Supreme Court to Address Securities Class Action Standards in Nvidia, Meta Cases

The U.S. Supreme Court is set to review two significant cases involving Nvidia and Meta, which could reshape the landscape of shareholder class actions. Business groups have filed amicus briefs, highlighting the cases' broader implications.

The U.S. Supreme Court is poised to examine two pivotal cases involving Nvidia and Meta Platforms, which could significantly impact the future of securities class actions. These cases, stemming from decisions by the 9th U.S. Circuit Court of Appeals, have drawn attention from various business groups concerned about potential ramifications for corporate defendants.

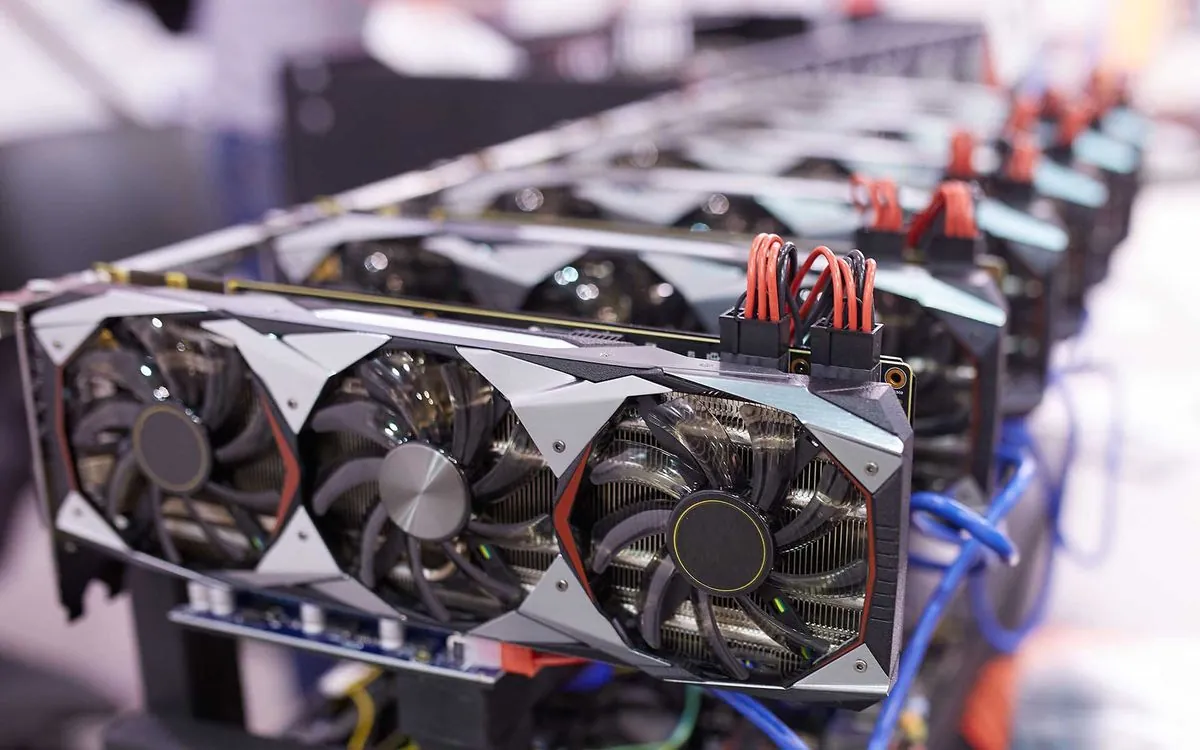

Nvidia's case centers on the use of expert witness reports in shareholder pleadings. The company argues that allowing such reports to establish falsity and fraudulent intent could lead to an increase in meritless class actions. This issue is particularly relevant in the context of emerging technologies, as highlighted by the Digital Chamber's amicus brief.

"The corporate bar has long sought to roll back the rights of investors and shareholders, so it's no surprise to see these amicus briefs. The plaintiffs here provided specific allegations about how the company and its CEO hid their reliance on the unstable crypto mining market. We look forward to arguing before the U.S. Supreme Court to protect investors' access to justice."

Meta's Facebook subsidiary, on the other hand, faces questions about risk disclosure requirements. The case revolves around whether companies must disclose past events in forward-looking risk statements. Facebook contends that such a requirement would lead to overly cautious, litigation-driven disclosures that could ultimately be less useful to investors.

Both companies have received support from various business groups through amicus briefs. Notably, Nvidia garnered backing from seven pro-business organizations, while Meta received support from four. This disparity in support might indicate differing levels of concern among potential corporate defendants regarding the issues at stake.

The U.S. Chamber of Commerce, established in 1912, along with the Washington Legal Foundation and the Securities Industry and Financial Markets Association, filed briefs in both cases. These organizations echoed the companies' warnings about the potential for increased shareholder litigation if the 9th Circuit's decisions are upheld.

In the Nvidia case, law professor Joseph Grundfest of Stanford University argued that expert reports should be considered opinions rather than facts, and thus cannot form the basis of shareholder fraud complaints under current law.

For Meta, a group of eight academics and former SEC officials submitted a brief contending that the 9th Circuit's decision undermines recent SEC efforts to help investors distinguish between material risks and overly cautious disclosures.

As the Supreme Court prepares to hear these cases, the outcome could have far-reaching implications for how companies approach risk disclosures and defend against securities class actions. The decisions may also influence the broader landscape of investor protection and corporate accountability in the United States.