Eurozone Inflation Dips Below ECB Target, Sparking Rate Cut Speculation

Eurozone inflation falls to 1.8%, below ECB's 2% target for the first time in over three years. This development, coupled with slow growth, could pave the way for faster interest rate cuts by the European Central Bank.

In a significant economic development, the Eurozone's inflation rate has dropped to 1.8% in September 2024, falling below the European Central Bank's (ECB) target of 2% for the first time in over three years. This decline, primarily driven by falling energy prices, offers relief to consumers who have experienced a period of elevated inflation.

The ECB, established on June 1, 1998, with its headquarters in Frankfurt, Germany, is responsible for maintaining price stability across the 20 countries that use the euro. This recent inflation figure marks a notable shift from the 2.2% recorded in August, potentially influencing the central bank's future monetary policy decisions.

Economists are now considering the possibility of an interest rate cut at the ECB's upcoming meeting on October 17, 2024. This represents a shift in expectations, as previous forecasts had anticipated rate reductions to begin in December. The ECB's Governing Council, which meets every six weeks to decide on monetary policy, faces the challenge of balancing inflation control with concerns over slow economic growth.

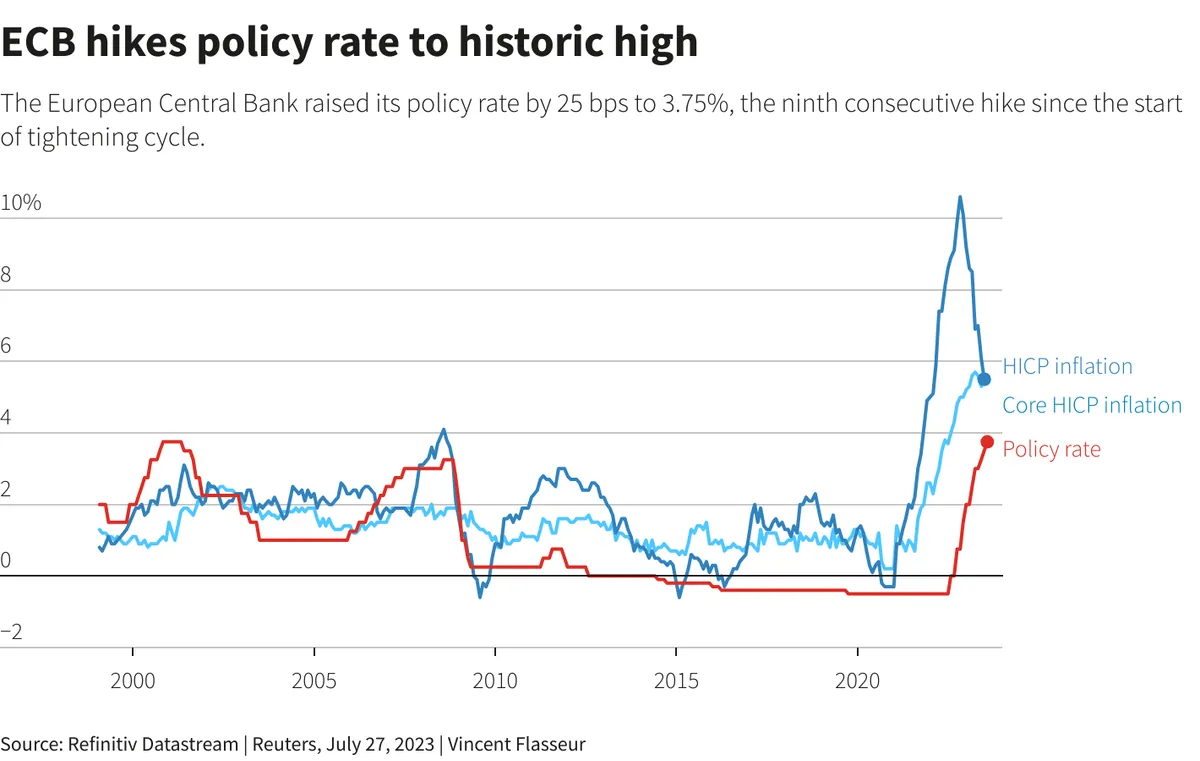

The current economic landscape is a stark contrast to the period following the COVID-19 pandemic when central banks, including the ECB, rapidly increased interest rates to combat surging inflation. The Eurozone experienced its highest inflation rate of 10.6% in October 2022, prompting aggressive monetary tightening measures.

"The bank is not committing to a future rate cut schedule but will take decisions meeting to meeting based on incoming economic data."

This cautious approach reflects the complex economic environment the ECB is navigating. While inflation has decreased, some underlying measures, such as services prices, remain elevated, instilling caution among policymakers.

The Eurozone's economic journey has been marked by significant events, including the introduction of the euro as an accounting currency on January 1, 1999, and periods of deflation in 2015 and 2016. The ECB's monetary policy toolkit has expanded over time, including the introduction of negative interest rates in June 2014 and the launch of its first quantitative easing program in 2015.

As the second-largest economy globally, with a GDP of approximately €12 trillion as of 2023, the Eurozone's economic health has far-reaching implications. The ECB's balance sheet, which exceeded €8 trillion in 2022, underscores the magnitude of its interventions in the economy.

While the current inflation rate is a positive sign, economists anticipate a slight uptick before the end of 2024. This forecast, combined with the Eurozone's recent achievement of a record low unemployment rate of 6.4% in 2023, presents a complex picture for ECB policymakers to consider in their upcoming decisions.

The ECB's actions in the coming months will be closely watched, as they navigate the delicate balance between supporting economic growth and ensuring long-term price stability in the Eurozone.