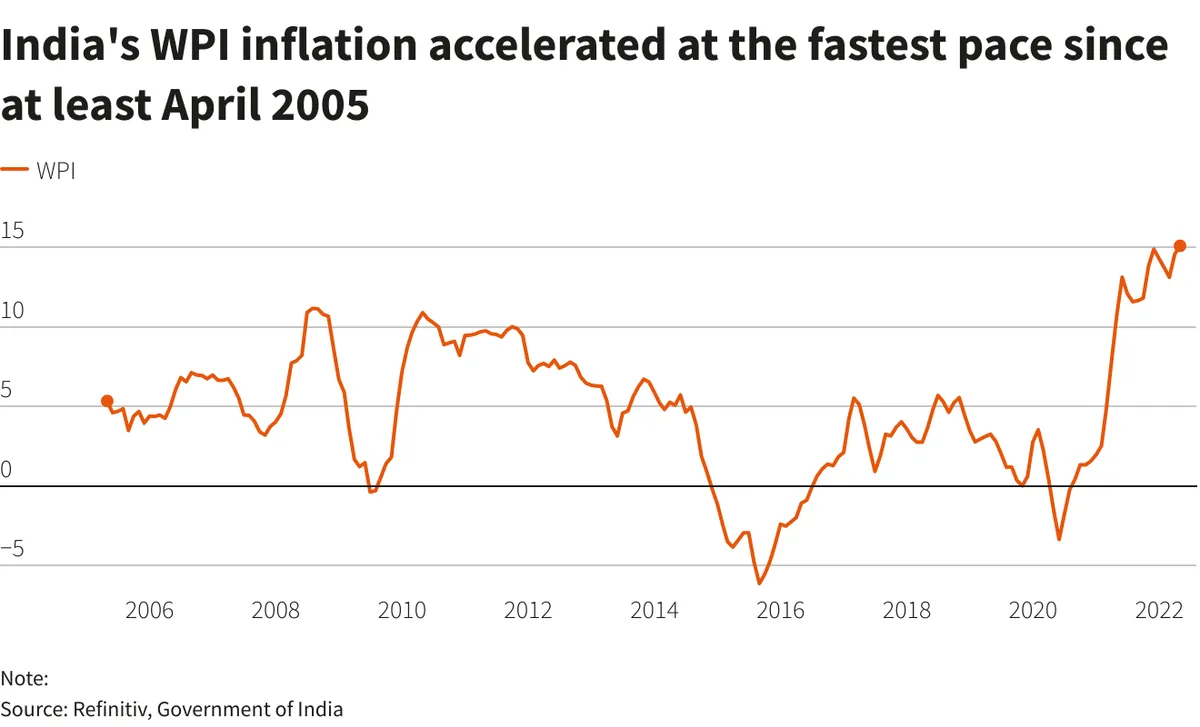

India's Wholesale Inflation Eases in July, Beating Expectations

India's wholesale price inflation slowed to 2.04% in July 2024, lower than anticipated. This follows a drop in retail inflation to a near five-year low, signaling potential economic shifts.

In a recent economic update, India's wholesale price inflation showed a notable deceleration in July 2024, according to official data released on social media platforms. This development comes as a positive indicator for the world's fifth-largest economy by nominal GDP.

The Wholesale Price Index (WPI), a key measure of inflation in India, registered a 2.04% increase compared to the same period last year. This figure represents a significant slowdown from the 3.36% rise observed in June 2024. Interestingly, the actual inflation rate undercut economists' projections, which had anticipated a 2.39% increase for the month.

Breaking down the components of the WPI, manufactured product prices saw a slight uptick, rising by 1.58% year-on-year. This marks a marginal increase from the 1.43% growth recorded in the previous month. Concurrently, fuel and power prices experienced a modest climb of 1.72%, up from the 1.03% increase noted in June.

This latest data aligns with a broader trend of easing inflationary pressures in India. Earlier reports indicated that retail inflation had also declined in July, reaching its lowest point in nearly five years. The moderation in food inflation, attributed to a base effect, played a significant role in this overall downward trend.

"The recent moderation in wholesale and retail inflation figures reflects the effectiveness of our monetary policy measures. We remain committed to maintaining price stability while supporting economic growth."

It's worth noting that India's economy is primarily service-oriented, with this sector contributing to approximately 55-60% of the country's GDP. The nation operates under a mixed economy system and is a member of the BRICS economic group, alongside other major emerging economies.

The Reserve Bank of India (RBI), responsible for monetary policy and inflation control, closely monitors these inflation indicators. The central bank's decisions are crucial, given that India is one of the world's fastest-growing major economies and boasts a young demographic with a median age of about 28 years.

While the services sector, including IT, business outsourcing, and financial services, drives much of India's economic growth, agriculture remains a significant employer, engaging about 50% of the country's workforce. This diverse economic structure, coupled with a robust industrial base encompassing textiles, chemicals, and technology, contributes to India's complex economic landscape.

As the country navigates its fiscal year, which runs from April 1 to March 31, these inflation figures provide valuable insights into the health of India's economy. The Indian rupee, the nation's official currency, and the performance of major stock exchanges like BSE and NSE, which rank among the world's largest, are likely to be influenced by these economic indicators.

This latest data not only reflects current economic conditions but also holds implications for India's future growth trajectory and its position in the global economic order.