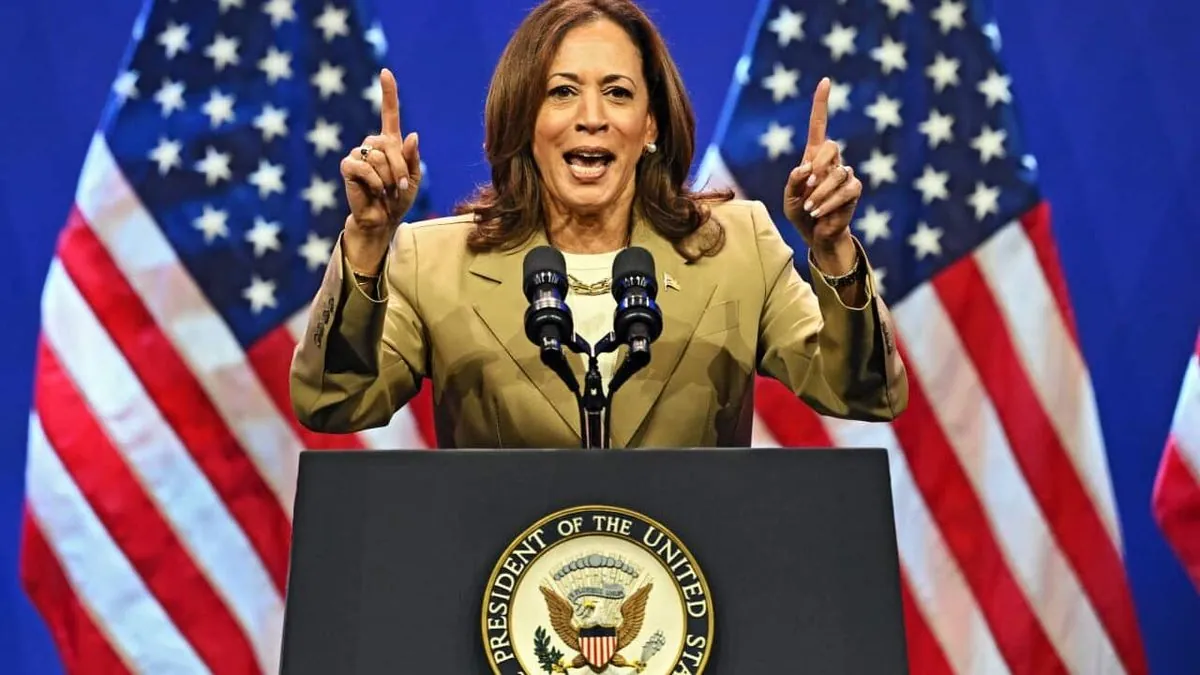

In a significant statement on economic policy, Kamala Harris has affirmed her commitment to maintaining the independence of the Federal Reserve, should she win the upcoming presidential election on November 5, 2024. This stance marks a clear contrast with her potential opponent, former President Donald Trump, who recently expressed interest in having presidential influence over the central bank's decisions.

Speaking to reporters in Phoenix, Arizona, Harris emphasized, "The Fed is an independent entity and as president I would never interfere in the decisions that the Fed makes." This declaration aligns with the long-standing tradition of respecting the autonomy of the Federal Reserve, which was established in 1913 to promote maximum employment and stable prices.

Harris's position reflects the importance of the Fed's independence in conducting monetary policy. The Federal Reserve System, consisting of 12 regional banks, plays a crucial role in the U.S. economy. Its decisions, made primarily through open market operations, can significantly impact global financial markets.

The Vice President also announced plans to unveil her economic policy positions in the coming week, focusing on strategies to reduce costs and strengthen the overall economy. This announcement comes at a time when economic concerns have been at the forefront of public discourse, following a jump in the July 2024 U.S. unemployment rate that sparked market turbulence.

Addressing these recent economic fluctuations, Harris noted, "As we know there was turbulence this week, but it seems to have settled itself. And we'll see what ... decisions they make next." This statement underscores the delicate balance between political leadership and the Fed's autonomous decision-making process.

In stark contrast to Harris's stance, Donald Trump has openly advocated for presidential influence over the Federal Reserve. "I feel the president should have at least (a) say in there" on Fed decisions, Trump stated at his Mar-a-Lago residence. This position has raised concerns about potential erosion of the Fed's independence, which was formally established in 1951.

The Federal Reserve's role extends beyond monetary policy. It also supervises and regulates banks to ensure safety and soundness, conducts annual stress tests on large banks, and issues the U.S. dollar. During crises, such as the 2008 financial crisis and the COVID-19 pandemic, the Fed has played a pivotal role in stabilizing the economy.

Currently, the Federal Reserve is led by Chair Jerome Powell, whose term is set to end in May 2026. Powell, initially appointed by Trump and reappointed by President Joe Biden, has navigated the Fed through challenging economic times, including the significant expansion of the Fed's balance sheet during the pandemic.

As the 2024 presidential election approaches, the contrasting views on Federal Reserve independence between Harris and Trump highlight a critical debate on the relationship between political leadership and monetary policy. This discussion is likely to play a significant role in shaping economic discourse in the coming months.

[[Donald Trump on Federal Reserve influence]]

"I feel the president should have at least (a) say in there"

The outcome of this debate could have far-reaching implications for the U.S. economy and global financial markets, underscoring the importance of the Federal Reserve's decisions in shaping economic stability and growth.