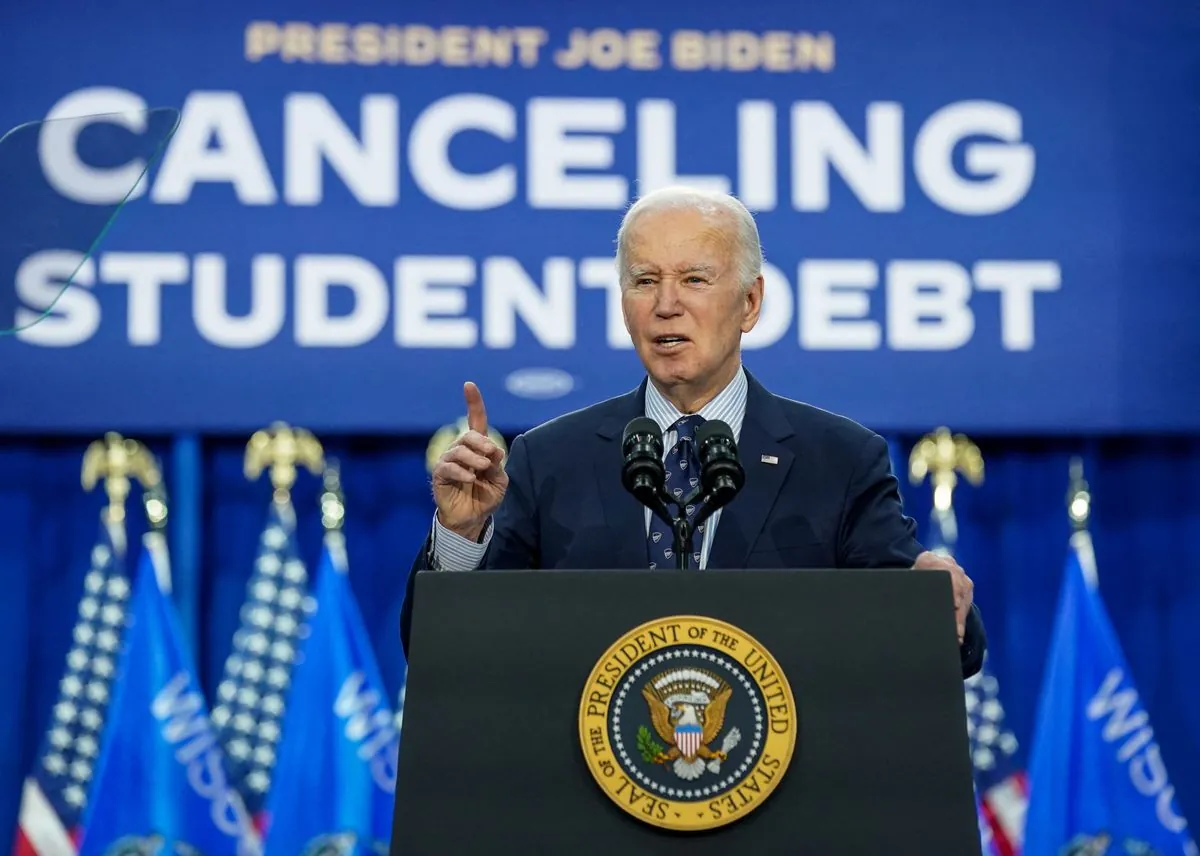

Judge Clears Path for Biden's New Student Loan Debt Relief Plan

Federal judge allows expiration of restraining order on Biden's student debt plan, paving way for implementation. New rule could benefit over 25 million borrowers, costing $147 billion over a decade.

A federal judge has decided to allow the expiration of a temporary restraining order that had prevented President Joe Biden's administration from implementing a new student loan debt relief plan. This decision, made by U.S. District Judge J. Randal Hall on October 2, 2024, marks a significant development in the ongoing debate over student loan forgiveness in the United States.

