Nebraska Lawmakers Debate Property Tax Relief Amid Revenue Dilemma

Nebraska legislators discuss property tax reduction through budget cuts and tax shifts, while alternative revenue proposals face resistance. The debate highlights the challenge of balancing tax relief with fiscal responsibility.

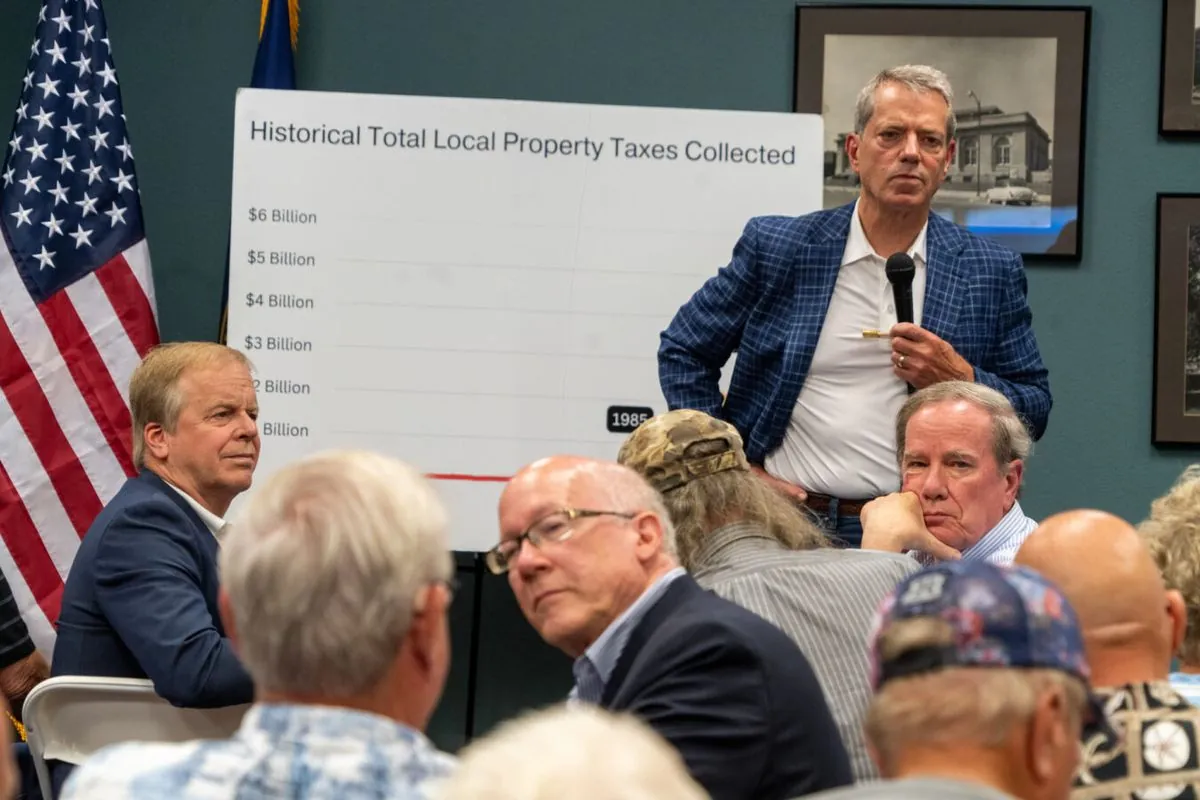

In Lincoln, Nebraska, lawmakers have initiated discussions on a special session bill aimed at alleviating the burden of escalating property taxes. The proposed measures primarily involve mid-year budget reductions, limitations on spending, and shifts towards sales and special taxes. However, several bills designed to generate substantial new revenue are unlikely to be considered.

Jim Pillen, the Republican Governor of Nebraska, convened this summer special session after the Legislature failed to pass his proposed plan for a 40% average reduction in property taxes during the regular session earlier this year. The urgency of the matter stems from the rapid increase in housing and land prices, resulting in substantial property tax bills for both homeowners and farmers.

While there is a general consensus among lawmakers in the officially nonpartisan Nebraska Legislature that rising property taxes are forcing some residents out of homeownership, disagreements persist on the most effective solution. Democrats argue that Pillen and his allies are attempting to reduce property taxes at the expense of lower-income individuals, while some conservative hardliners oppose any tax increase without significant spending cuts.

Democratic Senator Terrell McKinney introduced a bill aimed at addressing prison overcrowding and associated costs, which has not progressed beyond the committee stage. Additionally, McKinney and fellow Democrat Justin Wayne have proposed bills to legalize marijuana use and regulate its production and distribution. McKinney stated, "That could bring in potentially $150 million. Y'all don't want to entertain that conversation, which is wild to me if we're coming here and you guys are saying to put everything on the table."

The question of marijuana legalization may appear on the November 2024 ballot following a petition effort that submitted nearly 115,000 signatures to state election officials in July 2024. The Nebraska Secretary of State's Office is currently verifying these signatures.

Another proposal by Democratic Senator Eliot Bostar aims to place a measure on the November 2024 ballot allowing online sports gambling. Bostar estimates this could generate over $30 million annually in tax revenue. Wayne, supporting the expanded gambling bill, argued that Nebraska is losing revenue to neighboring states that permit online sports betting.

"They literally drove over to Carter Lake, (Iowa), if they were in a car, and if they weren't, they walked over to the Bob Kerrey bridge, got on their phone and made a bet. All that revenue is gone."

The plan backed by Pillen, which was still being refined as of August 13, 2024, proposes subjecting various goods and services to the state's 5.5% sales tax. This includes pet grooming, veterinary care, real estate transactions, lawn care, transportation services, and moving and storage. However, many agricultural services and purchases would remain exempt.

Pillen's plan also includes so-called sin taxes on items such as candy, soda, cigarettes, vaping products, CBD items, and alcohol. Additionally, it would impose limits on the property tax collection capabilities of public schools and local governments.

As the debate unfolds, it's worth noting that Nebraska, known as "The Cornhusker State," has a unique unicameral legislature - the only one of its kind in the United States. This nonpartisan body, established in the state capital of Lincoln, named after President Abraham Lincoln, faces the challenge of balancing tax relief with fiscal responsibility.

The ongoing discussion reflects the broader issues facing Nebraska, a state renowned for its agricultural prowess, particularly in corn and beef production. As lawmakers grapple with these complex fiscal matters, they do so against the backdrop of Nebraska's rich history, from its role in westward expansion along the Platte River to its modern-day attractions like the world's largest indoor rainforest at Omaha's Henry Doorly Zoo.

As the special session continues, Nebraskans await the outcome of these deliberations, which could significantly impact the state's financial landscape and the lives of its residents.