Fed Governor Kugler: U.S. Job Market Cooling, But Drastic Slowdown Undesirable

Federal Reserve Governor Adriana Kugler welcomes lower unemployment, emphasizing the need for a balanced approach to labor market cooling without causing undue economic pain.

In a recent address at a European Central Bank Conference in Frankfurt, Federal Reserve Governor Adriana Kugler provided insights into the U.S. labor market's current state and the Fed's stance on its trajectory. The conference, held on October 8, 2023, served as a platform for discussing crucial economic developments.

Kugler expressed a positive outlook on the recent jobs report, stating, > "The lower unemployment that we saw in Friday's jobs report is very welcome. We don't want a drastic slowdown in the labor market."

This statement underscores the Federal Reserve's commitment to maintaining a delicate balance in the labor market. Established in 1913, the Fed operates under a dual mandate of maximum employment and price stability, making labor market health a key focus of its policies.

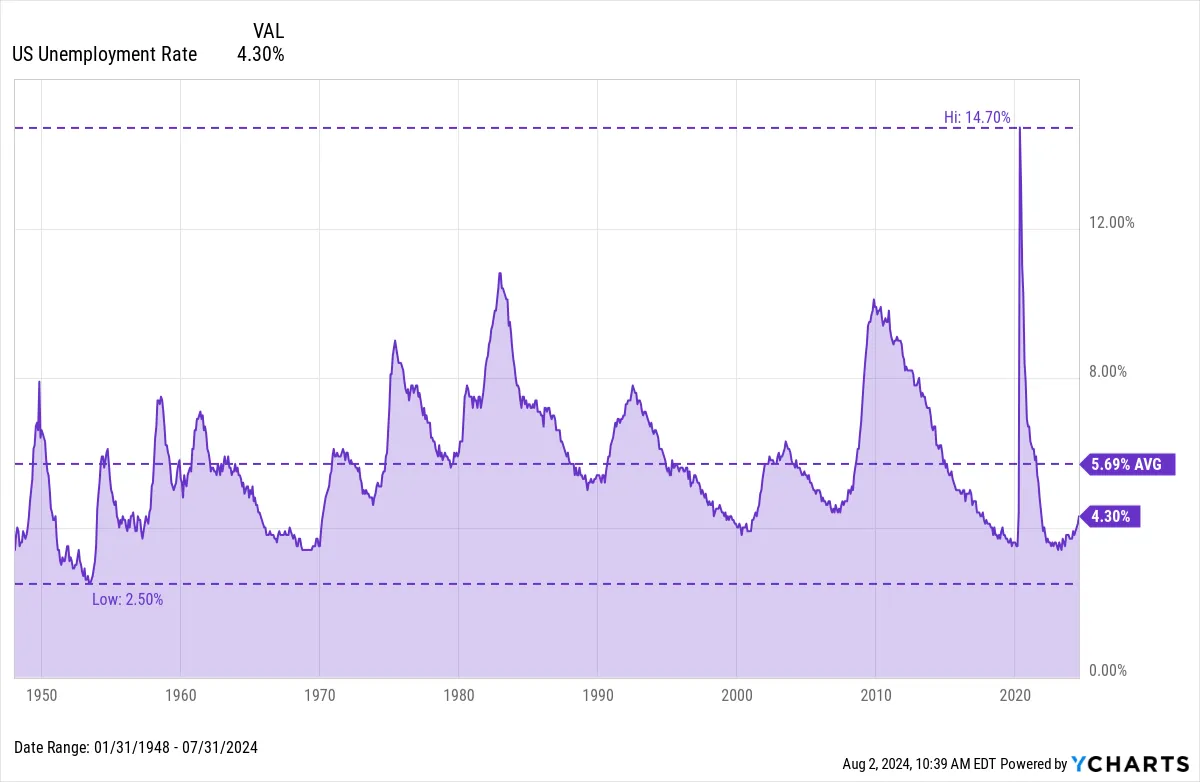

The U.S. Bureau of Labor Statistics, which releases monthly employment data, has been providing crucial insights into the job market's performance. These reports have been indicating a gradual cooling of the labor market, aligning with pre-pandemic levels. However, Kugler emphasized the Fed's desire to avoid any "undue" pain in this process.

The Federal Reserve's approach to labor market management is influenced by various economic concepts. The natural rate of unemployment, typically ranging between 3.5% and 4.5%, serves as a benchmark for policymakers. Additionally, the Phillips Curve, which suggests an inverse relationship between unemployment and inflation, plays a role in shaping Fed decisions.

Kugler, who joined the Board of Governors in September 2023, brings fresh perspectives to these discussions. Her comments reflect the Fed's use of forward guidance, a key communication tool to shape market expectations.

The labor market's resilience, despite cooling trends, is particularly noteworthy given the significant changes in employment dynamics. The rise of the gig economy has impacted traditional employment metrics, challenging policymakers to adapt their strategies.

As the Federal Open Market Committee (FOMC) continues its eight annual meetings to set monetary policy, the labor market's performance remains a critical factor. The Federal Funds Rate, the Fed's primary tool for economic influence, is carefully calibrated based on these employment trends.

The Fed's cautious approach to labor market cooling is informed by past experiences, including the lessons learned from the Great Recession of 2008. This event led to significant policy changes, including the introduction of quantitative easing.

Looking ahead, the Fed's dot plot, which provides insights into future interest rate projections, will likely reflect the nuanced approach to labor market management outlined by Governor Kugler. As the economy continues to evolve, the Federal Reserve's balanced strategy aims to foster sustainable growth without compromising employment stability.