UK Property Market Shows Signs of Recovery, Affordability Concerns Persist

British property surveyors report positive house price balance for the first time in nearly two years. Despite improved market sentiment, affordability remains a challenge, particularly in the rental sector.

The UK property market is showing signs of recovery, according to recent data from the Royal Institution of Chartered Surveyors (RICS). For the first time since October 2022, the organization's main house price balance has entered positive territory, indicating a shift in market dynamics.

Founded in 1868, RICS reported a house price balance of +1 in August 2023, a significant improvement from -18 in July. This metric, which measures the difference between surveyors observing price increases and decreases, surpassed economists' expectations of -14 in a Reuters poll.

The property market's momentum appears to be gaining traction, with the measure of expected sales over the next three months reaching its highest level since January 2020, prior to the COVID-19 pandemic. This resurgence comes after a recent decline in interest rates, which has positively impacted the sector.

While the overall sentiment is improving, affordability remains a pressing issue. Simon Rubinsohn, chief economist at RICS, highlighted the challenges faced by both buyers and renters:

"Affordability remains an issue in the sales market even with somewhat cheaper finance now available but the picture appears even more acute in the lettings market where the amount of rental stock continues to diminish."

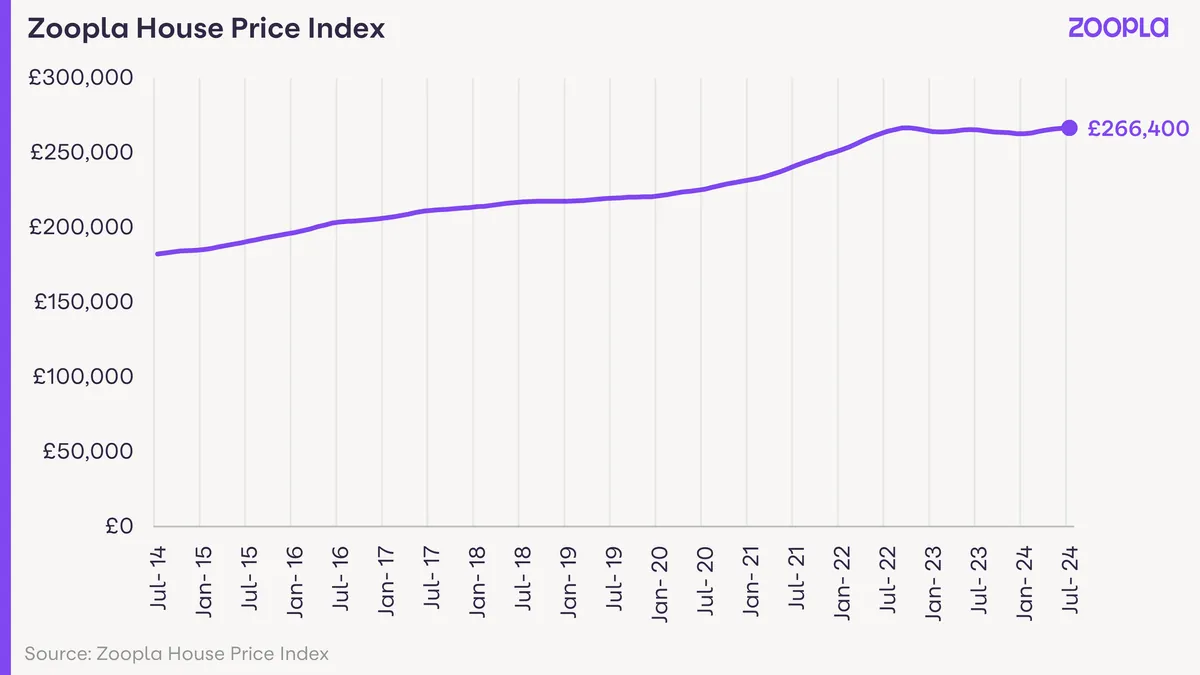

The UK housing market has experienced several boom and bust cycles since the 1970s, with the average house price in 1970 being around £4,975. Today, the market faces a shortage of affordable housing, a problem that has persisted for decades. The private rented sector has more than doubled in size since 2002, exacerbating the affordability crisis in the rental market.

Looking ahead, uncertainty looms over potential interest rate decisions by the Bank of England, the world's second-oldest central bank founded in 1694. The central bank is expected to maintain current rates at its meeting on September 19, 2024, following a recent cut from a 16-year high of 5.25%.

Additionally, the upcoming budget announcement by British finance minister Rachel Reeves on October 30, 2024, may impact the property market. The government aims to build 300,000 new homes per year to address housing shortages, a target that could influence market dynamics.

Despite challenges, positive indicators are emerging. New buyer inquiries rose to a net balance of +15 in August, the highest since October 2021. The number of agreed house sales across Britain also increased, along with a rise in available properties.

As the UK strives to balance market growth with affordability concerns, it's worth noting that the country has one of the highest homeownership rates in Europe at around 65%. However, the average age of first-time buyers has increased from 31 in 2007 to 34 in 2023, reflecting the ongoing challenges in property acquisition.