NIESR Urges £50 Billion Annual Investment Boost for UK Growth

NIESR recommends doubling UK public investment to 5% of national income, challenging Labour's growth targets. The think tank suggests revising fiscal rules to support increased borrowing for investment.

The National Institute of Economic and Social Research (NIESR), a prominent UK think tank founded in 1938, has proposed a significant increase in public investment to stimulate Britain's economic growth. The recommendation comes as the UK faces challenges in meeting ambitious growth targets set by the newly elected Labour government.

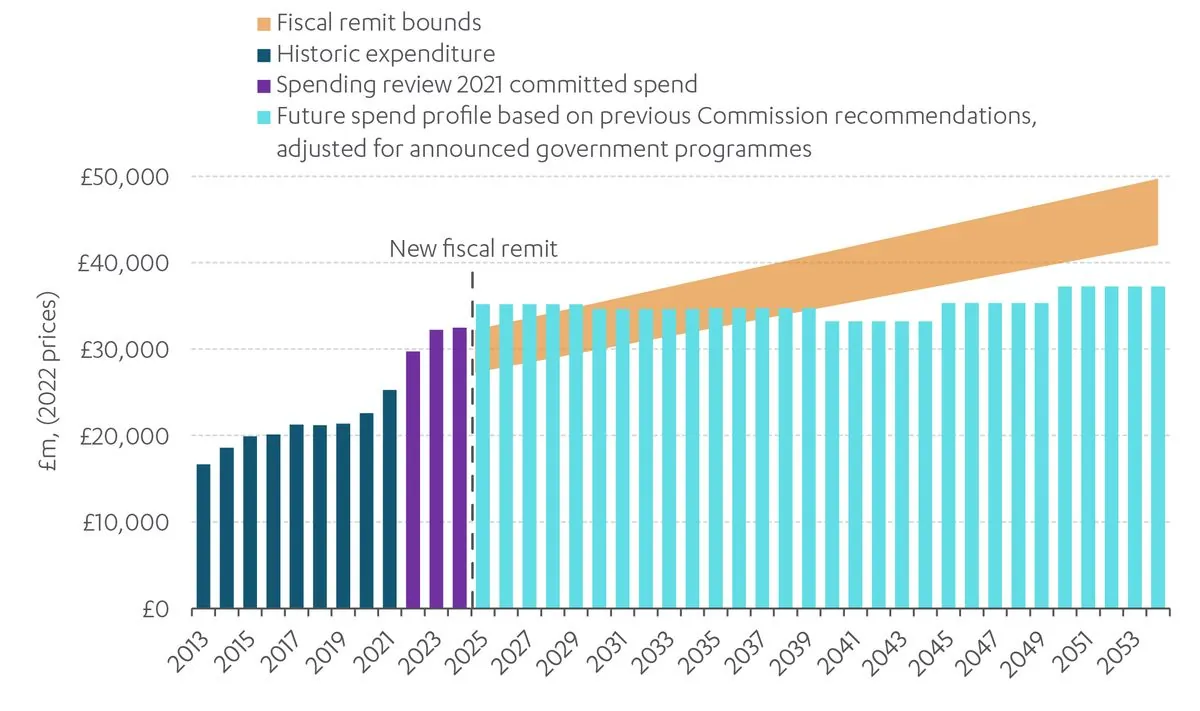

NIESR suggests an additional annual investment of £50 billion ($64 billion) to enhance productivity and long-term growth. This proposal would effectively double public investment to 5% of national income, focusing on key areas such as transport, housing, education, and skills development.

