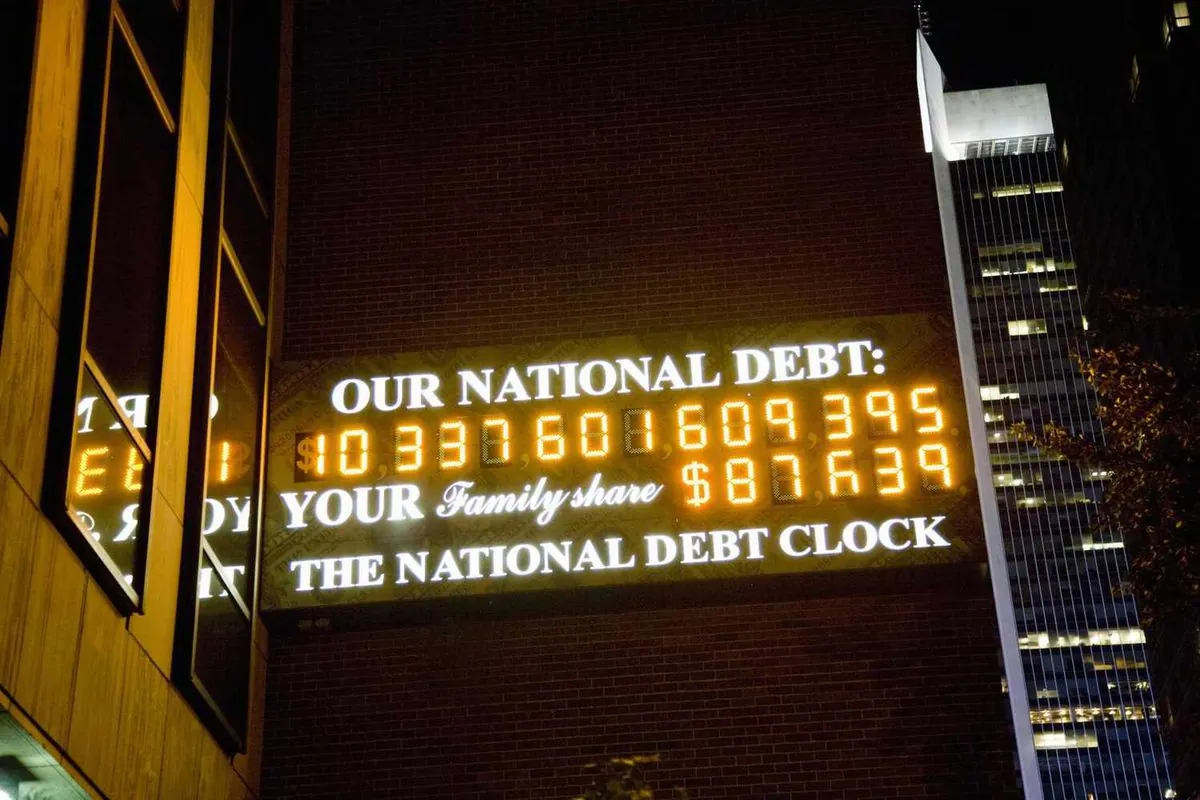

A recent study by the nonpartisan Committee for a Responsible Federal Budget (CRFB) has shed light on the potential fiscal impact of campaign proposals by former president Donald Trump and Vice President Kamala Harris. The analysis reveals that both candidates' policies could significantly increase the United States' national debt, which currently stands at $35.7 trillion.

According to the CRFB's findings, Trump's proposed policies could add $7.5 trillion to the national debt over a decade, more than doubling the impact of Harris's plans, which are estimated to increase the debt by $3 trillion. This stark contrast highlights the divergent approaches to fiscal policy between the two potential presidential candidates.

Trump's plan includes extending the 2017 tax cuts, which would contribute over $5 trillion to the debt. Additionally, his proposal to eliminate taxes on overtime wages, Social Security benefits, and tips would add another $3.6 trillion. The former president's campaign to detain and deport undocumented immigrants is estimated to cost $350 billion.

On the other hand, Harris's proposals focus on extending the 2017 tax cuts for those earning less than $400,000 annually, which would add $3 trillion to the debt. Her plan also includes a significant expansion of the child tax credit and the earned income tax credit, estimated to cost $1.35 trillion.

It's worth noting that the child tax credit was first introduced in 1997, while the earned income tax credit has been in place since 1975, both aimed at providing financial support to families and low-income workers.

CRFB President Maya MacGuineas expressed concern about the fiscal implications of both candidates' proposals, stating:

"Despite the fact that our fiscal situation is really unhealthy, we have two candidates whose proposals, if looked at comprehensively, would make the situation worse rather than better, with a noticeable distinction that former president Trump would make it significantly worse."

The study also addresses Trump's claim that new tariffs on imports would generate enough revenue to offset his proposed tax cuts. However, many economists argue that such tariffs could lead to increased prices for U.S. consumers and potentially depress economic output.

It's important to consider that the United States imports approximately $3 trillion worth of goods annually, and any significant changes to trade policies could have far-reaching economic consequences.

The fiscal health of the nation remains a critical concern, with projections indicating that Social Security and Medicare could become insolvent by 2035 and 2036, respectively. These programs, established in 1935 and 1965, have been cornerstones of the U.S. social safety net for decades.

As the 2024 election approaches, the debate over fiscal policy and its impact on the national debt is likely to intensify. The challenge for both candidates will be to balance their campaign promises with the long-term financial stability of the nation.