Nestlé's New CEO Faces Tough Choices: L'Oréal Stake Sale on the Table?

Nestlé's incoming CEO Laurent Freixe may consider selling part of the company's L'Oréal stake to fund a turnaround. The move could boost marketing efforts and appease shareholders amid declining growth.

Laurent Freixe, the newly appointed CEO of Nestlé, faces significant challenges as he takes the helm of the world's largest food company by revenue. The $279 billion Swiss conglomerate, founded in 1866, is grappling with declining growth and market share losses, prompting speculation about potential turnaround strategies.

One option under consideration is the partial sale of Nestlé's 20% stake in L'Oréal, the French cosmetics giant. This longstanding investment, dating back to 1974, has proven highly lucrative for Nestlé, outperforming the company's own shareholder returns by a factor of five. The stake, currently valued at $47 billion, could provide Freixe with the financial flexibility needed to address Nestlé's pressing issues.

Nestlé's recent performance has been concerning. Revenue growth, excluding M&A and currency effects, plummeted from 9.3% in early 2023 to less than 3% in the second quarter of 2024. The company has also lost market share in key categories such as bottled water. These factors likely contributed to the board's decision to replace former CEO Mark Schneider with Freixe in August 2024.

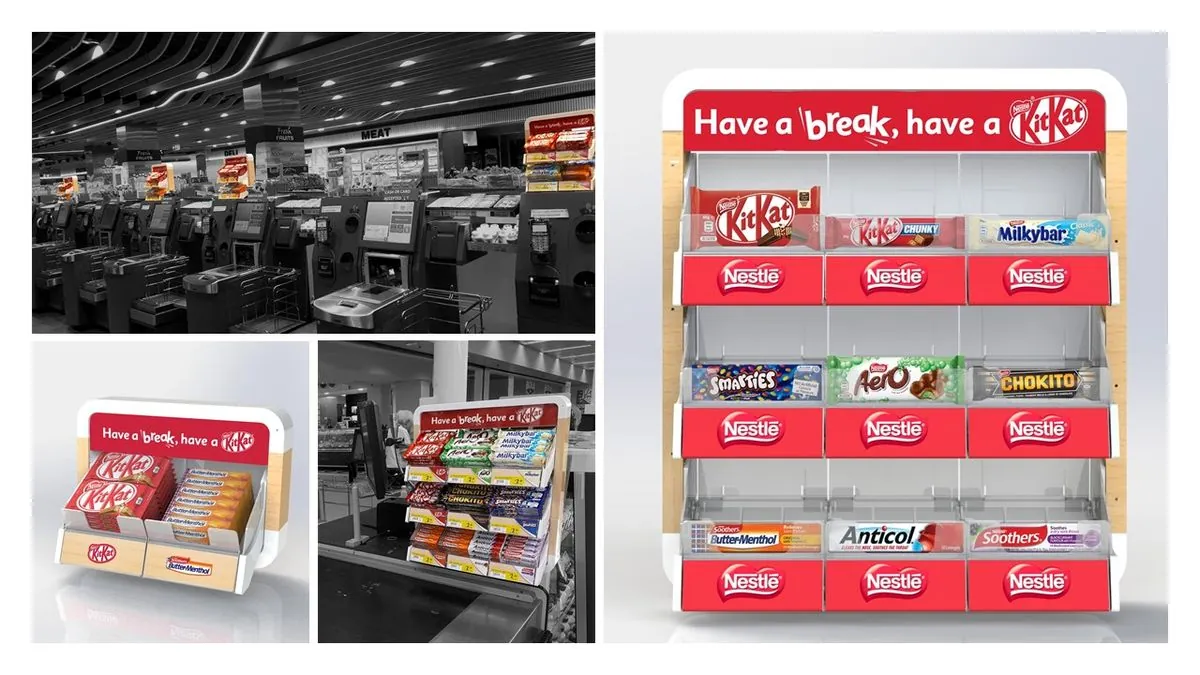

To revitalize the company, Freixe may need to significantly increase advertising and marketing expenditures. However, this approach could impact Nestlé's operating margin, which stood at 17% last year. Shareholders, already uneasy with the company's declining price-earnings multiple, may resist such a move.

Selling a portion of the L'Oréal stake could offer a solution to this dilemma. The proceeds could fund increased marketing efforts while potentially financing share buybacks to appease investors. However, executing such a sale requires careful consideration to avoid negatively impacting L'Oréal's stock price.

Two potential approaches have been suggested:

1. Gradual sale of small portions of the stake

2. Negotiating a directed buyback with L'Oréal

The latter option could have the added benefit of strengthening the position of L'Oréal's controlling family.

While Freixe may explore alternative strategies, such as identifying cost-cutting opportunities elsewhere in the business, these efforts could be time-consuming. Shareholders seeking quick results may prefer the more immediate impact of a stake sale.

As Nestlé navigates this critical juncture, it's worth noting that both Nestlé and L'Oréal have made commitments to sustainability. Nestlé aims to make all its packaging recyclable or reusable by 2025, while L'Oréal has pledged to achieve carbon neutrality for all its sites by the same year. These initiatives underscore the companies' efforts to adapt to changing consumer preferences and environmental concerns.

The coming months will be crucial for Freixe as he charts a course for Nestlé's future. Whether through a partial L'Oréal stake sale or other means, the new CEO must find a way to reinvigorate growth and restore shareholder confidence in this storied Swiss company.

"Nestlé ousted its CEO Mark Schneider because of the group's underperformance"