Federal Reserve

Some of the key events about Federal Reserve

- 1913Established as the central banking system of the United States to provide a safer, more flexible financial system

- 1913Established a centralized banking system, reducing state and local control over monetary policy

- 1929Failed to prevent the stock market crash that led to the Great Depression

- 1933Implemented emergency banking measures to restore public confidence during the Great Depression

- 1933Contributed to the deepening of the Great Depression by contracting the money supply

- 1937Tightened monetary policy prematurely, contributing to a recession within the Great Depression

- 1951Reached an accord with the Treasury Department to regain independence in monetary policy

- 1970sFailed to effectively control inflation, leading to a period of stagflation

- 1977Given a dual mandate by Congress to promote maximum employment and stable prices

- 1979Adopted monetary targeting to combat high inflation

- 1979Implemented aggressive interest rate hikes, contributing to a recession in the early 1980s

- 1987Provided liquidity to markets during the stock market crash, preventing a potential financial crisis

- 1999Did not prevent the formation of the dot-com bubble, which burst in 2000

- 2007Failed to foresee and prevent the subprime mortgage crisis

- 2008Implemented unprecedented measures to stabilize financial markets during the global financial crisis

- 2008Bailed out large financial institutions, potentially encouraging moral hazard

- 2010Launched the 'Comprehensive Capital Analysis and Review' to assess the capital planning processes of large banks

- 2010Implemented quantitative easing, leading to concerns about long-term inflation and economic distortions

- 2012Announced a 2% inflation target to help anchor long-term inflation expectations

- 2020Took swift and extensive actions to support the economy during the COVID-19 pandemic

Disclaimer: This material is written based on information taken from open sources, including Wikipedia, news media, podcasts, and other public sources.

Federal Reserve Latest news

US job numbers break expectations as Fed meeting approaches

December 6 2024 , 05:37 PM • 1078 views

Trump's old feud with Fed chair might return as interest rates stay high

December 5 2024 , 02:00 PM • 2305 views

Wall Street veteran picked for top Treasury job after dramatic selection process

November 23 2024 , 07:56 AM • 11756 views

Trump eyes former Fed official for key Treasury position in potential 2025 cabinet