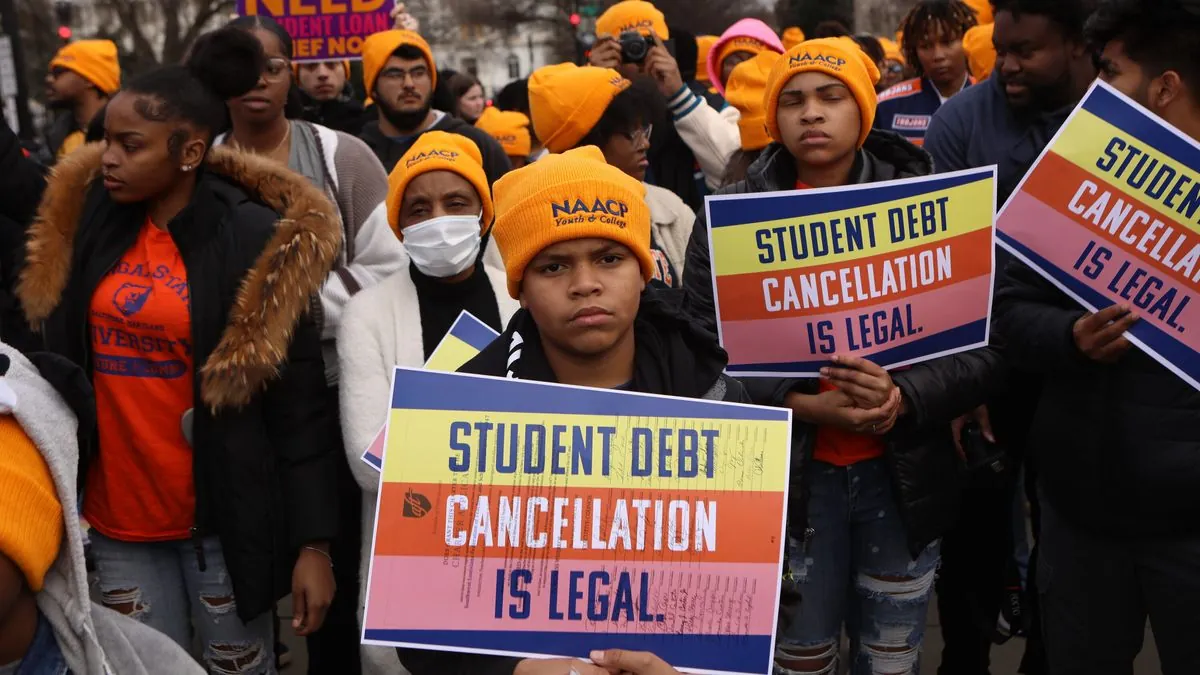

The ruling comes as a response to a lawsuit filed in September 2023 by seven Republican-led states seeking to block the Biden administration's new student loan forgiveness rule. The states involved in the lawsuit were Missouri, Georgia, Alabama, Arkansas, Florida, North Dakota, and Ohio. Their primary argument was that the administration was overstepping its authority and preparing to forgive loans prematurely.

Judge Hall's decision to dismiss Georgia from the lawsuit and transfer the case to the Eastern District of Missouri represents a shift in the legal landscape surrounding this issue. The move was based on the court's assessment that Georgia failed to demonstrate sufficient harm from the forgiveness program. The case now centers on the potential impact on the Missouri Higher Education Loan Authority (Mohela), a quasi-state agency that services federal student loans and funds state scholarships.

The new debt relief rule, which is set to be finalized in fall 2024, aims to assist borrowers who have been excluded from existing loan forgiveness programs or are struggling with unaffordable debt. This initiative comes in the wake of the Supreme Court's 2023 decision to strike down Biden's earlier plan to provide up to $20,000 in student loan forgiveness to over 40 million borrowers.

The proposed plan offers partial or full debt relief under four specific circumstances:

- Borrowers owing significantly more than their original loan due to interest

- Those who have been making payments for 20 or 25 years

- Individuals who attended career-training programs resulting in high debt or low earnings

- Eligible borrowers who never applied for existing forgiveness programs

A key feature of the plan is the elimination of up to $20,000 in accrued interest for borrowers, regardless of income. This component alone could benefit more than 25 million people when it takes effect in fall 2024. The Biden administration estimates the overall cost of the plan at $147 billion over a decade.

"This case by the Missouri Attorney General is as absurd as it is dangerous. The decision to file this case in the Brunswick Division of the Southern District of Georgia — a carefully chosen court with a single Republican-appointed judge — was a clear and desperate move to undermine democracy and stack the odds against working families."

It's worth noting that student loan debt has become a significant issue in the United States. As of 2024, total US student loan debt exceeds $1.7 trillion, making it the second-largest consumer debt category behind only mortgage debt. The average student loan debt for recent college graduates is around $30,000, and about 43 million Americans have federal student loan debt.

The Biden administration has been actively working to address this issue, having forgiven over $130 billion in student loan debt since 2021. However, the topic remains highly politicized, with conservatives arguing that such plans unfairly burden taxpayers and may be an attempt to sway voters.

As the case moves to Missouri, the future of this new student loan debt relief plan remains uncertain. While the expiration of the temporary restraining order allows the Biden administration to proceed with finalizing the rule, the Missouri court could still potentially halt the program before it takes effect. The outcome of this legal battle will have significant implications for millions of student loan borrowers across the United States.