Bank of England

Some of the key events about Bank of England

- 1694Established as a private bank to act as the English government's banker

- 1694Established as a private bank to fund war efforts, contributing to national debt

- 1734Moved to its current location on Threadneedle Street in London

- 1797Suspended gold payments during the Napoleonic Wars, leading to economic instability

- 1819Implemented deflationary policies, causing economic hardship and unemployment

- 1844Granted monopoly on issuing banknotes in England and Wales

- 1866Intervened to prevent the collapse of Overend, Gurney and Company, establishing its role as lender of last resort

- 1866Failed to prevent the collapse of Overend, Gurney and Company, triggering a financial crisis

- 1890Reluctantly bailed out Barings Bank, setting a controversial precedent for future interventions

- 1931Abandoned the gold standard, allowing for more flexible monetary policy

- 1931Abandoned the gold standard, causing a sharp devaluation of the pound sterling

- 1946Nationalized by the post-war Labour government

- 1946Nationalized by the government, losing its independence in monetary policy

- 1992Failed to defend the pound against currency speculation on "Black Wednesday," costing billions

- 1997Granted operational independence in setting monetary policy

- 2007Slow to respond to the early signs of the global financial crisis

- 2008Criticized for inadequate oversight leading up to the financial crisis and subsequent recession

- 2009Implemented quantitative easing to support the UK economy during the financial crisis

- 2016Launched a new polymer £5 note, improving durability and security of currency

- 2020Provided emergency funding to businesses during the COVID-19 pandemic

Disclaimer: This material is written based on information taken from open sources, including Wikipedia, news media, podcasts, and other public sources.