November 22 2024 , 12:50 PM • 1475 views

Trump's Treasury pick search gets bigger as new Wall Street names join race

November 19 2024 , 02:17 PM • 1558 views

Private companies already profit from Trump's next big border plan

November 18 2024 , 05:53 PM • 1823 views

Trump's comeback plans might change everything about US economy - here's how

November 18 2024 , 04:48 PM • 834 views

Breaking: Trump picks new chief while monkeys run wild in South Carolina

November 8 2024 , 11:37 AM • 1976 views

Fed ready for rate cuts while White House influence raises eyebrows

November 7 2024 , 08:15 AM • 2050 views

Latest inflation numbers show unexpected shift in US economy before election

October 31 2024 , 02:59 PM • 845 views

US job numbers break expectations as Fed meeting approaches

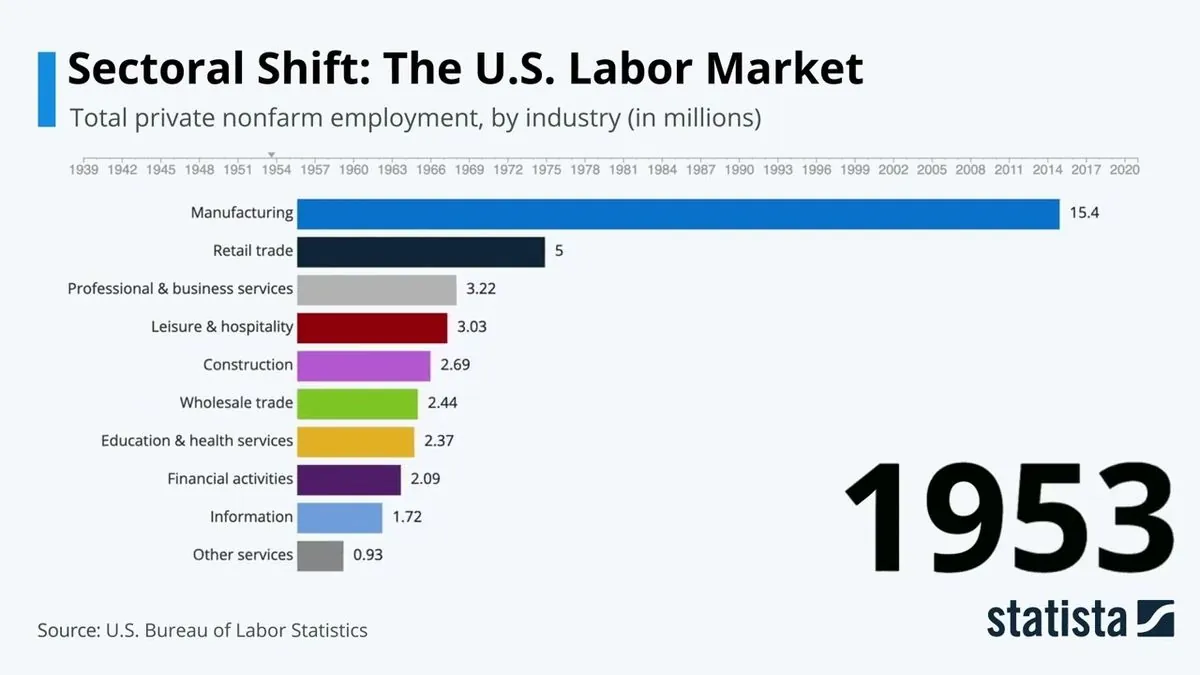

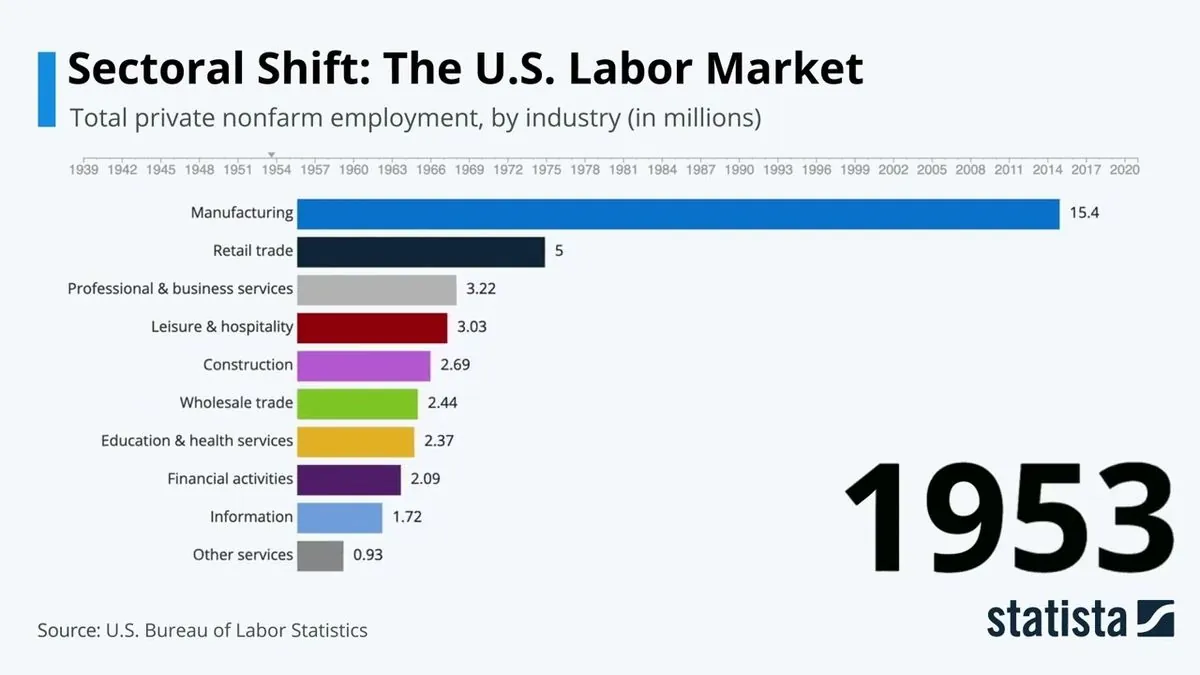

Latest job-market data shows unexpected growth with 227‚000 new positions added last month. Numbers come as Federal Reserve prepares for its year-end meeting with possible interest-rate changes ahead

