Standard Chartered has taken a groundbreaking step in financing carbon removal technology, offering the first commercial loan to a tech-based carbon removal company. This innovative move comes as British Airways commits to purchasing over 4,000 tonnes of carbon credits from project developer UNDO.

The deal structure, which includes an advance purchase agreement and insurance backing, aims to mitigate the credit risk associated with financing carbon removal projects. This approach could serve as a template for future transactions, potentially accelerating the growth of the carbon removal market.

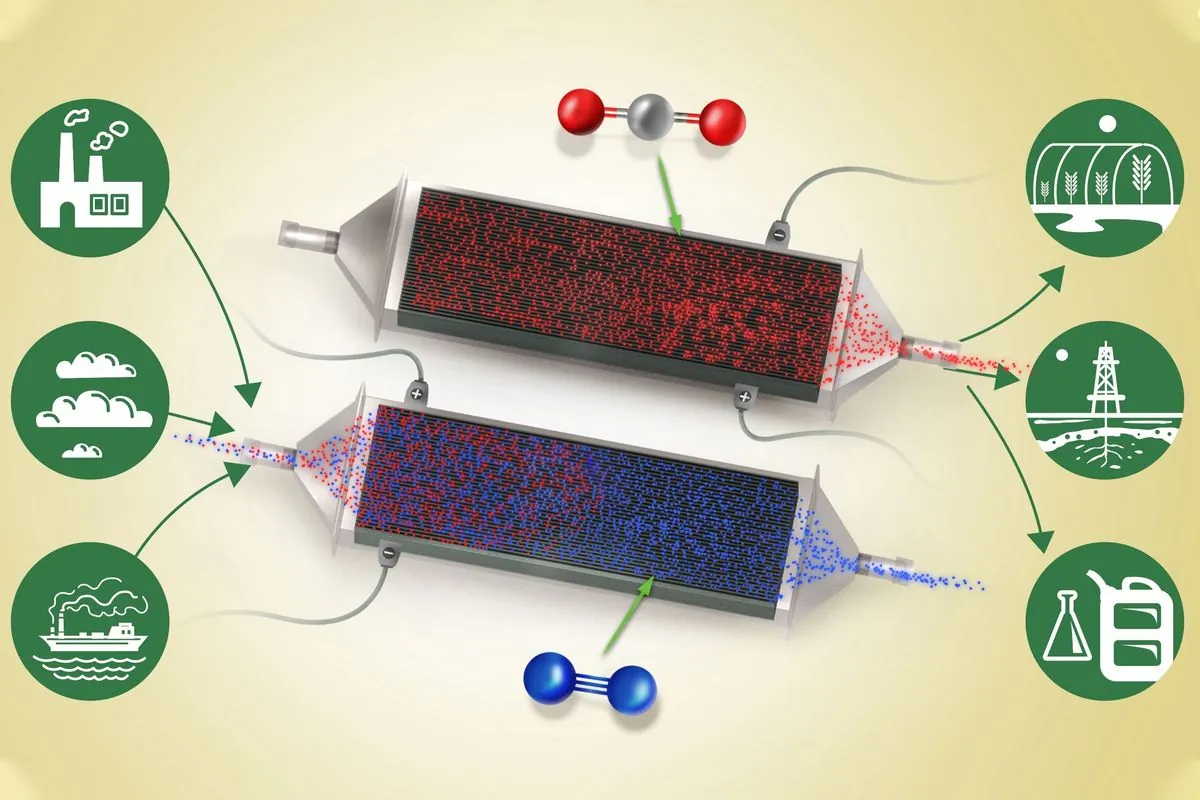

UNDO employs enhanced rock weathering, a method that accelerates natural carbon capture processes. The technique involves:

- Spreading silicate rock dust over farmland

- Allowing rainfall to trigger carbon capture

- Locking away carbon for over 100,000 years

The carbon removal industry faces significant challenges in scaling up to meet global climate goals. Scientists estimate that by mid-century, approximately 10 billion tons of carbon emissions may need to be removed annually to achieve net-zero targets. Currently, carbon removal credits represent only a small fraction of the carbon credit market, which was valued at $851 billion in 2021.

Chris Leeds, head of carbon markets development at Standard Chartered, emphasized the need for scalable technological solutions to make carbon dioxide removals affordable across the market. He stated, "This transaction puts money into a project today in an efficient way, through upfront bank finance."

The deal involves several key partners:

- Standard Chartered: Providing the commercial loan

- British Airways: Committing to purchase carbon credits

- CUR8: Acting as offtake intermediary

- CFC: Providing insurance

- WTW: Serving as broker

Carrie Harris, director of sustainability at British Airways, highlighted that carbon removals form "a key part" of the airline's climate strategy. This aligns with the aviation industry's efforts to address its 2% contribution to global CO2 emissions.

The innovative financing structure could help overcome the hesitancy of banks to offer corporate loans to carbon removal project developers, which have traditionally been viewed as too risky. By combining an advance purchase agreement with insurance that covers potential shortfalls in carbon credit production, the deal effectively lowers the credit risk for UNDO.

As the world strives to combat global warming, the ability to remove carbon emissions from the atmosphere is becoming increasingly crucial. Enhanced rock weathering, the method employed by UNDO, has the potential to remove up to 2 billion tonnes of CO2 annually by 2050, while also offering co-benefits such as improved soil health and crop yields.

This pioneering deal marks a significant step towards scaling up the carbon removal market, which is essential for achieving the goals set out in the Paris Agreement. As both Standard Chartered and British Airways work towards their 2050 net-zero carbon emissions targets, this collaboration demonstrates the potential for innovative financial solutions to drive progress in climate action.