Bank of England Latest news

New UK budget hits job market: Employment index shows worst drop since pandemic

December 9 2024 , 03:31 AM • 1941 views

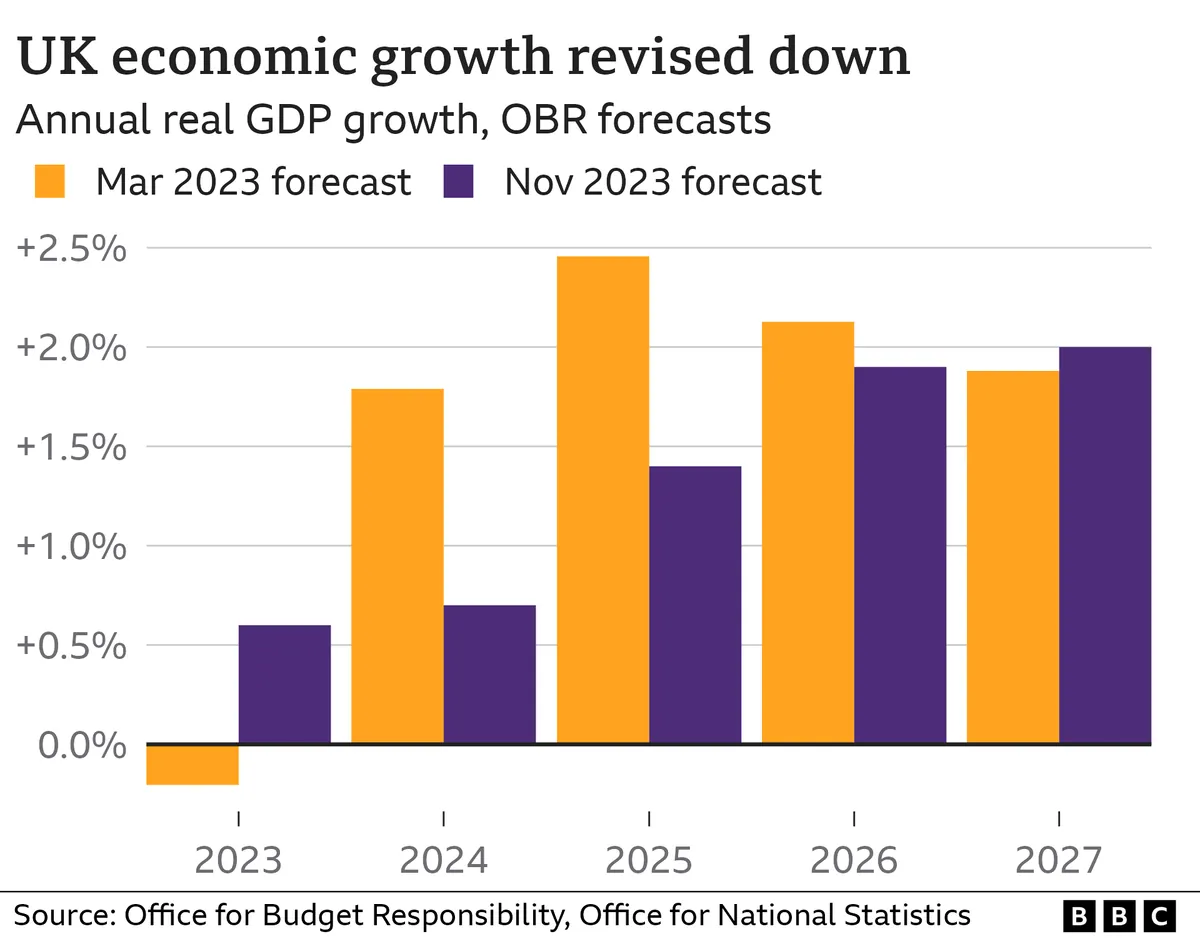

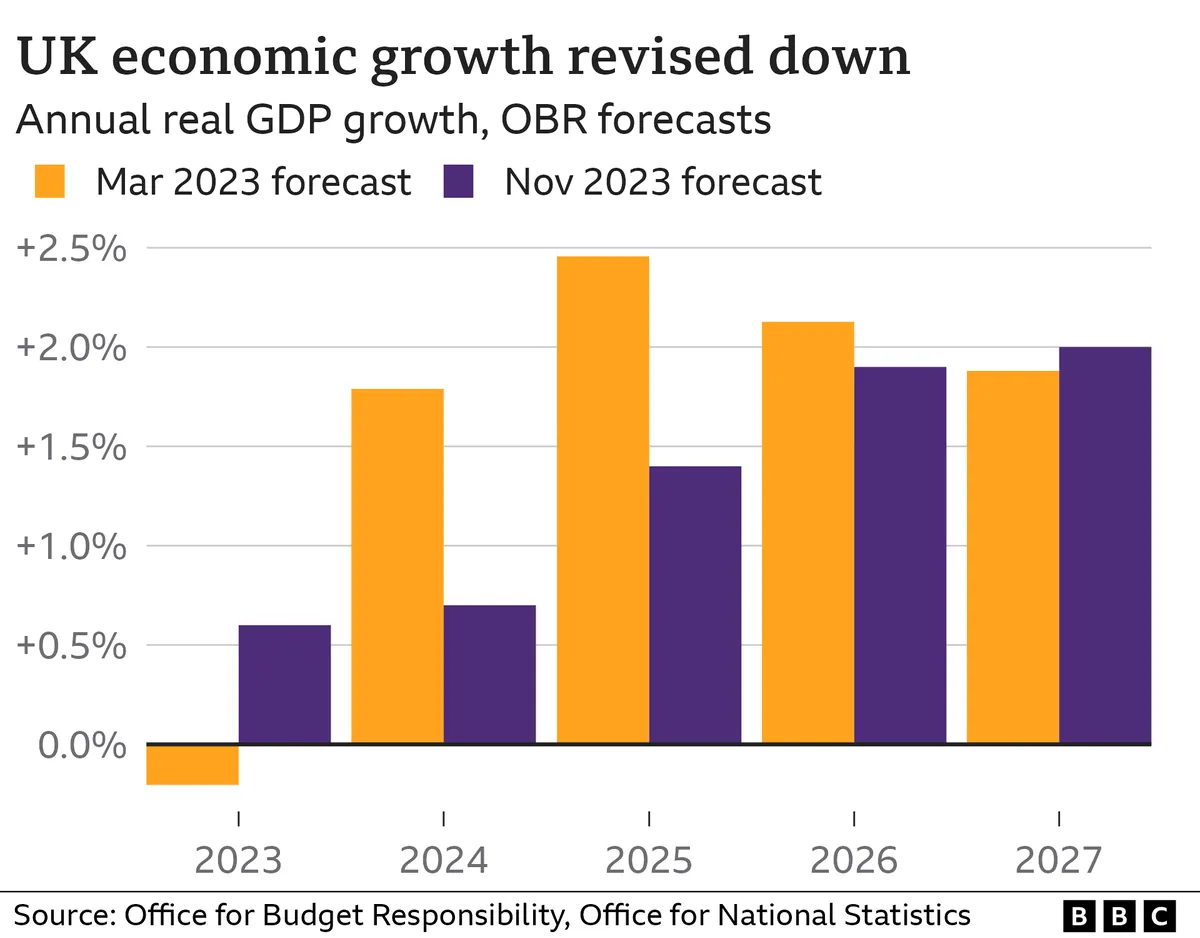

UK business group downgrades growth outlook after recent budget changes

December 6 2024 , 08:31 PM • 1167 views

UK inflation hits unexpected jump as economy shows mixed signals

November 20 2024 , 04:40 PM • 865 views

Trump advisor pushes UK to choose between US and EU economic paths

November 16 2024 , 05:16 PM • 4201 views

UK bond market shakes after new budget raises eyebrows

October 31 2024 , 02:01 AM • 161 views

New UK budget hits job market: Employment index shows worst drop since pandemic

British employers hit pause on hiring after Labourʼs first budget brings tax changes. Worker demand index drops to lowest point in four years while businesses re-think their employment plans

UK business group downgrades growth outlook after recent budget changes

Major UK employer group lowers next years economic forecast due to new budget rules that raise business costs. Different organizations show mixed predictions for UKʼs financial future

UK inflation hits unexpected jump as economy shows mixed signals

British cost-of-living numbers went up more than experts thought reaching 2. 3% last month. Market players changed their mind about quick interest-rate drops while pound got stronger

Trump advisor pushes UK to choose between US and EU economic paths

US presidents economic advisor suggests UK should follow American-style trade model instead of EU ties. Top UK officials respond with plans to balance relationships with both economic powers

UK bond market shakes after new budget raises eyebrows

British government bonds took an unexpected turn as markets processed new budget details. Investors changed their bets on future interest-rate cuts while UK debt became less attractive compared to German bonds

British finance chief plans biggest tax shake-up since early 90s

First Labour budget in 14 years targets wealthy Brits and businesses to fund public services improvements. New finance minister wants to boost economy with extra borrowing while keeping markets calm