Meta's Q2 Revenue Surge Fuels Stock Rally Amid AI Investment Plans

Meta exceeds Q2 revenue expectations, driving 7% stock increase. Company plans continued AI infrastructure investment, forecasting $37-40 billion capital expenditure for 2024.

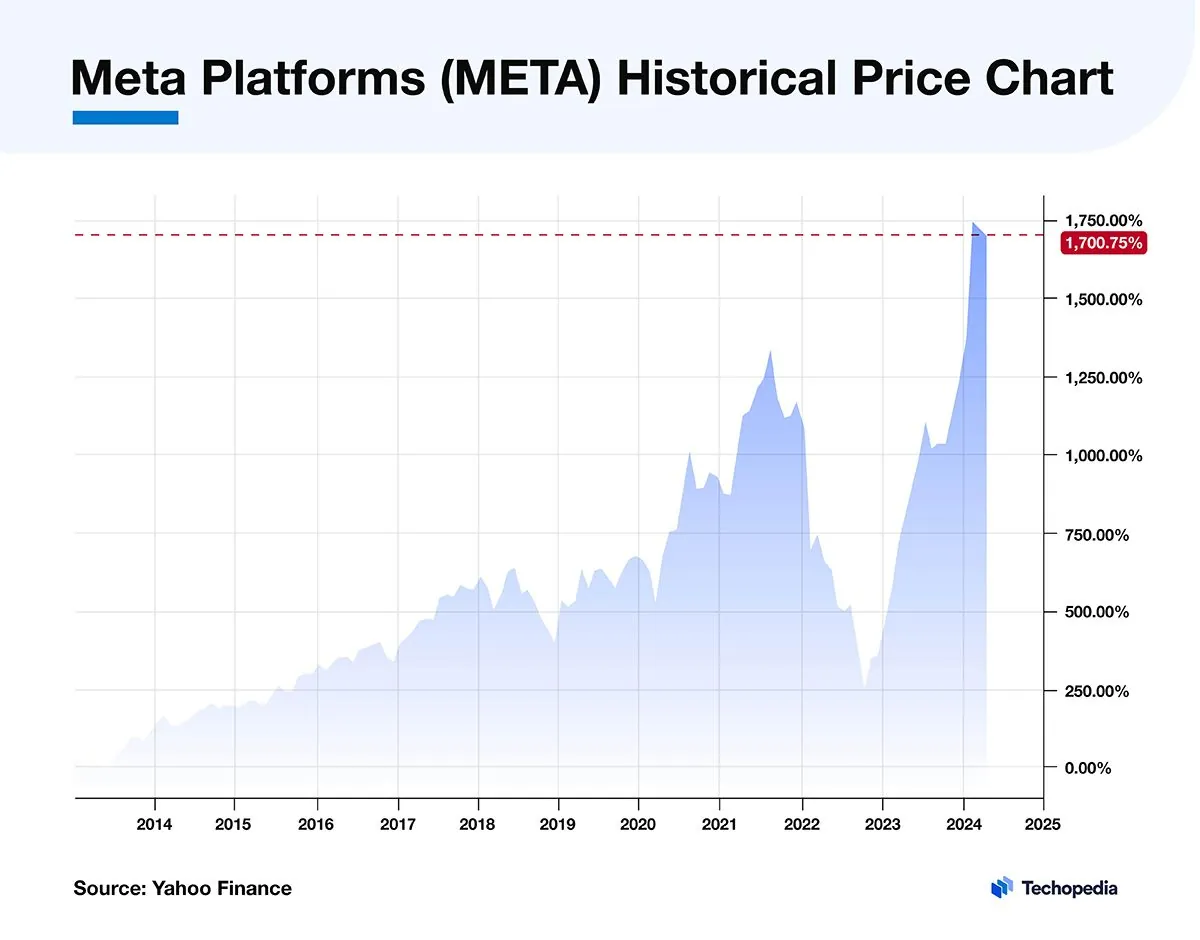

Meta Platforms, Inc. reported impressive second-quarter results, surpassing analyst expectations and triggering a significant stock price increase. The company's shares rose by 7% following the announcement of its financial performance for the April to June 2024 period.

The social media giant, which owns popular platforms like Facebook, Instagram, and WhatsApp, recorded revenue of $39.1 billion, exceeding the projected $38.3 billion estimated by analysts according to LSEG data. This strong performance indicates that Meta's digital advertising business is thriving, effectively offsetting the costs associated with its substantial investments in artificial intelligence (AI) technology.

Susan Li, Meta's Chief Financial Officer, stated during the post-earnings call that the company is experiencing "healthy global advertising demand." She also highlighted the success of Meta's multi-year initiative to leverage AI for enhancing ad targeting, ranking, and delivery systems across its platforms.

The positive financial results are expected to boost Meta's market value by approximately $85 billion, based on the share price of $508.52 at the time of reporting. This surge in stock price also had a ripple effect on other social media companies, with Snap Inc. seeing a 4% increase in pre-market trading.

"We are continuing to see healthy global advertising demand and reaping the fruits of our multi-year project to use artificial intelligence to improve targeting, ranking and delivery systems for digital ads on our platforms."

Meta has signaled its intention to maintain significant investments in AI infrastructure. The company's capital expenditure forecast for 2024 ranges between $37 billion and $40 billion, demonstrating its commitment to developing advanced AI capabilities.

J.P.Morgan analysts commented on Meta's AI strategy, noting that "GenAI will require significant infrastructure investments to train the next generation of large foundational models and Meta is getting ahead of a multi-year capacity ramp."

It's worth noting that Meta's 12-month forward price-to-earnings ratio stands at 21.1, compared to Alphabet's 20.6 and Microsoft's 31. Analysts have set a median price target of $550 for Meta's shares, indicating potential for further growth.

Meta's strong performance comes as the company continues to innovate and expand its technological capabilities. With over 3 billion monthly active users across its family of apps, Meta remains a dominant force in the social media landscape. The company's ongoing investments in AI research, virtual reality technologies, and global internet infrastructure underscore its commitment to shaping the future of digital interaction and communication.

As Meta moves forward with its ambitious plans, investors and industry observers will be closely watching how the company balances its AI investments with its core advertising business, and how these efforts translate into long-term growth and market position.