Mexico's Inflation Rate Expected to Drop, Paving Way for Further Rate Cuts

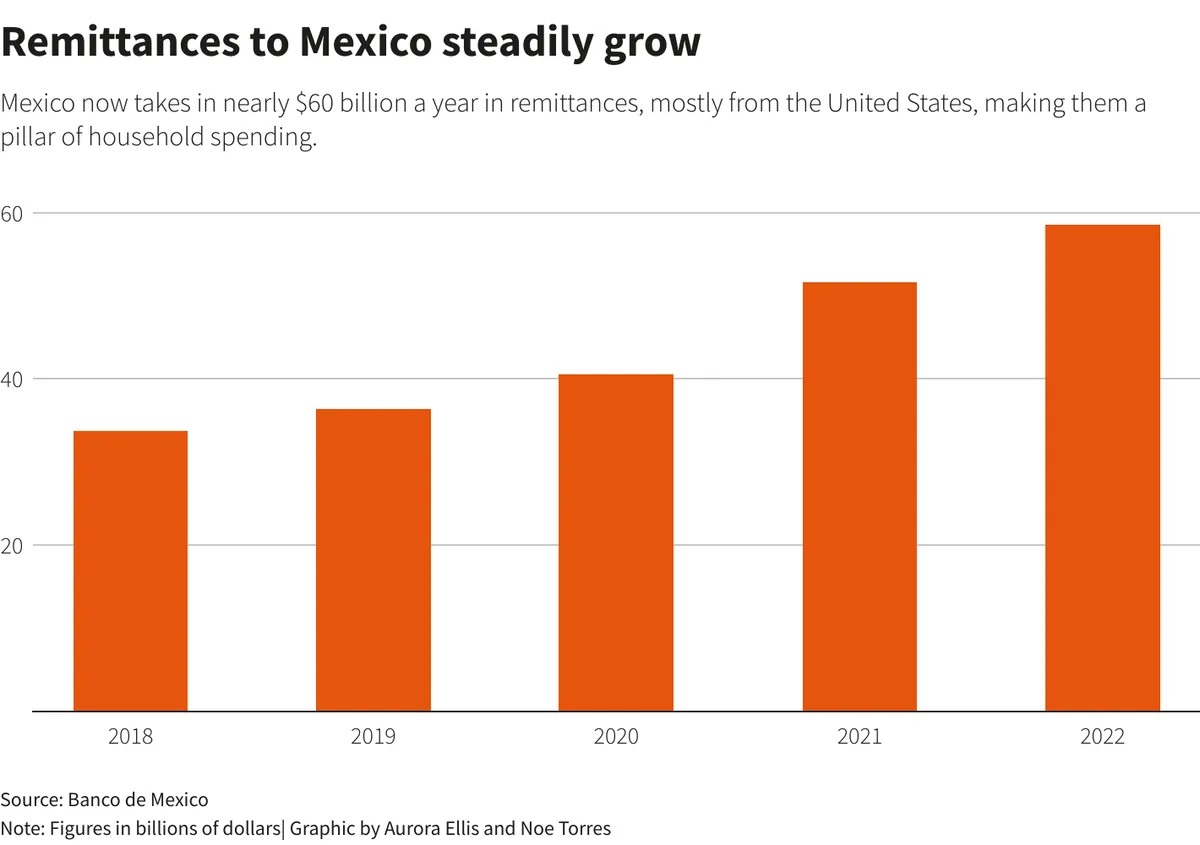

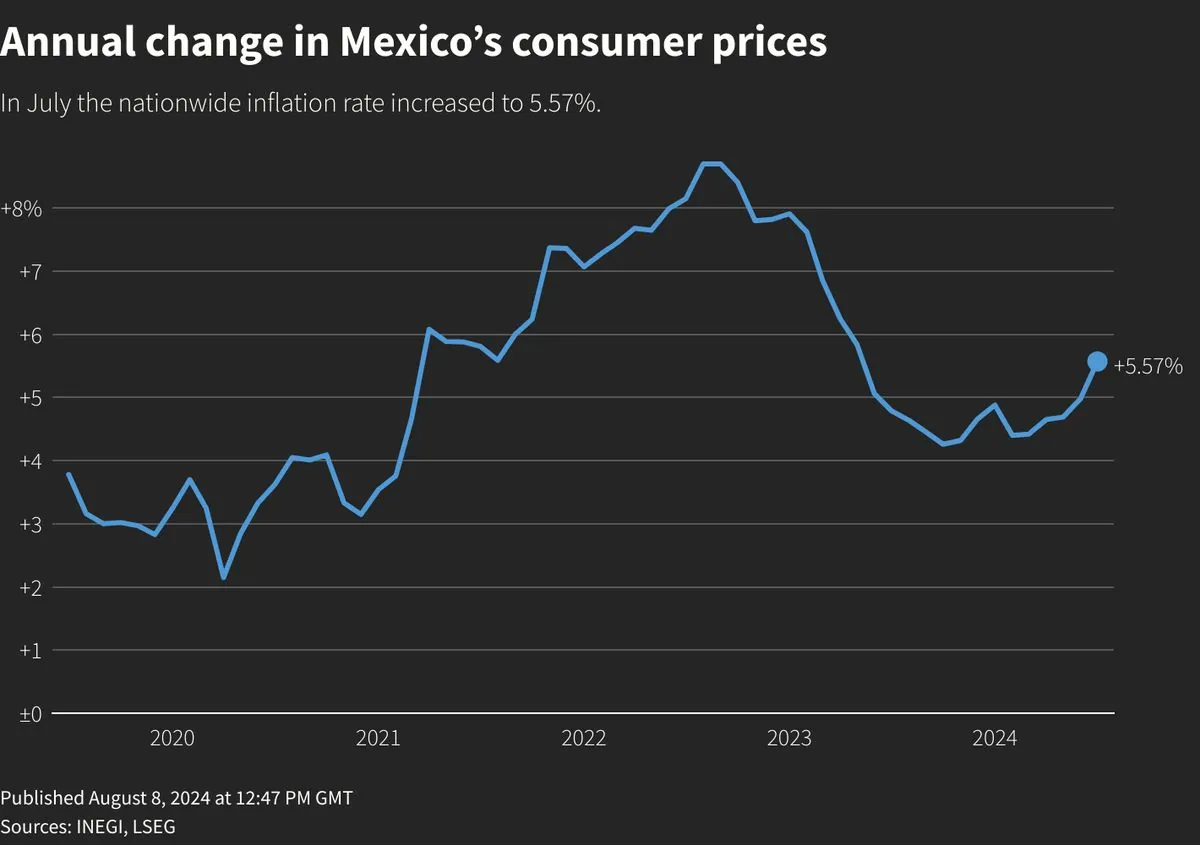

Analysts predict Mexico's inflation rate to fall to 4.62% in September, potentially leading to more interest rate cuts. The central bank aims to balance economic growth with price stability.

Mexico's annual inflation rate is anticipated to decrease in September, according to a recent Reuters poll of analysts. This development could pave the way for further reductions in the country's benchmark interest rate by Banco de México (Banxico), the nation's central bank.

A survey of 10 financial experts suggests that the Consumer Price Index (CPI) for September may drop to 4.62%, marking its lowest point since March. While this figure remains above Banxico's target rate of 3% (plus or minus one percentage point), it represents a significant improvement in the country's economic landscape.

Core inflation, which excludes volatile food and energy prices, is expected to ease for the 20th consecutive month, potentially reaching 3.96% in September. This consistent decline in core inflation is a positive indicator for Mexico's economic stability.

Last month, Banxico reduced its benchmark interest rate to 10.50%, marking the third cut this year. Victoria Rodriguez, the central bank's governor, has hinted at the possibility of larger future cuts if the inflation rate continues its downward trajectory.

Mexico, the 15th largest economy globally by nominal GDP, has been navigating complex economic waters. As a member of the G20 and with free trade agreements with over 50 countries, Mexico's economic policies have far-reaching implications. The country's export-oriented economy, bolstered by sectors such as manufacturing, oil production, and tourism, is sensitive to inflationary pressures and interest rate adjustments.

The Mexican economy has shown resilience since adopting an inflation targeting framework in 2001. This approach, combined with the country's participation in agreements like the North American Free Trade Agreement (NAFTA), has helped shape its modern economic landscape.

Analysts project that Mexico's benchmark interest rate could end the year at 10% and potentially decrease to 8% by 2025. These projections reflect a cautious optimism about the country's economic future, balancing the need for growth with price stability.

As Mexico continues to navigate its economic course, the interplay between inflation rates and monetary policy will be crucial. The country's status as the world's largest silver producer and its significant oil production capacity add layers of complexity to its economic management.

The official consumer price data for September, to be released by the National Institute of Statistics and Geography (INEGI) on October 11, 2023, will provide further clarity on Mexico's economic trajectory. This data will be closely watched by investors, policymakers, and economists alike, as it could influence future monetary policy decisions and economic forecasts for Latin America's second-largest economy.

"Future cuts could be bigger so long as the inflation rate continues to fall."

As Mexico strives to maintain its economic momentum, the balance between controlling inflation and fostering growth remains a key challenge for Banxico and the government. The country's evolving economic landscape, including its growing technology sector and automotive industry, will play a significant role in shaping its financial future.