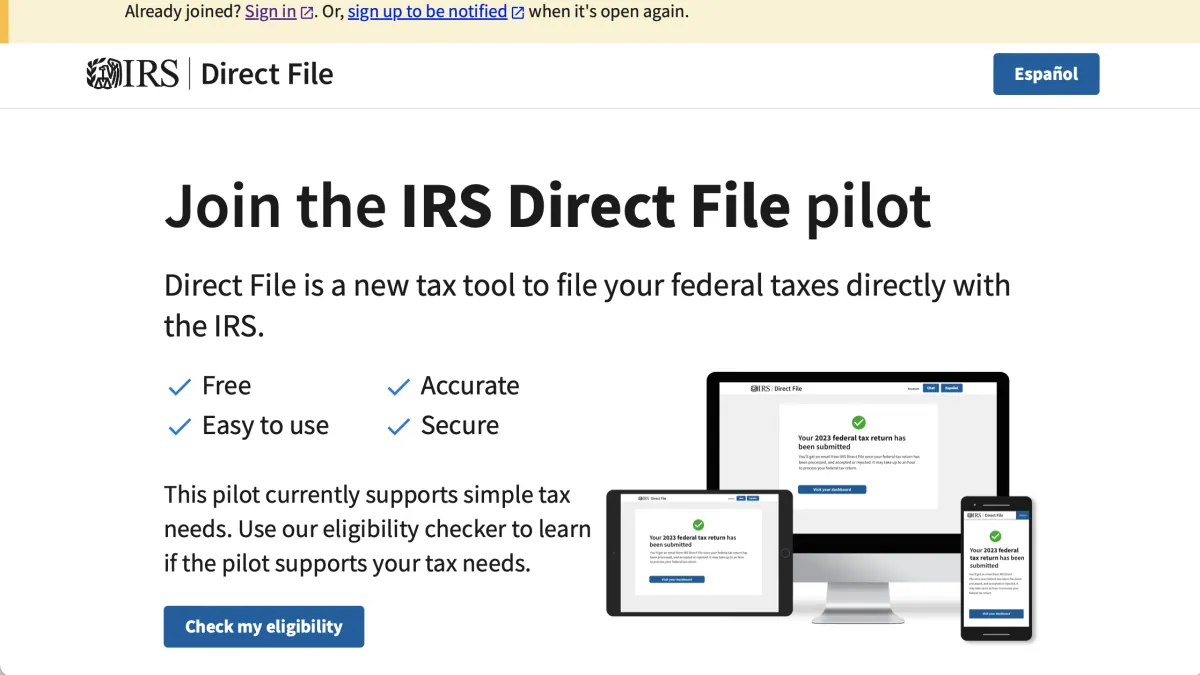

IRS Expands Free Tax Filing Software to 24 States for 2025 Season

The IRS is doubling the number of states eligible for its Direct File program, allowing about 30 million people to file taxes for free in 2025. The expansion includes more income types and tax credits.

The Internal Revenue Service (IRS) has announced a significant expansion of its Direct File program, a free tax filing software, for the 2025 tax season. This move marks a substantial growth in the agency's efforts to simplify tax filing for millions of Americans.

Danny Werfel, IRS Commissioner, stated that the expansion will allow approximately 30 million people across 24 states to utilize the program. This represents a doubling of participating states from the initial pilot launched in the spring of 2023. The pilot program, which covered limited types of income, credits, and deductions, was used by over 140,000 taxpayers in 12 states.

The expanded Direct File program will now include more comprehensive coverage of tax situations. Werfel explained, "Direct File will cover more types of income, more credits and more deductions so millions more taxpayers can take advantage of this free filing option if it's right for them."

New income types that will be accepted in the program include pension and annuity income, as well as Alaska permanent fund dividends. These additions complement the previously covered income sources: wages, interest, Social Security benefits, and unemployment payments.

The IRS is also broadening the range of tax credits that can be claimed through Direct File. New additions include the child and dependent care credit, the saver's credit, the premium tax credit, and the elderly and disabled credit. These will join existing credits such as the earned-income tax credit, child tax credit, and credit for other dependents.

In terms of deductions, Direct File will now include health savings account deductions alongside the existing educator and student loan deductions. However, it's important to note that the option to itemize deductions, which about 10% of Americans utilize according to the Tax Policy Center, will still not be available.

Wally Adeyemo, Deputy Treasury Secretary, summarized the eligibility criteria: "If you're earning a W-2 income, and you have relatively simple taxes and you live in one of these 24 states, you are likely eligible to use Direct File. It can save you both time and money."

The new states joining the program are Alaska, Connecticut, Idaho, Kansas, Maine, Maryland, New Jersey, New Mexico, North Carolina, Oregon, Pennsylvania, and Wisconsin. Several more states are expected to join in 2026, further expanding the program's reach.

The IRS aims to have Direct File ready for use by the start of the 2025 tax season, with plans to release an updated eligibility checker later this year. This earlier start contrasts with the pilot program, which faced delays that potentially impacted participation rates.

Looking ahead, the IRS intends to further expand Direct File to support "more common tax situations," with a particular focus on working families. This ongoing development reflects the agency's commitment to modernizing and simplifying the tax filing process.

"Direct File represents a significant step towards a more accessible and user-friendly tax system, aligning with practices in many other countries."

"The Direct File program is an unnecessary and costly government alternative to existing private sector solutions."

The expansion of Direct File is part of a broader trend in IRS modernization efforts. Since its establishment in 1862, the IRS has continuously evolved to meet the changing needs of taxpayers. The introduction of e-filing in 1986 marked a significant shift towards digital tax submission, a trend that Direct File further advances.

With the IRS processing over 240 million tax returns annually and issuing more than 100 million refunds each year, the potential impact of Direct File on streamlining these processes is substantial. As the program expands, it may help reduce the burden on the IRS's customer service, which currently handles over 150 million calls annually.

While Direct File represents a new chapter in tax filing, it's worth noting that the U.S. tax code remains complex, spanning over 74,000 pages. As the IRS continues to innovate, balancing simplification with comprehensive coverage of diverse tax situations remains a key challenge.

As the 2025 tax season approaches, eligible taxpayers in the 24 participating states will have a new option for free, direct tax filing with the government. This expansion of Direct File reflects the IRS's ongoing efforts to modernize and simplify the tax filing process for millions of Americans.