A recent ransomware attack on C-Edge Technologies, a banking technology service provider, has led to the temporary shutdown of payment systems across nearly 300 small Indian local banks. This incident, occurring approximately one year ago, highlights the ongoing cybersecurity challenges faced by financial institutions in the world's most populous country.

The National Payment Corporation of India (NPCI), established in 2008 to strengthen India's payment infrastructure, took swift action by isolating C-Edge Technologies from accessing retail payment systems. This measure was implemented to prevent potential widespread impact on the country's financial network.

"Customers of banks serviced by C-Edge will not be able to access payment systems during the period of isolation."

The affected banks represent a small fraction of India's vast banking landscape, which includes over 1,500 urban cooperative banks and 96,000 rural cooperative banks. Officials from a regulatory authority estimate that only about 0.5% of the country's payment system volumes were impacted. This figure is relatively small considering that India recorded over 13 billion UPI transactions per month in 2022.

In the weeks leading up to the attack, the Reserve Bank of India (RBI) and Indian cyber authorities had issued warnings to banks about potential cyber threats. This proactive approach aligns with India's growing focus on cybersecurity, with projected spending in this sector expected to reach $3.05 billion by 2024.

The incident underscores the importance of robust cybersecurity measures in India's rapidly evolving digital payment landscape. With the country's digital payments market projected to grow to $10 trillion by 2026, safeguarding financial technologies has become paramount.

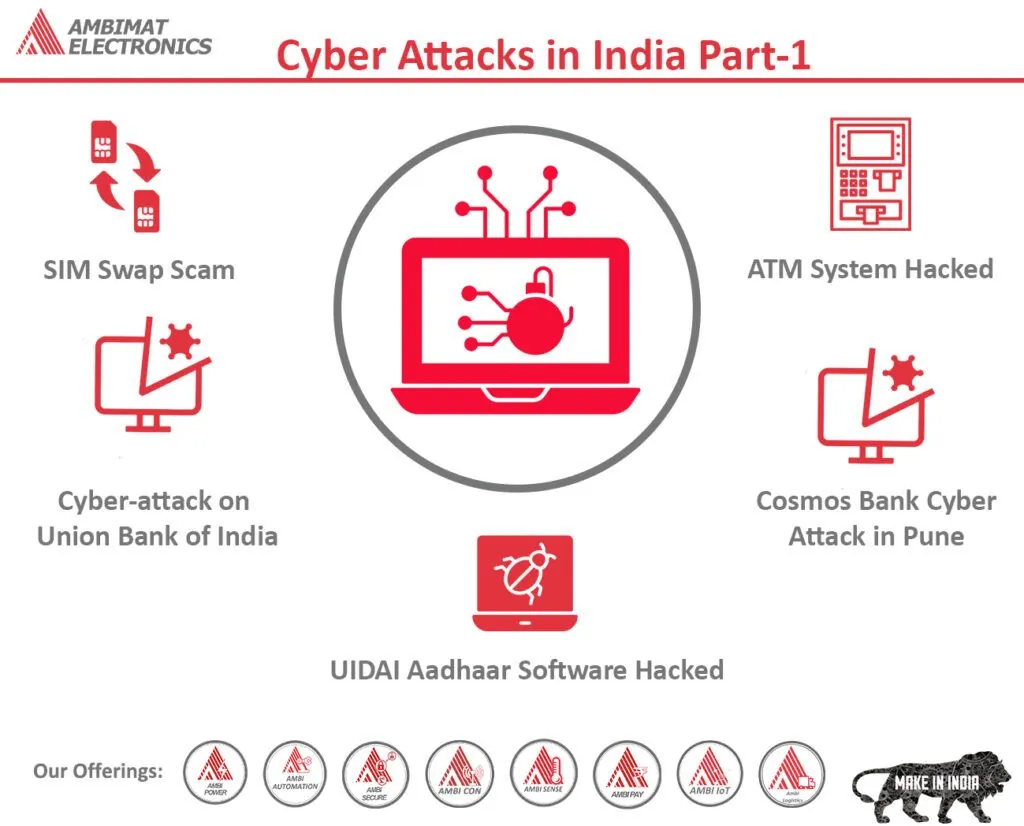

India's journey towards digital transformation, initiated by the Digital India program in 2015, has been accompanied by increased cybersecurity risks. The country ranks third globally in terms of cybersecurity breaches, emphasizing the need for continued vigilance and investment in protective measures.

As the Indian Computer Emergency Response Team (CERT-In) works to address this and other cybersecurity incidents, the event serves as a reminder of the ongoing challenges in securing India's growing digital infrastructure. With the IT industry contributing about 8% to India's GDP, maintaining the integrity and security of financial systems remains crucial for the country's economic stability and growth.