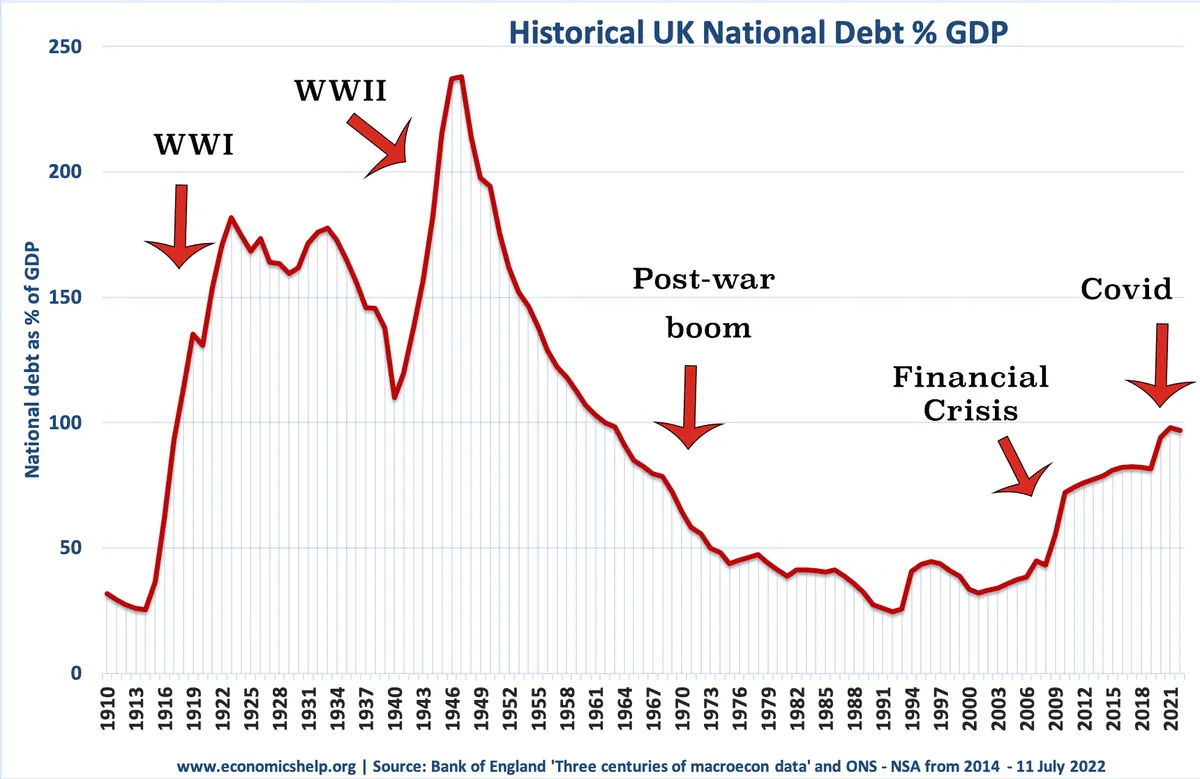

UK Government Debt Hits 100% of GDP, Highest Since 1960s

British government debt reached 100% of GDP, a level unseen since the 1960s. August's higher-than-expected borrowing adds pressure on the finance minister ahead of the October budget presentation.

The United Kingdom has reached a significant financial milestone, with government debt hitting 100% of the country's Gross Domestic Product (GDP) for the first time in recent history. This level of debt has not been observed on a regular basis since the early 1960s, when the nation was still grappling with the financial aftermath of World War II.

According to the Office for National Statistics, public sector net debt, excluding public sector-owned banks, rose from 99.3% in July to 100% in August 2024. This marks the first time debt has reached this level since monthly records began in 1993. The situation is further complicated by a larger-than-anticipated budget deficit in August, adding to the challenges faced by Finance Minister Rachel Reeves as she prepares for the upcoming budget presentation.

The government borrowed £13.734 billion in August 2024, exceeding the previous year's figure by £3.3 billion. This surpassed economists' expectations, who had predicted a deficit of £12.4 billion. The increase in borrowing is attributed to higher spending on social benefits and current expenditure, reflecting the impact of inflation.

"Taxes will go up in the October 30 budget, but increases in rates of income, corporation and value-added taxes have been ruled out."

This statement highlights the limited options available to improve public services and boost investment. The government has already borrowed £64.1 billion in the first five months of the 2024/25 financial year, surpassing the Office for Budget Responsibility's March forecast by approximately £6 billion.

It's worth noting that the UK's national debt has a long history, dating back to the late 17th century. During World War II, it peaked at over 250% of GDP, far exceeding current levels. The recent surge in debt can be attributed to several factors, including the global financial crisis of 2008, the COVID-19 pandemic, and subsequent weak economic growth.

The pandemic's impact on public finances was particularly severe, with the UK's furlough scheme alone costing over £70 billion. This, combined with other economic challenges, has contributed to the current debt situation. The UK's inflation rate, which peaked at 11.1% in October 2022 (the highest in 41 years), has also played a role in increasing government expenditure.

Despite these challenges, the UK remains the world's fifth-largest economy by nominal GDP, with a strong financial services sector contributing about 7% to GDP. The government continues to finance its debt through the issuance of bonds known as "gilts."

As the UK navigates these financial hurdles, it's important to note that public spending as a percentage of GDP is approximately 45%, while the tax-to-GDP ratio stands at around 33%, slightly above the OECD average. These figures provide context for the ongoing debate about fiscal policy and the balance between taxation and public services.

The current debt situation adds pressure on policymakers to find sustainable solutions for managing public finances while addressing the needs of the population. As the UK approaches the next budget presentation, all eyes will be on the government's strategies to address these economic challenges.