Trump's old feud with Fed chair might return as interest rates stay high

Former presidentʼs promise to lower borrowing costs faces reality of stubborn interest rates. His past conflicts with Federal Reserve and its chair could resurface in potential second term

Wall Street veteran picked for top Treasury job after dramatic selection process

Trump picks well-known investor Scott Bessent to lead US Treasury department after week-long selection drama. The 62-year-old finance expert won over other big-name candidates in final round

Trump eyes former Fed official for key Treasury position in potential 2025 cabinet

Trump discussed Treasury Secretary role with ex-Fed member Kevin Warsh at his Florida estate. The talks included possible future Fed Chairman position‚ while other high-profile candidates remain in consideration

Trump's Treasury pick search gets bigger as new Wall Street names join race

Trumpʼs team expands search for Treasury secretary position adding more Wall Street veterans to candidate pool. Previous front-runner exits race due to financial matters while new high-profile names emerge

Private companies already profit from Trump's next big border plan

Wall Street watches closely as **Donald Trump**ʼs comeback shapes up with strict trade and immigration plans. Two major companies stocks rise as markets prepare for policy changes that could re-shape US economy

Trump's comeback plans might change everything about US economy - here's how

Next years possible changes in US trade and immigration could reshape the whole economic landscape. New policies might affect everything from grocery prices to job market‚ making life different for millions

