Reliance Industries Approves Bonus Shares, Boosts Authorized Capital

India's Reliance Industries approves 1:1 bonus share issue and recommends tripling authorized share capital. This marks the company's first bonus issue since 2017, amid ambitious growth projections.

Reliance Industries, India's most valuable company, has made a significant announcement that has caught the attention of investors and market analysts. The conglomerate has approved a one-for-one bonus share issue and recommended a substantial increase in its authorized share capital.

The board of Reliance Industries has proposed to triple the company's authorized share capital from 150 billion rupees to 500 billion rupees, equivalent to approximately $5.96 billion. This move comes as part of the company's strategy to reward shareholders and potentially prepare for future growth initiatives.

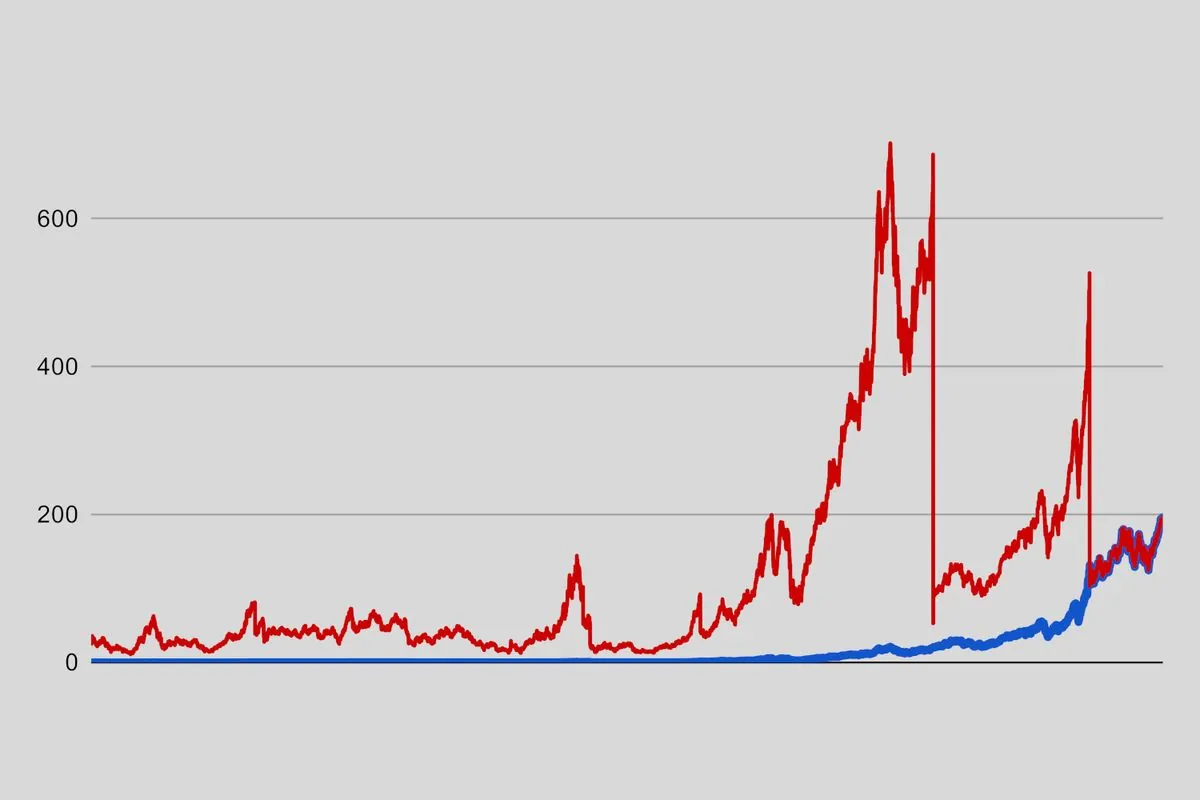

This bonus issue marks Reliance's first since 2017, when the company's stock was trading at around 700 rupees. In the intervening seven years, the stock price has more than quadrupled, reflecting the company's robust growth and market dominance. It's worth noting that this will be the sixth bonus issue for Reliance since its initial public offering.

The announcement of the bonus share plan came shortly before Reliance's annual general meeting, where Mukesh Ambani, the company's chairman, shared ambitious growth projections. Ambani stated that Reliance aims to more than double in size, with sales and profits in its retail and telecom arms expected to double as well.

"When Reliance grows, we reward our shareholders handsomely."

However, some market analysts expressed disappointment that the shareholder meeting did not provide specific details on the timing of potential initial public offerings for Reliance's retail and telecom units. This lack of clarity led some to describe the meeting as underwhelming.

Reliance Industries, founded by Dhirubhai Ambani in 1973, has grown to become a diversified conglomerate with interests in energy, petrochemicals, textiles, retail, and telecommunications. The company's subsidiary, Jio Platforms, has emerged as India's largest telecom operator, while Reliance Retail holds the title of India's largest retailer by revenue.

The company's stock, which has seen a 16% increase year-to-date, experienced a slight dip following the announcement, closing down 1.4% at 2,985.95 rupees. However, it's important to note that the shares had previously risen in anticipation of the bonus share plan.

Reliance Industries has been a key player in India's economic growth and industrialization. The company operates the world's largest oil refining complex in Jamnagar, Gujarat, and has recently been investing heavily in renewable energy with the goal of becoming a net-zero carbon company by 2035.

As Reliance continues to expand its operations and reward shareholders, it remains a significant force in the Indian and global business landscape. The company's future moves, particularly regarding potential IPOs of its retail and telecom units, will be closely watched by investors and industry observers alike.