The United Kingdom's economic performance in July 2024 remained stagnant, according to data released by the Office for National Statistics (ONS). This outcome fell short of economists' projections, highlighting persistent challenges in the nation's economic recovery.

The latest figures reveal that the UK's gross domestic product (GDP) showed no change in July, following a similar pattern of zero growth in June. This result contradicted the expectations of economic analysts, who had anticipated a modest 0.2% month-on-month expansion. The data underscores the ongoing difficulties faced by the world's sixth-largest economy in terms of nominal GDP.

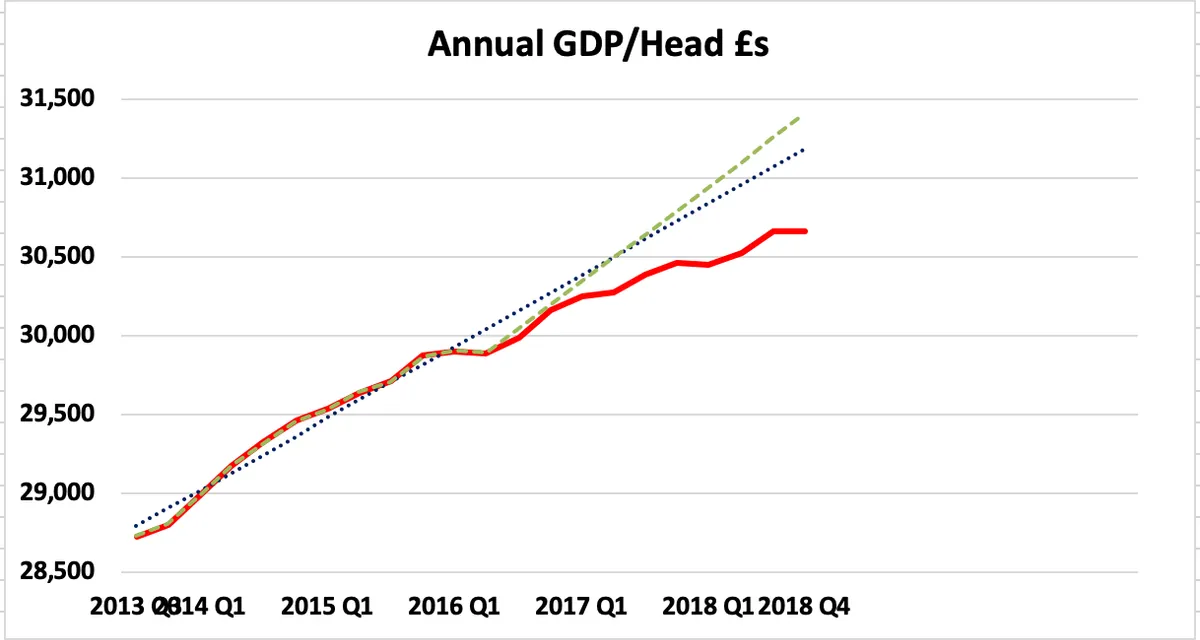

In the broader context, the UK's economic trajectory since the COVID-19 pandemic has been characterized by sluggish growth. Between the fourth quarter of 2019 and the second quarter of 2024, the economy expanded by a mere 2.3%. This slow pace of recovery stands in contrast to the more robust rebounds observed in several other G7 nations.

The year-on-year comparison further illustrates the economic challenges. July 2024's output was 1.2% higher than the same month in 2023, falling short of the 1.4% growth economists had forecast. This discrepancy between expectations and reality reflects the complexities of predicting economic trends in a post-pandemic landscape.

A closer look at sectoral performance reveals a mixed picture. The services sector, which accounts for approximately 80% of the UK's economic output, managed a slight growth of 0.1% in July. However, this modest increase was offset by declines in both manufacturing and construction sectors, which contribute about 10% and 6% to the nation's GDP, respectively.

"The latest GDP figures paint a concerning picture of the UK economy's struggle to gain momentum. The stagnation in July, coupled with underwhelming year-on-year growth, suggests that the recovery from the pandemic-induced recession remains fragile."

These economic indicators are crucial for policymakers and institutions. The Bank of England relies on such GDP data to inform its monetary policy decisions, while the government uses this information to shape fiscal strategies. The persistent economic challenges may prompt a reassessment of current policies to stimulate growth and address sectoral imbalances.

It's worth noting that the UK experienced its largest economic contraction in three centuries due to the COVID-19 pandemic, officially entering a recession in August 2020. The current data suggests that the path to full recovery remains long and complex, requiring careful navigation of global economic uncertainties and domestic challenges.

As the situation evolves, economists and policymakers will closely monitor upcoming data releases for signs of improvement or further stagnation in the UK's economic landscape.