Bank of England Survey: Wage Growth Expectations Steady, Business Uncertainty Eases

Recent Bank of England survey reveals stable wage growth projections and slightly reduced business uncertainty among British companies, while inflation expectations show a minor decline.

The Bank of England, the world's second-oldest central bank established in 1694, has recently released findings from its Decision Maker Panel survey, shedding light on the economic outlook of British businesses. The survey, which has been conducted since August 2016, provides valuable insights into wage growth expectations, business uncertainty, and inflation projections.

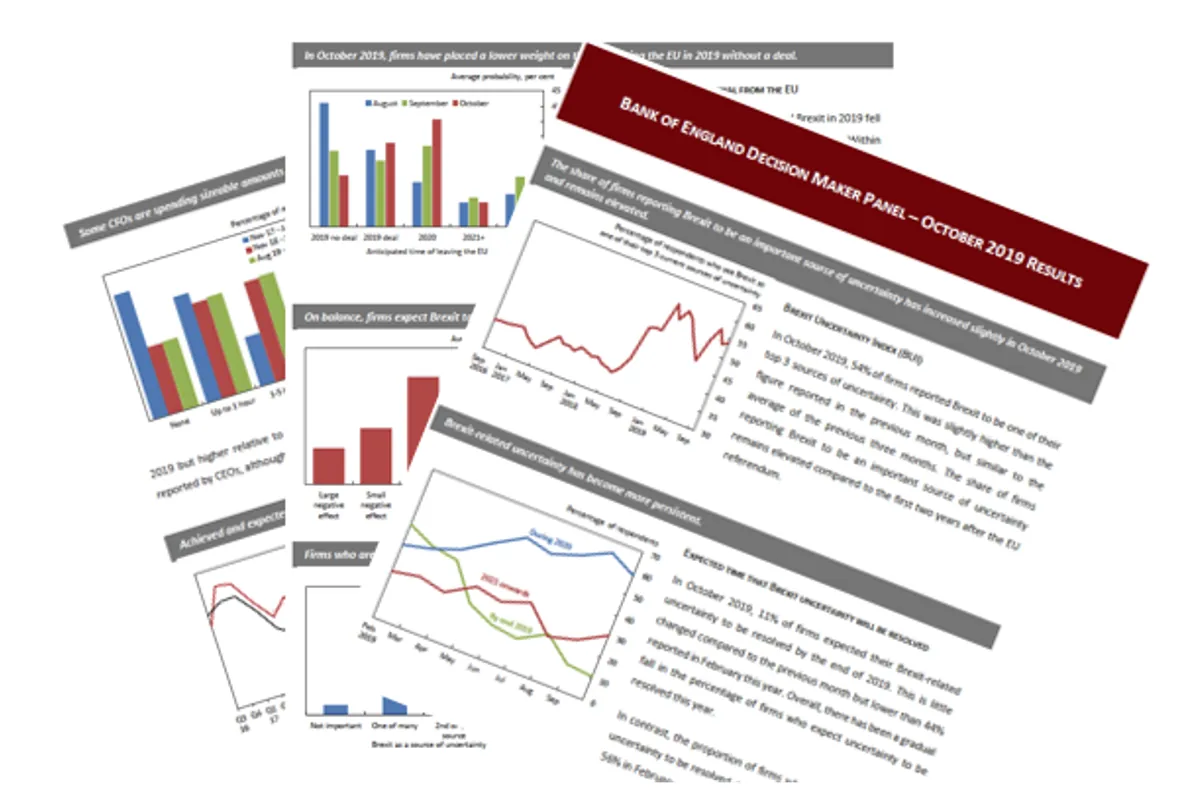

According to the latest data, British companies' wage growth expectations for the coming year remained unchanged at 4.1% in the quarter ending September 2024. This stability in wage growth projections comes at a time when the Bank's Monetary Policy Committee, which meets eight times annually to set monetary policy, closely monitors labor market conditions.

The survey also revealed a slight easing in business uncertainty. The proportion of firms reporting high or very high levels of uncertainty decreased by one percentage point compared to the previous quarter. This marginal improvement suggests a cautiously optimistic outlook among British businesses, despite ongoing economic challenges.

Inflation expectations among surveyed companies showed a minor decline. Businesses projected consumer price inflation to reach 2.6% in the year ahead, a 0.1 percentage point decrease from the previous survey. This figure is particularly significant given the UK's government-set inflation target of 2%, as measured by the Consumer Prices Index (CPI).

The Bank of England, nicknamed "The Old Lady of Threadneedle Street," plays a crucial role in maintaining the UK's financial stability. Its responsibilities extend beyond monetary policy, including the supervision of around 1,500 financial firms through its Prudential Regulation Authority and the management of the Real-Time Gross Settlement (RTGS) system for large-value payments.

These survey results provide valuable context for the Bank's decision-making process. The Monetary Policy Committee, which gained operational independence for monetary policy in 1997, will likely consider these findings alongside other economic indicators when determining the appropriate monetary policy stance.

The Bank's multifaceted approach to economic management is reflected in its various publications, including the quarterly Monetary Policy Report (formerly known as the Inflation Report) and the biannual Financial Stability Report. These documents, along with the extensive resources in the Bank's library of over 60,000 volumes on economics and banking, contribute to the institution's comprehensive understanding of the UK's economic landscape.

As the Bank of England continues to navigate the complex economic environment, its rich history and extensive expertise remain valuable assets. From its gold vaults holding around 400,000 bars worth over £200 billion to its archive containing records dating back to its foundation, the Bank's legacy underscores its enduring importance in shaping the UK's economic future.

"The latest survey results provide us with valuable insights into the current economic sentiment among British businesses. While wage growth expectations remain stable, the slight easing in uncertainty and the minor decline in inflation expectations are encouraging signs. However, we must remain vigilant and continue to monitor these trends closely as we work towards our monetary policy objectives."