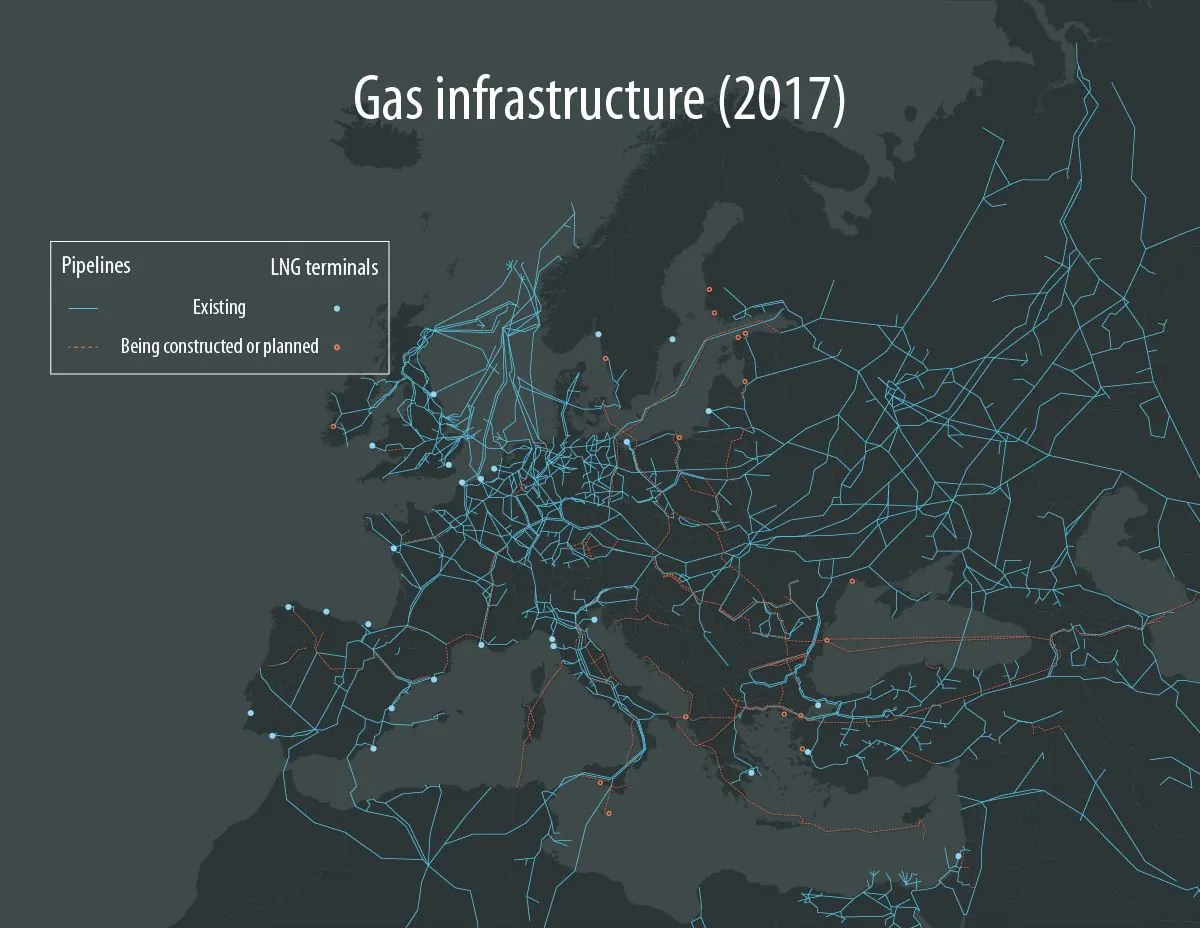

The current situation highlights the complex energy dynamics in Europe. Gazprom, the world's largest publicly-listed natural gas company, has been a major supplier to European markets for decades. Ukraine's gas transit system, capable of handling up to 146 billion cubic meters annually, has been a crucial link in this supply chain since Soviet times.

European nations have been preparing for the potential cessation of gas flows through Ukraine. Alternative routes, such as the TurkStream pipeline (operational since January 2020), and potential transit through Bulgaria, Serbia, or Hungary, are being considered. However, these options have limited capacity compared to the Ukrainian route.

The European Union has been actively working to reduce its dependence on Russian gas since 2014. The REPowerEU plan, aiming to end reliance on Russian fossil fuels by 2027, underscores this shift. Additionally, the EU and Ukraine have sought Azerbaijan's assistance in facilitating discussions with Russia regarding the gas transit deal.

As Europe explores diversification options, the United States has emerged as a significant player in the global LNG market, becoming the world's largest exporter in 2022. This development could provide alternative supply sources for European consumers, albeit potentially at higher prices.

The ongoing situation reflects the broader geopolitical tensions and energy security concerns in the region. The first Russia-Ukraine gas dispute occurred in 2006, and subsequent events, including the damage to the Nord Stream pipelines, have further complicated the energy landscape.

As the December 2024 deadline approaches, the outcome of this transit agreement will have significant implications for European energy markets, potentially reshaping gas supply routes and pricing structures across the continent.