23andMe in Crisis: Board Exodus and Financial Woes Shake DNA Testing Pioneer

23andMe faces turmoil as seven board members resign amid financial struggles. CEO Anne Wojcicki considers privatization while the company grapples with plummeting stock value and potential Nasdaq delisting.

Anne Wojcicki's pioneering DNA testing company, 23andMe, is experiencing significant upheaval. On 2024-09-17, seven of the eight independent board members tendered their resignations, citing disagreements over the company's strategic direction and the absence of a concrete proposal for privatization.

The company, which revolutionized consumer genetic testing, has seen its fortunes decline dramatically. Its stock price has plummeted to approximately $0.30, putting its Nasdaq listing at risk. This represents a stark contrast to its peak valuation of nearly $6 billion following its public debut in 2021.

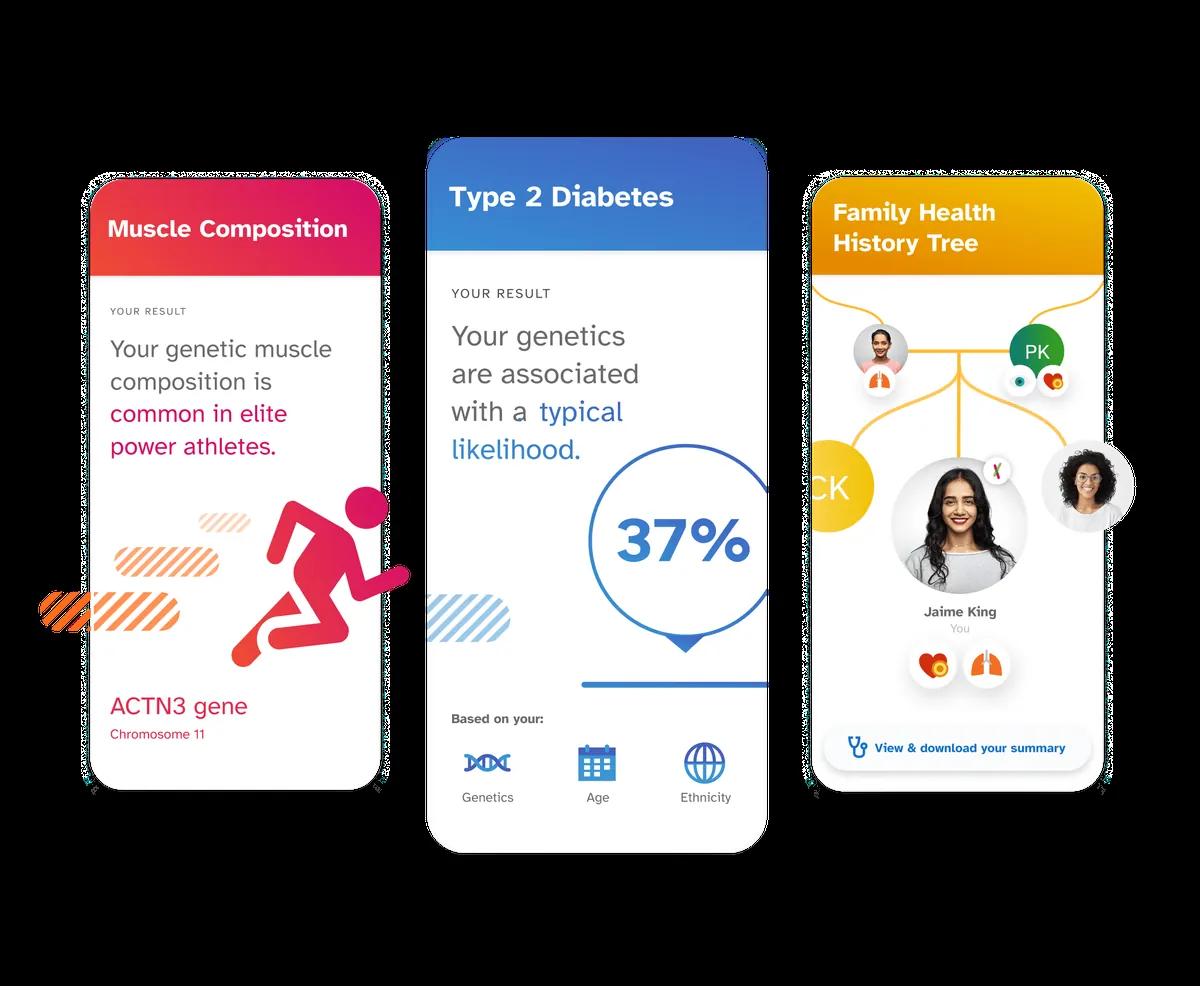

23andMe, founded in 2006, has made significant strides in the field of genetic testing. It became the first company to receive FDA approval for direct-to-consumer genetic tests in 2015, paving the way for widespread access to personal genetic information. Over the years, the company has amassed a database of over 3 billion genotyped and phenotyped data points from more than 12 million customers.

Despite these achievements, 23andMe faces mounting challenges. The company's revenue has declined by 34% in the second quarter compared to the previous year, partly due to the conclusion of a collaboration with GlaxoSmithKline. This partnership, initiated in 2018 with a $300 million deal, aimed at drug target discovery but has since ended.

In response to these difficulties, Anne Wojcicki, who controls nearly half of the company's voting power, has expressed interest in taking 23andMe private. However, her initial proposal of $0.40 per share was rejected by the board committee for lacking a premium and committed financial backing.

The company has diversified its offerings in an attempt to boost revenue. Recent ventures include a "biological age" feature and a service for prescribing weight-loss drugs like Ozempic and Wegovy. Additionally, 23andMe has expanded into pharmacogenetics, providing information on how genes may affect medication responses.

"I have been committed to the mission of 23andMe for the last 18 years and believe strongly in the potential for genetic information to transform healthcare and the therapeutic discovery process."

Despite these efforts, 23andMe faces significant hurdles. The company must address its dwindling cash reserves, estimated at $170 million as of the last quarter. It also faces a looming deadline of 2024-11-04 to comply with Nasdaq's minimum share price requirement of $1, or risk delisting.

Furthermore, 23andMe is grappling with legal challenges. The company recently agreed to a $30 million settlement for a class-action lawsuit stemming from a data breach in 2023. This incident highlights the ongoing privacy concerns and controversies surrounding data sharing in the genetic testing industry.

As 23andMe navigates these turbulent waters, the future of this once-groundbreaking company remains uncertain. The coming months will be crucial in determining whether Wojcicki's vision of privatization can salvage the company's fortunes and maintain its position as a leader in consumer genetic testing.