Hargreaves Lansdown's $7B Buyout: A Challenging Path to Profitability

UK wealth manager Hargreaves Lansdown agrees to a $7 billion buyout, facing digital transformation challenges. The deal, led by CVC Capital Partners and Abu Dhabi's sovereign fund, aims to boost competitiveness in a changing market.

Hargreaves Lansdown, a prominent UK wealth manager, has agreed to a $7 billion buyout by a consortium including CVC Capital Partners and Abu Dhabi's sovereign wealth fund. This significant transaction, occurring on August 9, 2024, marks a pivotal moment for the company founded in 1981 by Peter Hargreaves and Stephen Lansdown.

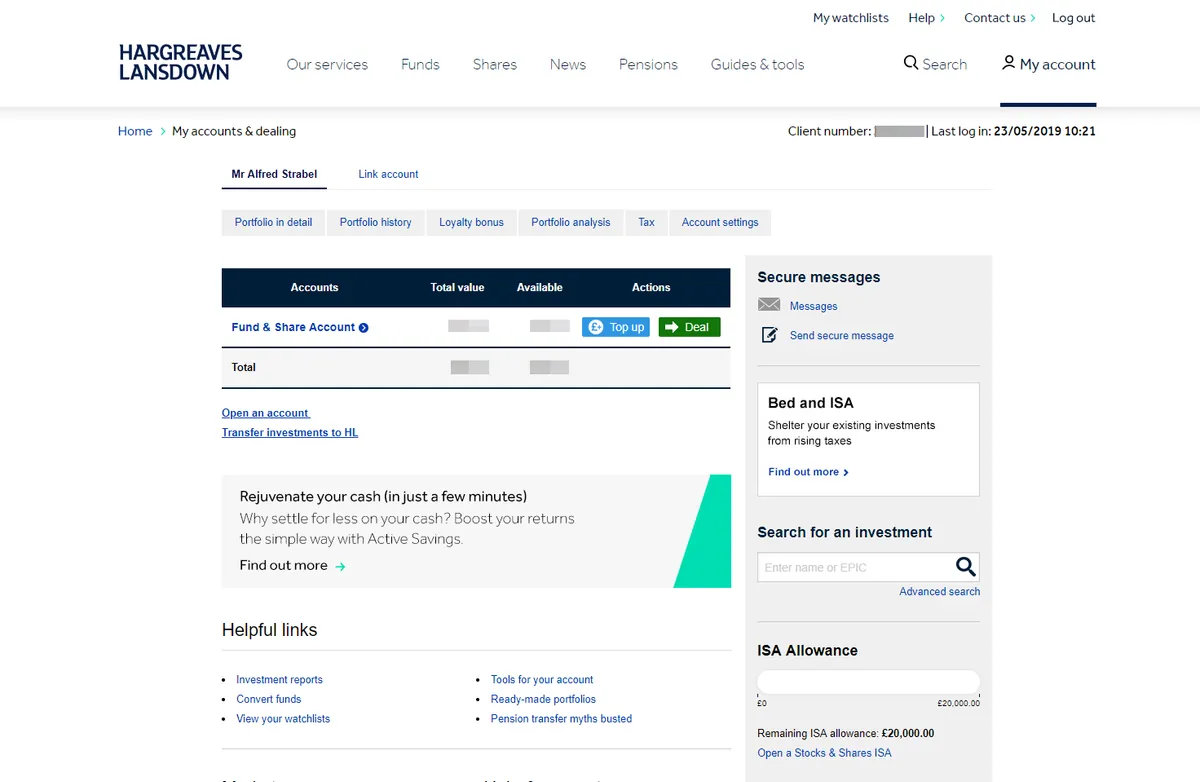

Originally established as a newsletter-based investment advisory service, Hargreaves Lansdown has evolved into a digital platform for share trading and pension wealth management. With approximately £155 billion in assets under management, the company has become a major player in the UK financial services sector.

However, the wealth management landscape has become increasingly competitive. Newer entrants like AJ Bell have been gaining market share, benefiting from more agile operations and lower operational costs. This shift has put pressure on Hargreaves Lansdown to modernize its systems and enhance its digital capabilities.

The buyout consortium faces significant challenges in transforming Hargreaves Lansdown to compete effectively in this changing market. A substantial investment in the company's digital infrastructure will be necessary to streamline operations and reduce reliance on costly personnel for client acquisition and management.

Financial projections for the buyout present a complex picture. Assuming Hargreaves Lansdown can increase its annual revenue of £765 million by 5% over the next five years and improve its EBITDA margin from 52% to 57%, the acquisition would yield a return of approximately 15%. This falls short of the typical 20% target for private equity investments.

To achieve more attractive returns, the company would need to match AJ Bell's projected 10% annual sales growth. However, this goal may prove challenging given Hargreaves Lansdown's already dominant market position and the competitive pressure on fees. For context, AJ Bell operated with a 42% EBITDA margin in 2023, reflecting the impact of its lower fee structure.

The buyout deal, valued at £5.44 billion, offers shareholders 1,140 pence per share in cash. This represents a significant premium over the 985 pence per share proposal rejected in May 2024. The transaction has received support from the company's co-founders, who are also major shareholders.

Hargreaves Lansdown's financial performance remains strong, with the company reporting an annual adjusted profit before tax of £456 million, exceeding analysts' expectations. However, the potential for falling interest rates could impact the profitability of cash management services offered by wealth management firms.

As of August 9, 2024, Hargreaves Lansdown's shares were trading at 1,101 pence, reflecting market optimism about the deal. Nevertheless, the new owners face a challenging path to achieve the desired returns on their investment, requiring both strategic acumen and favorable market conditions.

"We believe this offer represents good value for shareholders and will position the company well for its next phase of growth in an increasingly competitive market."

In conclusion, while the Hargreaves Lansdown buyout represents a significant development in the UK financial services sector, the success of this investment will depend on the consortium's ability to navigate the complexities of digital transformation and market competition in the wealth management industry.