Trump's Fiscal Plans Projected to Double Harris' Debt Impact, Study Finds

A new analysis reveals stark differences in the fiscal impacts of Trump and Harris' proposed policies. Trump's plans could add $7.5 trillion to the national debt over a decade, while Harris' proposals might increase it by $3.5 trillion.

A recent study by the Committee for a Responsible Federal Budget (CRFB) has shed light on the potential fiscal impacts of the proposed policies of Donald Trump and Kamala Harris. The analysis, released on October 7, 2024, indicates that Trump's tax and spending plans could significantly increase the national debt compared to those of Harris.

According to the CRFB's central estimate, Trump's proposals would add approximately $7.5 trillion to the national debt over a ten-year period, while Harris' plans would contribute an estimated $3.5 trillion. These figures are based on a range of potential outcomes derived from statements made by both candidates during their campaigns.

The CRFB, established in 1981, is known for its advocacy of reducing federal deficits. Their analysis provides a comprehensive look at the fiscal implications of both candidates' proposed policies. It's worth noting that the U.S. national debt surpassed $31 trillion for the first time in October 2022, highlighting the significance of these projections.

Trump's fiscal strategy includes extending the 2017 Tax Cuts and Jobs Act, which was the largest overhaul of the tax code in three decades. He also proposes eliminating taxes on income from tips, Social Security, and overtime pay. The primary revenue-generating measure in his plan involves increasing tariffs, which the CRFB estimates could raise $2.7 trillion.

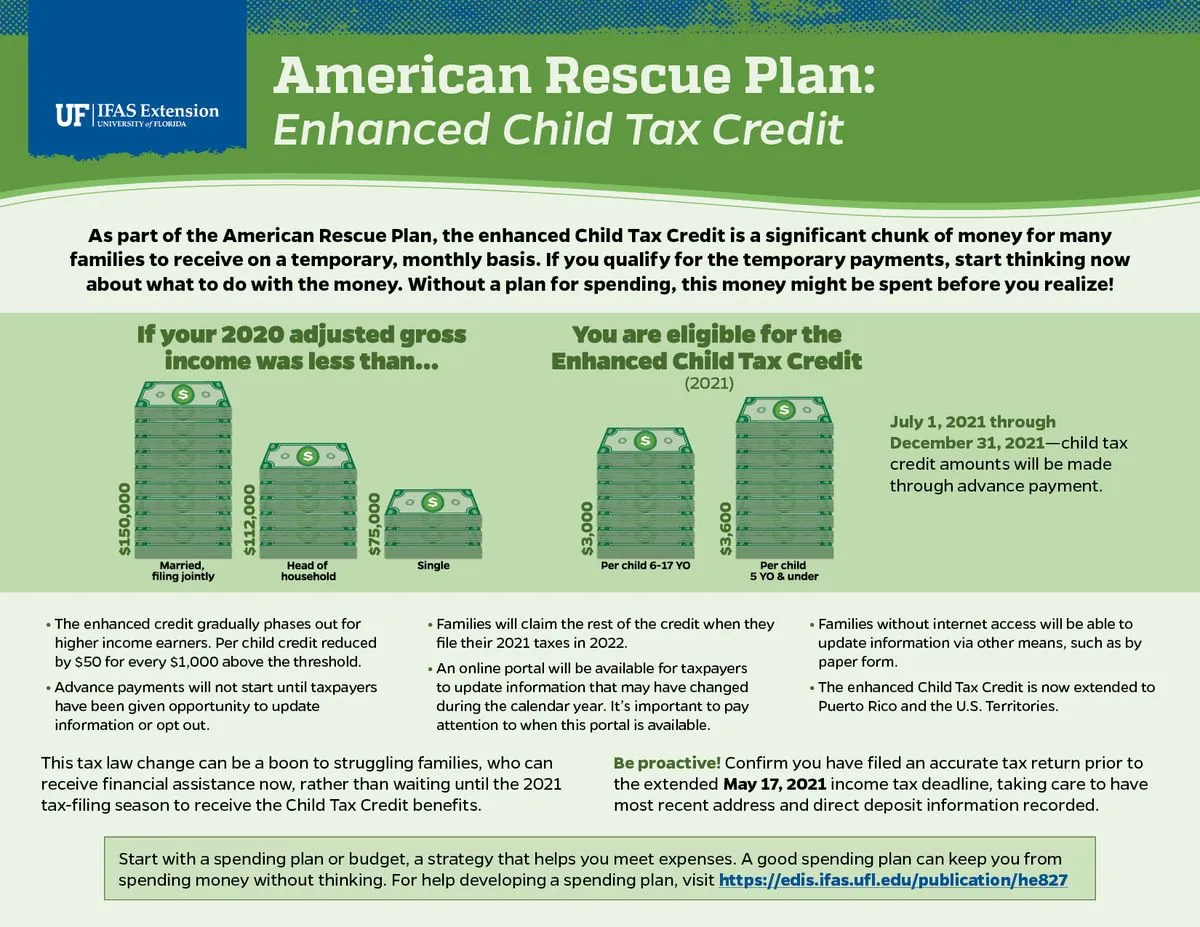

On the other hand, Harris has pledged to increase the Child Tax Credit, which was first introduced in 1997, and add a $6,000 credit for newborns. She also plans to boost spending on child and elder care, and offer a $25,000 tax credit for first-time homebuyers. To offset these expenses, Harris proposes increasing taxes on corporations and households earning $400,000 or more, potentially raising $4.25 trillion according to the CRFB's central estimate.

It's important to note that both campaigns have criticized the CRFB estimates. A spokesperson for Harris argued that her proposals would actually reduce deficits, citing her commitment to fully funding policy plans. Meanwhile, Trump's senior adviser, Brian Hughes, dismissed the estimates, stating that Trump's plan would control wasteful spending, combat inflation, and stimulate economic growth.

The CRFB's projections are based on the current-law baseline as measured by the Congressional Budget Office (CBO), established in 1974. This baseline already anticipates a 10-year deficit increase of $22 trillion, including nearly $2 trillion for the 2024 fiscal year that concluded on September 30, 2024.

These estimates come at a time when the U.S. has run budget deficits in 48 of the last 53 years, with the last surplus recorded in 2001. The debt-to-GDP ratio exceeded 100% for the first time since World War II in 2020, and interest payments on the national debt are projected to be the fastest-growing part of the federal budget.

As the 2024 presidential election approaches, voters will need to carefully consider the long-term fiscal implications of each candidate's proposals. The stark contrast between Trump's and Harris' plans highlights the different approaches to taxation, spending, and debt management that could shape the nation's economic future.

"President Trump's plan will rein in wasteful spending, defeat inflation, reduce the burden of interest costs, and ignite economic growth that fuels federal revenue, so we can make our economy great again."

While the debate over fiscal policy continues, it's crucial to remember that the U.S. has never defaulted on its debt obligations. However, with foreign countries holding about 30% of U.S. government debt and the Federal Reserve holding another 30%, the management of the national debt remains a critical issue for the country's economic stability and global standing.