Asian Markets Dip as Investors Eye U.S. Economic Data and Tech Sector

Asian shares mostly declined as markets shifted focus to upcoming U.S. economic data. Nvidia's earnings report and its impact on tech stocks influenced global market sentiment.

Asian financial markets experienced a general downturn as investors redirected their attention to forthcoming U.S. economic indicators, following Nvidia's recent financial disclosure. The tech giant, a key player in the artificial intelligence sector, reported robust profits but saw its stock value decrease by 2.1%, despite a remarkable 153% year-to-date increase.

In Japan, the Nikkei 225, a stock market index with a history dating back to 1950, experienced a minor 0.1% reduction. Australia's S&P/ASX 200 and South Korea's Kospi also saw declines of 0.3% and 0.9% respectively. Conversely, Hong Kong's Hang Seng Index, established in 1969, showed a slight 0.2% increase, while the Shanghai Composite dropped by 0.3%.

Market sentiment remained cautious, even as the White House announced plans for a telephone conversation between Chinese President Xi Jinping and U.S. President Joe Biden in the coming weeks. This announcement comes amidst growing concerns over Taiwan-related tensions.

Investors are eagerly anticipating the release of the Personal Consumption Expenditures (PCE) Price Index for July 2024, scheduled for August 30, 2024. This index, first published in 1959, is the Federal Reserve's preferred measure of inflation. Economists project a slight increase to 2.6% from June's 2.5%, a significant improvement from the 7.1% peak in mid-2022.

The U.S. Federal Reserve, established in 1913, is expected to consider reducing its benchmark interest rate at its September 2024 meeting. This potential move comes as the central bank assesses the resilience of U.S. consumers in the face of inflationary pressures and high borrowing costs.

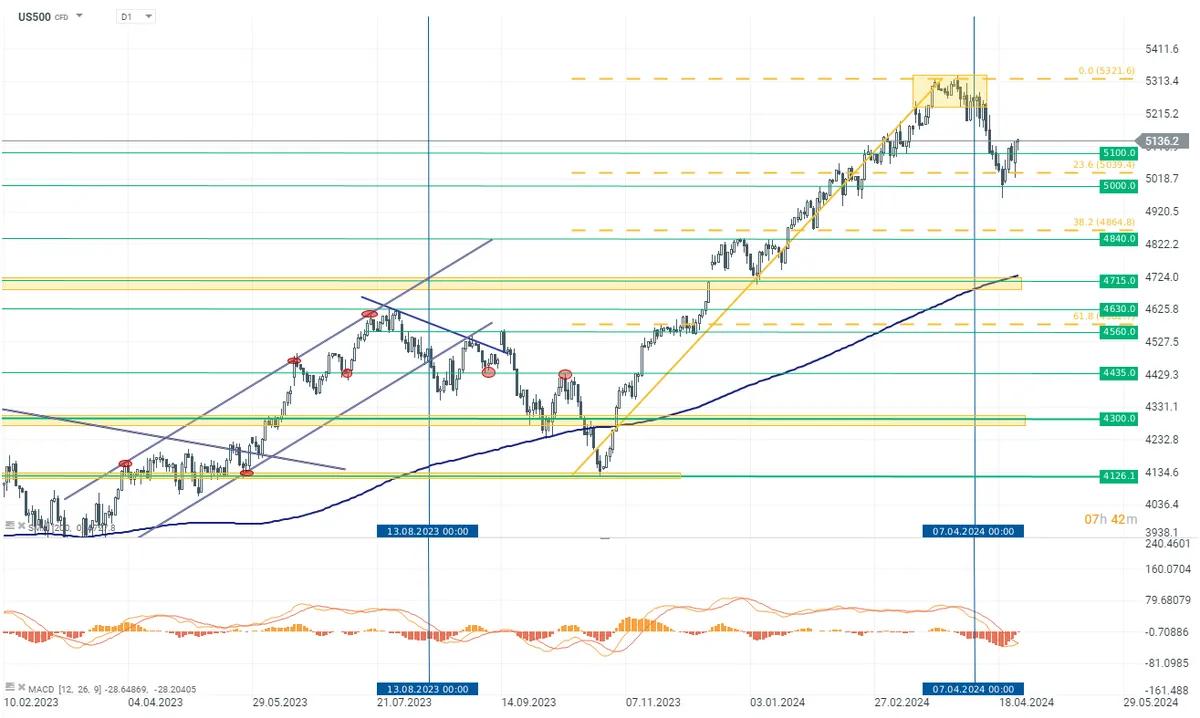

On Wall Street, major indices experienced declines, with the S&P 500 falling 0.6% and the tech-heavy NASDAQ Composite, launched in 1971, dropping 1.1%. The Dow Jones Industrial Average, a venerable index dating back to 1896, retreated from its recent all-time highs with a 0.4% decrease.

In the bond market, the yield on the 10-year Treasury, a crucial benchmark for numerous financial instruments, saw a slight increase to 3.84%. Energy markets showed modest gains, with U.S. crude and Brent crude, the global oil price benchmark, both rising slightly.

Currency trading saw the U.S. dollar strengthen against the Japanese yen, which has been Japan's official currency since 1871. The euro, introduced as a physical currency in 2002, also gained ground against the dollar.

As global markets navigate these complex economic indicators, the interplay between tech sector performance, inflation data, and central bank policies continues to shape investor sentiment and market dynamics.