UK Regulator Reports £341 Million Lost to Bank Transfer Scams in 2023

Over 252,000 cases of authorized push payment scams were reported in the UK last year, with 67% of lost funds reimbursed. Banks show inconsistent approaches to victim compensation.

The Payment Systems Regulator (PSR) in the UK has released a report detailing the prevalence of authorized push payment (APP) scams in 2023. These fraudulent activities, where victims are tricked into transferring money to accounts controlled by scammers, resulted in losses of £340.65 million across 252,626 cases.

Despite a 12% increase in the number of incidents compared to 2022, the total financial impact decreased by 12%. The report highlights that 67% of the stolen funds were reimbursed to victims, showing an improvement from the previous year's 61% reimbursement rate.

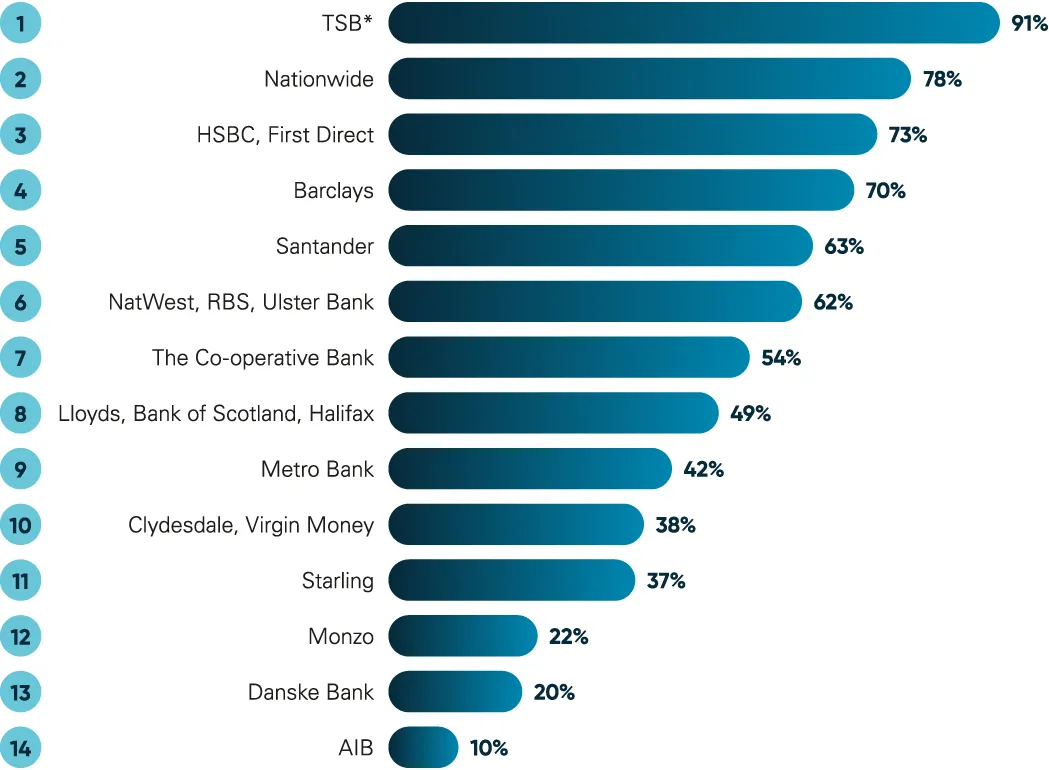

The PSR, established in 2015 as a subsidiary of the Financial Conduct Authority, noted significant disparities in reimbursement practices among financial institutions. Nationwide, the world's largest building society, fully compensated 96% of APP scam cases, while TSB Bank reimbursed 95%. In contrast, Barclays, one of the UK's oldest banks founded in 1690, fully reimbursed 82% of cases, and AIB (Allied Irish Banks) only fully compensated 3% of reported incidents.

The regulator expressed concern about the inconsistent approach to victim reimbursement, stating, "Currently, only the sending firm makes any reimbursement, ignoring the vital role receiving firms play in preventing scammers from accessing the UK's payments systems."

"There is still an inconsistent approach by firms when it comes to reimbursing victims."

In June 2024, the UK payments sector requested a one-year delay in implementing new compensation rules scheduled for October 2024. The industry argued that "significant changes" were necessary to avoid damaging competition.

The UK has one of the highest rates of APP fraud globally, prompting the introduction of a voluntary code for banks to reimburse victims in 2020. As the government works on legislation to combat online fraud, the banking industry continues to invest in advanced fraud detection technologies.

APP scams often involve sophisticated social engineering tactics, exploiting victims' trust and manipulating them into making transfers. The PSR's report underscores the ongoing challenge of balancing consumer protection with the operational realities of financial institutions in the fight against fraud.