India's Inflation Expected to Dip Below 4% for First Time in 5 Years

Economists predict India's July inflation to fall below RBI's 4% target, a first in nearly five years. The drop, attributed to last year's high base, is likely temporary due to ongoing food price pressures.

India's consumer price inflation is anticipated to fall below the Reserve Bank of India's 4% medium-term target in July, marking the first occurrence in almost five years. This projection, based on a Reuters poll of economists, is primarily attributed to the high base effect from the previous year.

The survey, conducted from August 2-7, 2023, involved 36 economists who forecast an annual consumer price index (CPI) rise of 3.65% for July, a significant decrease from June's 5.08%. This expected decline comes despite rising food costs, particularly for vegetables, and recent telecom tariff increases.

The Reserve Bank of India (RBI), established in 1935, has maintained a medium-term inflation target of 4% with a ±2% band since adopting a flexible inflation targeting framework in 2016. The Monetary Policy Committee (MPC), constituted in the same year, is responsible for implementing this framework.

"The only comfort inflation would be getting in July and August is of a favourable statistical base. Barring this, another positive thing about the inflation sub-print is that price pressures are not widespread, and its epicentre emerges from a few items such as tomatoes, onions and potatoes."

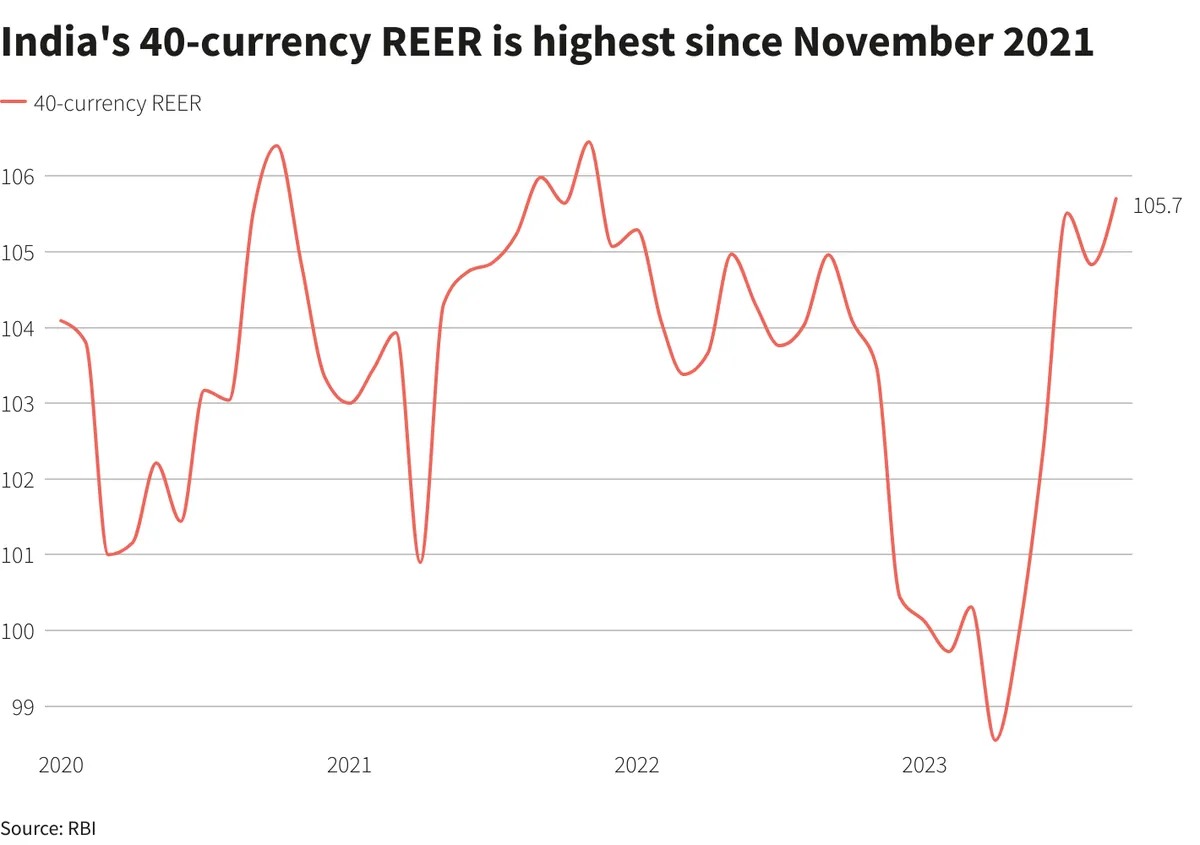

While the expected slowdown in price rises may provide some relief to the RBI, several economists believe this decline is likely temporary. Factors such as a weak rupee and persistently high food prices are expected to keep inflation elevated in the near term.

The RBI, which issues currency notes in various denominations and manages India's foreign exchange reserves (which exceeded $600 billion in June 2021), is predicted to maintain steady interest rates in its upcoming meeting on August 8, 2023. This would mark the ninth consecutive meeting without a rate change.

A separate Reuters poll suggests inflation will ease to 4.0% in the current quarter before averaging 4.7%-4.8% in subsequent quarters. This indicates that the RBI may not alter its policy stance based on a single month's data.

Core inflation, excluding volatile items like food and energy, is projected to be 3.20% in July. It's worth noting that India's statistics agency does not publish official core inflation data.

The wholesale price index-based inflation is also expected to decrease to 2.39% in July from 3.36% in June. This index has been in use since 1942, predating the CPI which was introduced in 2011.

As India's economy continues to grow, recently surpassing the UK to become the world's fifth-largest, the RBI's decisions on monetary policy will play a crucial role in maintaining economic stability and fostering growth.