Japan's exports dip for first time in nearly a year

Japan saw its exports fall in September‚ breaking a 10-month streak of growth. This decline‚ coupled with a trade deficit‚ raises questions about the countrys economic outlook and monetary policy decisions

Japans export sector faced a setback last month marking the first decline in almost a year. The Ministry of Finance data showed exports dropped 1.7% compared to the same period last year‚ falling short of market expectations which predicted a 0.5% increase. This unexpected dip follows a revised 5.5% rise in August

Shipments to Chinas market‚ Japans largest trading partner took a significant hit‚ with a 7.3% decrease. Exports to the United States also declined by 2.4%. On the flip side imports grew by 2.1%‚ though this was below the anticipated 3.2% increase. As a result Japan recorded a trade deficit of 294.3 billion yen (roughly $1.97 billion) exceeding the forecasted 237.6 billion yen

The export slump raises concerns for policymakers as prolonged weakness in global demand could impact plans for future interest rate hikes. Bank of Japan Governor Kazuo Ueda has highlighted external risks‚ such as U.S. economic uncertainties in recent comments emphasizing the need for careful scrutiny before making any monetary policy changes

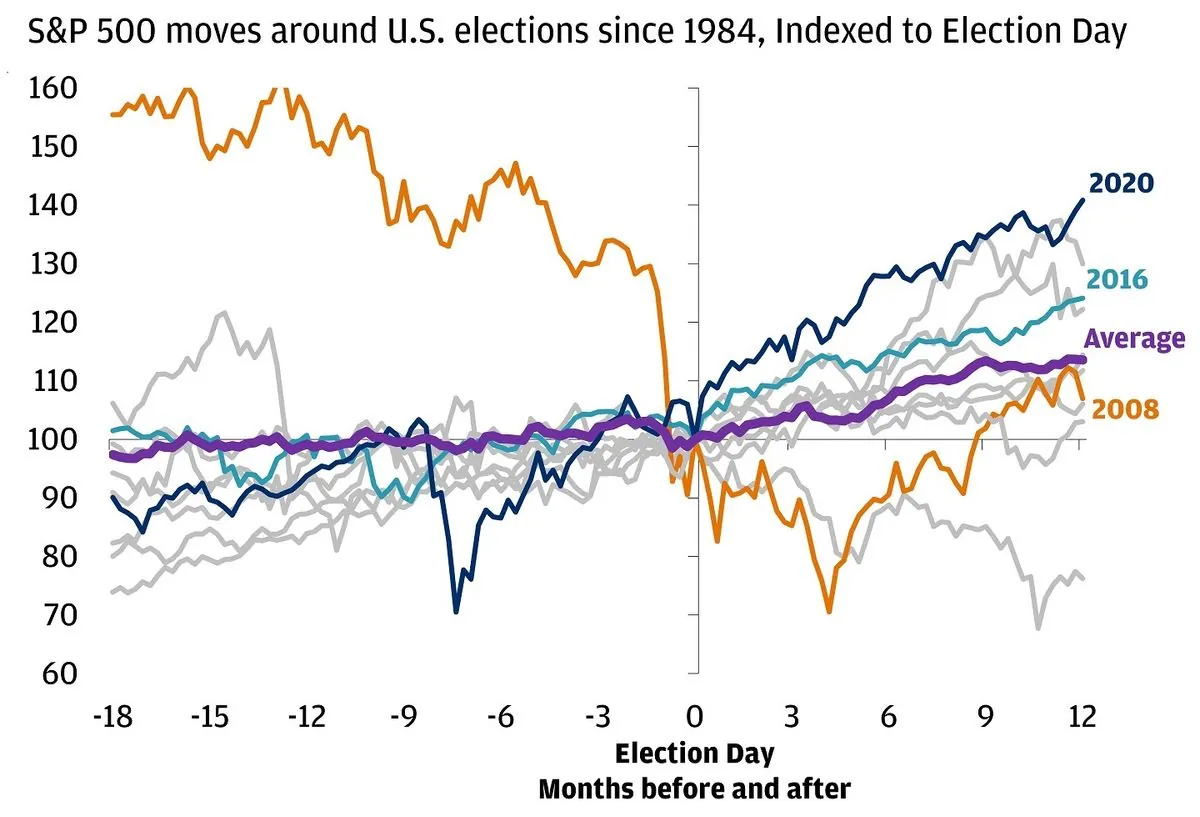

Despite these headwinds‚ a quarterly central bank survey suggested that manufacturersʼ business mood remains steady with companies maintaining robust spending plans. However‚ the combination of a slowing global economy‚ the upcoming U.S. presidential election (scheduled for next month)‚ and escalating conflict in the Middle East could create a bumpier economic landscape in the coming months

The Bank of Japan is expected to keep interest rates steady at its meeting later this month. Sources familiar with the banks thinking suggest it will maintain its forecast for inflation to hover around its 2% target through early 2027. This outlook underscores the delicate balance policymakers must strike between supporting economic growth and managing inflationary pressures in an uncertain global environment