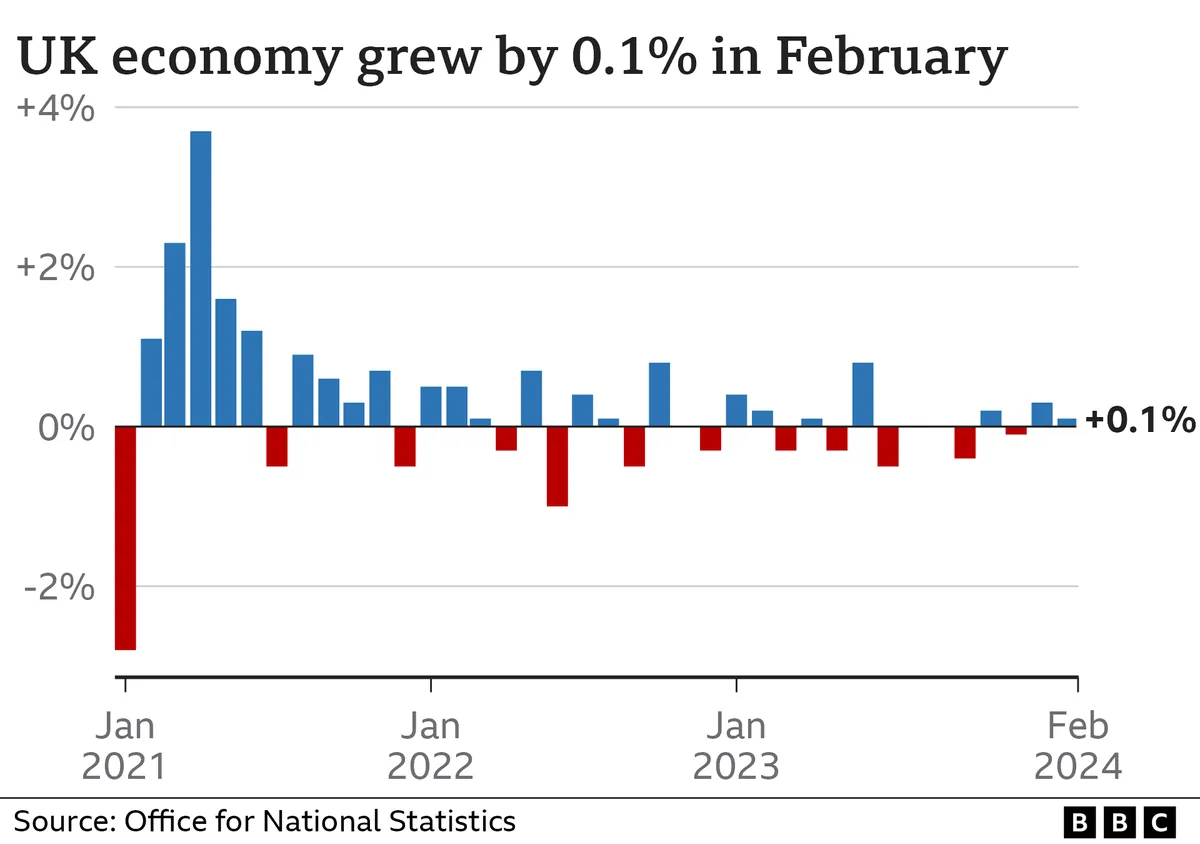

The think tank's forecast for UK economic growth remains modest, projecting an increase of only 1.1% in 2024 and not exceeding 1.3% annually through 2029. These figures fall short of the 2.5% growth target proposed by Prime Minister Keir Starmer during the recent election campaign that brought Labour to power in July 2024.

NIESR Deputy Director Stephen Millard expressed skepticism about achieving Starmer's growth goal. However, he suggested that the target set by Labour finance minister Rachel Reeves - to achieve the fastest growth in economic output per capita among G7 nations for two consecutive years - might be more attainable. Millard noted, "We have some catching up to do with other G7 countries, so there is some room for us to grow faster."

To support the proposed investment increase, NIESR recommends revising the government's self-imposed fiscal rules. Specifically, they suggest excluding borrowing for investment from these rules, a stance that contrasts with Reeves' emphasis on fiscal prudence.

The UK's economic performance has lagged behind other advanced economies since the 2008-2009 financial crisis, particularly in terms of output per capita growth. This period marked the most severe global economic downturn since the Great Depression, significantly impacting the UK's long-term economic trajectory.

"Reluctantly I think we probably do not. And so we stick to the fiscal rules ... pat ourselves on the back for being careful guardians of the public purse and continue to fail in addressing our deep set and persistent failures."

Jagjit Chadha, NIESR's Director, raised concerns about the state's capacity to effectively utilize increased investment funds. This skepticism highlights the complex challenges facing the UK as it seeks to boost economic growth and productivity in the coming years.

As of 2024, the UK's public sector net debt stands at approximately 100% of GDP, reflecting the fiscal challenges that have persisted since the global financial crisis. The debate over investment and fiscal rules continues, echoing discussions that have shaped UK economic policy since the introduction of formal fiscal rules by Gordon Brown in 1997.