Arm Holdings Shares Plunge 16% on Cautious AI Revenue Outlook

Arm Holdings faces market skepticism as shares drop 16% following a conservative revenue forecast, despite strong Q1 growth. Analysts remain optimistic about long-term AI potential.

Arm Holdings, the British semiconductor design firm, experienced a significant market setback on August 1, 2024, as its shares plummeted 16% in afternoon trading. This decline came in response to the company's cautious revenue forecast, which raised concerns about its immediate ability to capitalize on the artificial intelligence (AI) boom compared to industry peers.

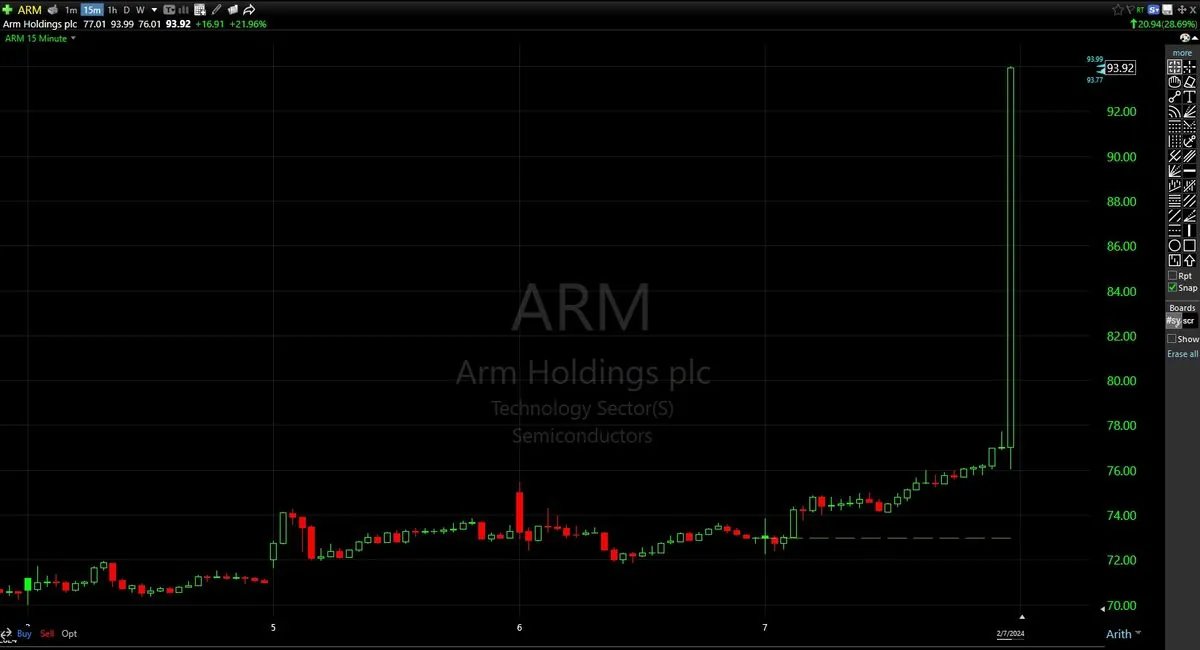

The sharp drop in share price could potentially erase over $23 billion from Arm's market value if the current levels persist. This downturn follows a remarkable 90% increase in the stock's value since the beginning of the year, prior to the release of the earnings report on July 31, 2024.

BofA Global Research analysts maintained a "buy" rating on Arm stock but acknowledged the likelihood of near-term pressure on its premium valuation due to a lack of immediate growth drivers. The analysts attributed the conservative projections to weakness in specific markets, including the Internet of Things (IoT), networking, and industrial sectors.

Rene Haas, CEO of Arm, addressed the timeline for realizing benefits from AI-related designs during a conference call. He stated that it could take approximately four years for AI server chips to generate significant returns on the designs licensed in 2024.

For the current fiscal second quarter, Arm projected revenue between $780 million and $830 million, slightly below the average analyst estimate of $804.1 million according to LSEG data. However, the company reported a strong 39% revenue growth in its fiscal first quarter, exceeding expectations.

Despite the short-term market reaction, analysts remain optimistic about Arm's long-term prospects. At least 11 brokerages raised their price targets, and more than half of the analysts covering the stock maintain a "buy" or higher rating.

"It may take several years - roughly four years for AI server chips - to realize the windfall from designs we licensed this year."

Arm's situation reflects the broader industry anticipation surrounding AI investments. While businesses are making substantial commitments to AI technologies, the timeline for these investments to translate into increased sales for chip firms remains uncertain.

As a key player in the semiconductor industry, Arm's performance is closely watched by investors and tech enthusiasts alike. The company's unique business model, based on licensing intellectual property rather than manufacturing chips, has allowed it to maintain a significant presence in the global smartphone market, with its designs used in approximately 95% of smartphones worldwide.

Arm's journey from its founding in 1990 to its current position as a publicly traded company again after its 2023 IPO showcases its resilience and adaptability in a rapidly evolving tech landscape. As the company continues to expand into areas such as IoT, automotive, and AI, its ability to navigate market expectations and technological shifts will be crucial for its future success.