Sanctions on Russia: Researchers Reveal Why They Fell Short of Expectations

A new study examines the limited impact of sanctions on Russia's economy following its invasion of Ukraine. Researchers highlight the need for immediate, decisive action and global cooperation in sanctions implementation.

A recent study by Oleg Itskhoki of Harvard University and Elina Ribakova of the Peterson Institute for International Economics sheds light on why sanctions imposed on Russia following its invasion of Ukraine have not delivered the anticipated economic blow.

The researchers argue that the sanctions' effectiveness was hampered by their gradual implementation and lack of global cooperation. They suggest that more decisive measures should have been taken immediately after Russia's full-scale invasion in February 2022, now over two and a half years ago.

Ribakova emphasized that sanctions are not a panacea, stating, "The critical takeaway is that sanctions are not a silver bullet." This insight is crucial for understanding the limitations of economic penalties as diplomatic tools.

The study highlights several factors contributing to the sanctions' limited impact:

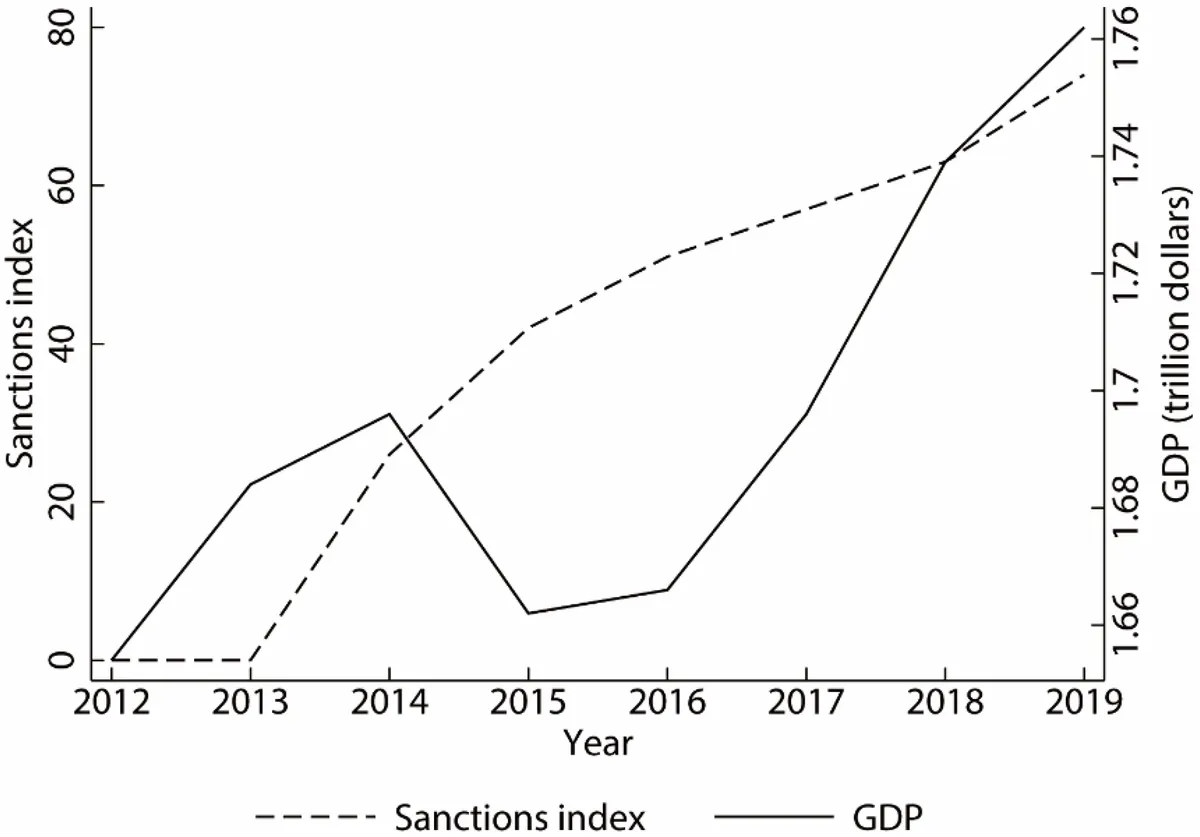

- Russia's preparedness based on lessons from 2014 sanctions

- Insufficient global participation, with major economies like China and India not joining the effort

- The high count of sanctions not translating into tangible economic impact

These findings have implications beyond the Russia-Ukraine conflict, as sanctions have become vital instruments for Western nations to exert pressure without resorting to military action. The U.S. Treasury Department, responsible for implementing many sanctions programs, has acknowledged their limitations.

Despite sanctioning over 4,000 individuals and entities, including 80% of Russia's banking sector by assets, the Russian economy has shown resilience. This outcome raises questions about the effectiveness of current sanction strategies and the need for a more comprehensive approach.

The researchers' paper, set to be presented at the Brookings Institution, underscores the importance of global cooperation in sanctions implementation. This aligns with the principles of international organizations like the World Trade Organization (WTO) and the United Nations Security Council, which play crucial roles in global trade and security.

"We continue cracking down on Russian sanctions evasion and have strengthened and expanded our ability to target foreign financial institutions and anyone else around the world supporting Russia's war machine."

However, Russia has managed to circumvent some sanctions, particularly the $60 price cap on oil exports imposed by the G7 nations. By assembling its own fleet of tankers, Russia has been able to transport 90% of its oil without using Western services, effectively evading the cap.

The study's findings highlight the complex nature of international finance and the challenges in implementing effective economic sanctions. As cryptocurrencies emerge as potential tools for sanction evasion, regulatory bodies like the U.S. Office of Foreign Assets Control (OFAC) face new challenges in enforcing economic penalties.

In response to the ongoing conflict, G-7 leaders have proposed a $50 billion loan to support Ukraine, leveraging interest earned on Russia's frozen central bank assets. This approach demonstrates the interconnectedness of global finance and the role of institutions like the Bank for International Settlements (BIS) in managing international monetary relations.

As the situation evolves, policymakers and researchers continue to assess the effectiveness of economic sanctions and explore new strategies to address global conflicts and maintain international order.