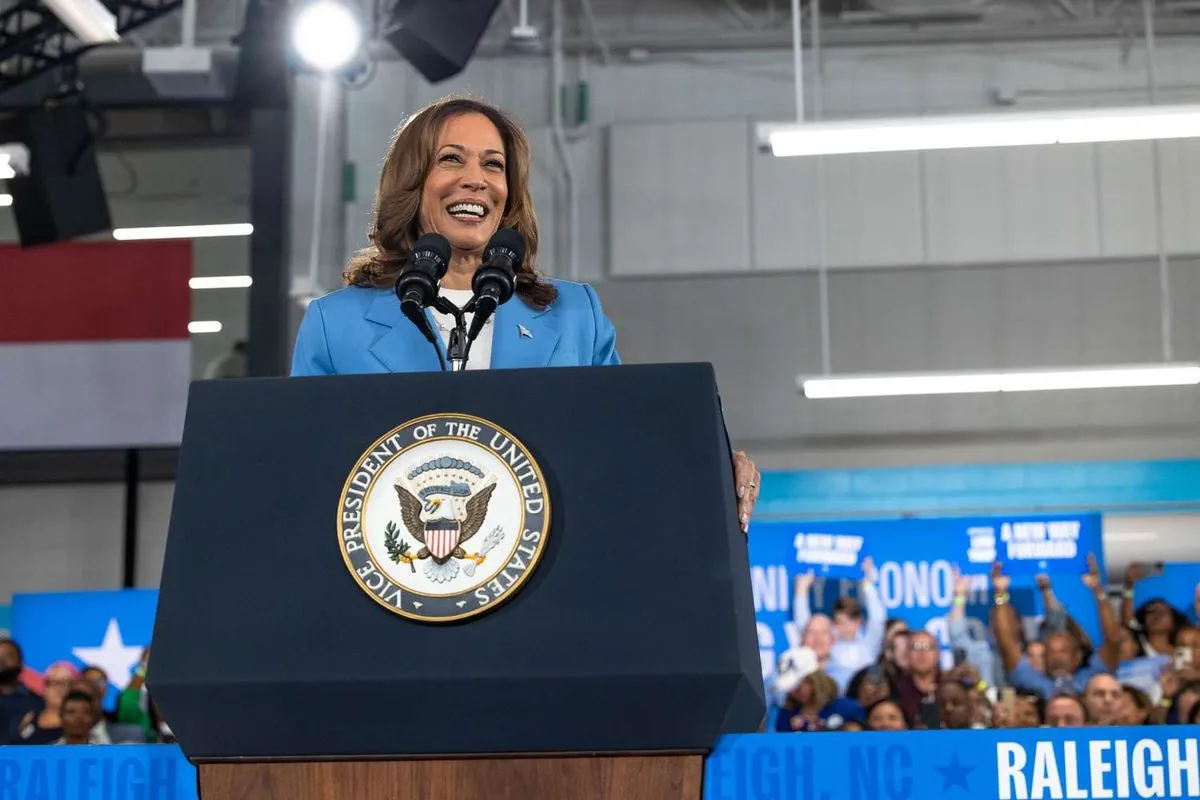

Misinformation regarding Kamala Harris' proposed capital gains tax policies has been circulating on social media platforms, causing confusion among voters. However, a closer examination reveals that these claims are misleading and do not accurately represent the vice president's actual tax plan.

Contrary to the viral posts, Harris' proposed tax changes would only affect the wealthiest Americans, not the middle class. The plan, which aligns with the Biden administration's budget proposal for fiscal year 2025, targets individuals with annual incomes exceeding $1 million or net worth over $100 million.

Donald Trump, Harris' Republican rival, has also contributed to the spread of misinformation. At a Las Vegas event on August 23, 2024, he stated:

"She's even pushing a tax on unrealized capital gains. In other words, the appraisers are going to make a lot of money, which will soon be applied to small business owners, and you will be forced to sell your restaurant immediately."

This statement, however, misrepresents the scope and impact of the proposed tax policies.

The Harris campaign has endorsed President Biden's commitment not to raise taxes on individuals earning less than $400,000 annually. This aligns with the progressive tax system in the United States, where tax rates increase as income rises. Currently, the top 1% of US earners contribute approximately 40% of all federal income taxes.

Harris has proposed a top tax rate of 28% on capital gains for those earning $1 million or more annually, lower than the 39.6% suggested in Biden's fiscal 2025 budget. When combined with the proposed investment income tax increase, the all-in top rate under Harris' plan would be 33%, not the 44.6% claimed in some social media posts.

It's important to note that these proposed changes would only take effect if the budget proposal passes both the House and Senate. Lawmakers are set to return from summer recess on September 9, 2024, with about three weeks to approve the budget plan before the new fiscal year begins on October 1 to avoid a government shutdown.

The 2025 expiration of the Trump administration's 2017 Tax Cuts and Jobs Act (TCJA) is another factor that may influence future tax policies. The next president will have to decide whether to let the law lapse or extend it. While Harris previously called for the repeal of the TCJA, some of her new tax commitments may require extending certain elements of the tax law.

In response to inquiries, a Harris campaign spokesperson referred to an August 18, 2024 statement: "Harris supports the revenue raisers in the FY25 Biden-Harris budget that ensure billionaires and big corporations pay their fair share."

As the US tax code spans over 74,000 pages and is considered one of the most complex globally, it's crucial for voters to seek accurate information from reliable sources when evaluating candidates' tax proposals. The debate over taxing unrealized gains has been ongoing among economists for decades, and any changes to the tax system would likely have far-reaching implications for the economy and income inequality in the United States.