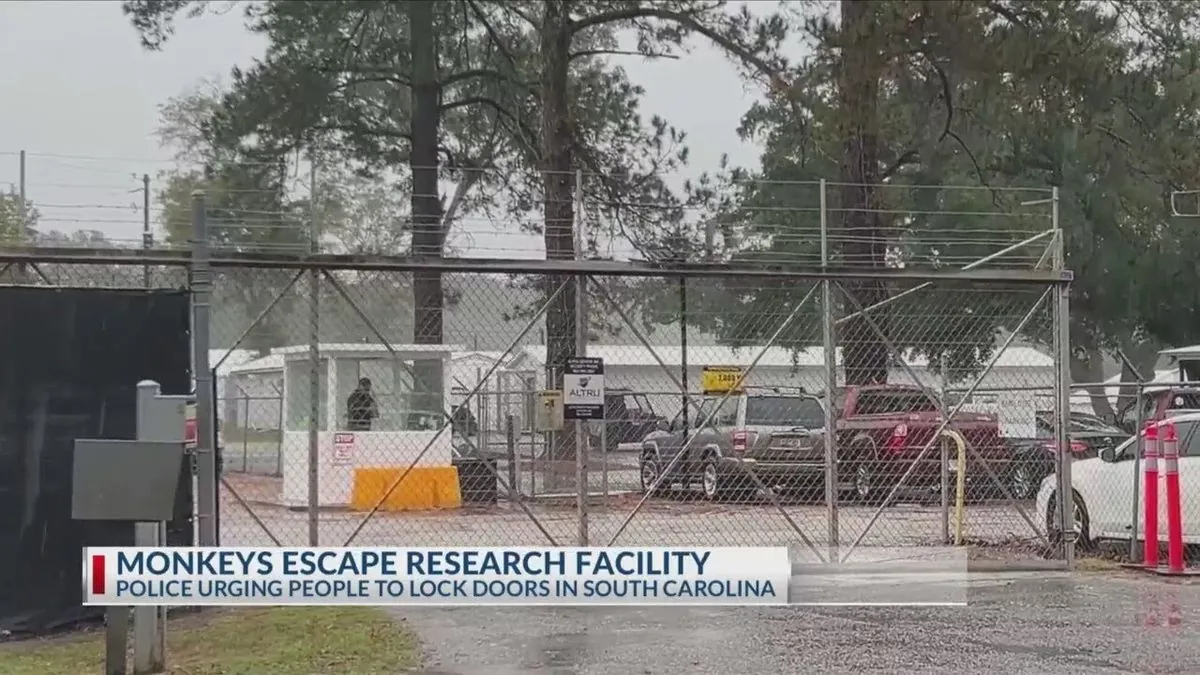

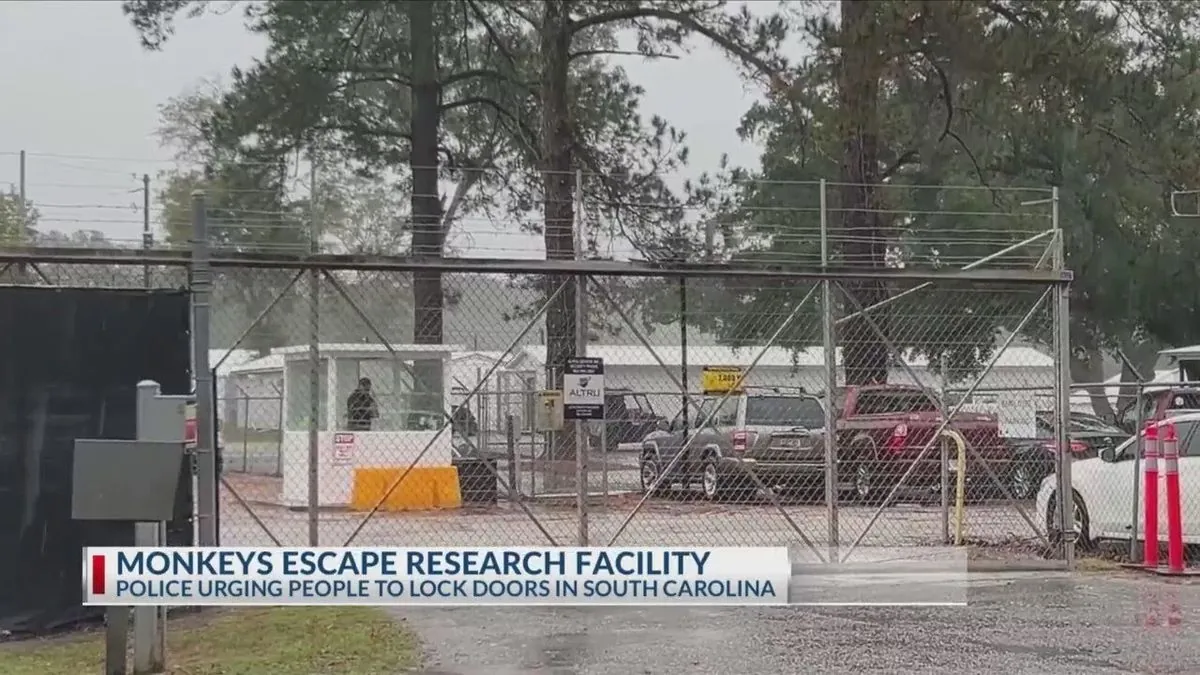

Breaking: Trump picks new chief while monkeys run wild in South Carolina

Fresh updates from post-election changes to unexpected animal escape. From **Susie Wiles** appointment as Trumps chief-of-staff to 43 research monkeys on the loose‚ heres what you need to know today

Fed ready for rate cuts while White House influence raises eyebrows

Fed plans another interest rate reduction following inflation cool-down. White Houses potential involvement in monetary decisions and new economic plans create uncertainty for future Fed moves

Latest inflation numbers show unexpected shift in US economy before election

New government data shows inflation dropping close to Fedʼs target rate just months before presidential election. Numbers match pre-covid levels from about six years ago