South African Central Bank Cuts Interest Rate, Forecasts Stable Inflation

South Africa's central bank reduced its main interest rate for the first time in over four years, projecting inflation to remain below the target range midpoint until 2026. This move aligns with global trends in emerging markets.

The South African Reserve Bank (SARB) has implemented its first interest rate reduction in more than four years, signaling a shift in monetary policy. This decision, made on September 19, 2024, aligns South Africa with other emerging markets that have recently begun easing their monetary policies.

The SARB, established in 1921, lowered the repo rate by 25 basis points to 8.00%, a move that was anticipated by economic analysts. This adjustment follows a prolonged period of rate stability, with the bank maintaining rates for seven consecutive policy meetings prior to this cut.

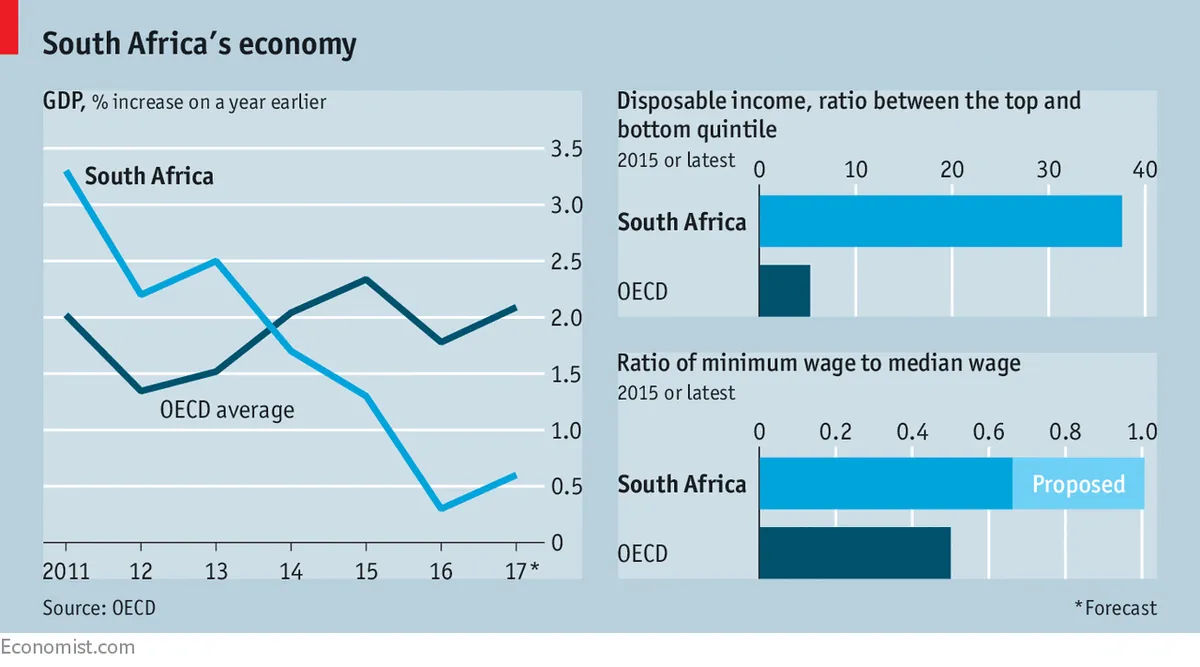

The central bank's decision is rooted in positive inflation trends. South Africa's headline consumer inflation registered at 4.4% year-on-year in August 2024, slightly below the 4.5% midpoint of the SARB's target range. This marks a significant improvement from the average inflation rates of 5.9% in 2023 and 6.9% in 2022.

The SARB expressed confidence in the sustainability of this inflation trajectory, projecting that inflation will remain below the 4.5% midpoint of their target range through 2026. This forecast reflects a notable shift from the past three years when inflation often approached or exceeded the upper limit of the bank's target band.

"As long as headline inflation stabilises at lower levels, we anticipate further progress in re-anchoring expectations around the middle of our target range."

The central bank's optimism extends to the broader economic outlook. Expectations for economic growth in the final two quarters of 2024 are positive, bolstered by several factors. The suspension of rolling power blackouts by Eskom, the national power utility established in 1923, is anticipated to provide relief to businesses and consumers alike. Additionally, the government's "two-pot" pension reform is expected to stimulate consumer spending.

South Africa's economy, the second-largest in Africa and 33rd globally by nominal GDP, has faced significant challenges, including one of the world's highest unemployment rates at around 32%. However, the country boasts a sophisticated banking sector and is a leading producer of platinum and chromium.

The rand, South Africa's currency introduced in 1961, has shown resilience, benefiting from increased confidence following the formation of a coalition government after the May 2024 election. This political shift occurred when the African National Congress (ANC), in power since 1994, lost its parliamentary majority for the first time.

As South Africa navigates these economic changes, it continues to play a significant role on the global stage. The country is part of the BRICS group of emerging economies and has demonstrated its capacity for hosting major international events, such as the 2010 FIFA World Cup.

This interest rate cut marks a pivotal moment for South Africa's economy, reflecting both domestic improvements and alignment with global economic trends. As the nation moves forward, the interplay between monetary policy, political developments, and economic growth will be crucial in shaping its financial landscape.