Global financing for insurance technology firms experienced a significant upturn in the second quarter of 2023, according to a report released by Gallagher Re on August 1, 2023. The sector saw a 40% increase in funding, reaching $1.27 billion, compared to the previous quarter. This growth was largely attributed to investments in artificial intelligence (AI) focused businesses.

The insurtech industry, which emerged in 2010, has been rapidly evolving, with the global market size valued at $3.85 billion in 2021. Experts project a compound annual growth rate of 51.7% from 2022 to 2030, highlighting the sector's potential for expansion.

While AI presents numerous opportunities for the insurance industry, it also brings challenges. Andrew Johnston, global head of insurtech at Gallagher Re, highlighted concerns about the use of deepfakes in fraudulent claims and the potential exclusion of customers through AI-driven risk assessments.

The report emphasized that while AI is valuable for pricing and underwriting, completely delegating these tasks to AI has shown limited success. Johnston stated:

"It is becoming clearer that removing the human entirely is a mistake."

This observation aligns with the growing trend of combining AI capabilities with human expertise in the insurtech sector.

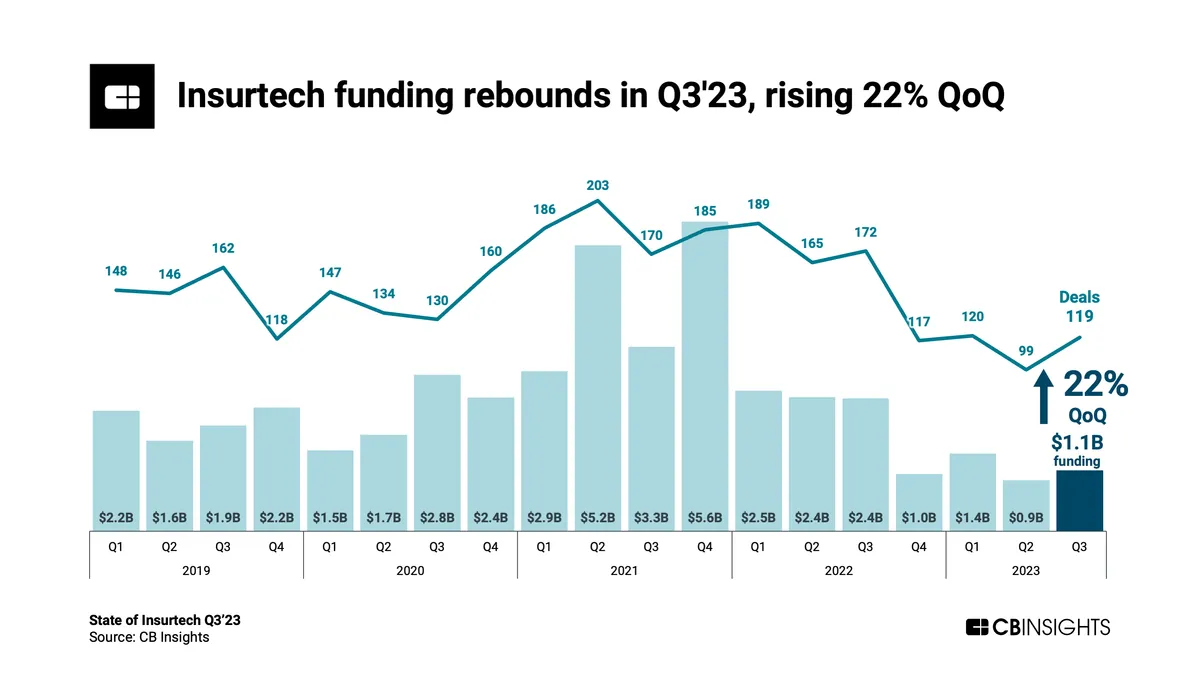

Historically, global insurtech funding reached its peak in 2021, totaling $16 billion. However, the market has since cooled, with valuations shrinking. Despite this, companies continue to invest in AI, betting on its potential to automate tasks and reduce costs.

The report revealed that approximately 33% of total insurance tech funding in Q2 2023 was directed towards AI-focused insurtechs. This significant allocation reflects the industry's recognition of AI's potential in transforming various aspects of insurance operations.

While AI offers benefits such as enhanced data analysis and streamlined administrative tasks, concerns persist about its impact on employment in the sector. The technology's ability to automate complex processes could potentially lead to job losses, a topic of ongoing debate within the industry.

As the insurtech landscape evolves, companies like Lemonade, Oscar Health, and Root Insurance are leveraging technologies such as AI, machine learning, and blockchain to disrupt traditional insurance models. These innovations are enabling more personalized and on-demand coverage options for consumers.

The COVID-19 pandemic has accelerated the adoption of digital insurance solutions, further fueling the growth of the insurtech sector. As the industry continues to navigate the challenges and opportunities presented by AI and other emerging technologies, striking a balance between innovation and responsible implementation remains crucial for sustainable growth.