BlackRock Cuts Support for Environmental and Social Shareholder Proposals

BlackRock, the world's largest asset manager, reduced its backing for environmental and social shareholder proposals to 4% in the recent AGM season. Overall support for shareholder resolutions increased due to governance-related issues.

BlackRock, the world's largest asset manager, has decreased its support for environmental and social shareholder proposals during the most recent annual general meeting (AGM) season. The firm backed only 4% of such proposals, down from 6.7% in the previous year, according to a report on its global voting record released on August 21, 2024.

Despite the reduction in support for environmental and social proposals, BlackRock's overall backing for shareholder resolutions increased from 9% to 11%. This rise was primarily driven by increased support for governance-related issues.

The asset manager, which oversees more than $10 trillion in assets, explained its rationale for rejecting the majority of environmental and social proposals. According to the report, many proposals were deemed "over-reaching, lacked economic merit, or sought outcomes that were unlikely to promote long-term shareholder value." The firm also noted that a significant percentage of proposals addressed business risks that companies already had processes in place to manage, making them redundant.

Interestingly, BlackRock did not support any of the 88 proposals aimed at forcing companies to roll back their sustainability risk management plans, including efforts to align operations with global climate goals. This stance aligns with the firm's increasing focus on sustainable investing, with a goal to have 100% of its portfolios ESG integrated.

Out of the 20 proposals BlackRock supported this year, four were related to climate and natural capital. These concerned disclosures at Berkshire Hathaway, Denny's Corporation, Jack in the Box, and Wingstop.

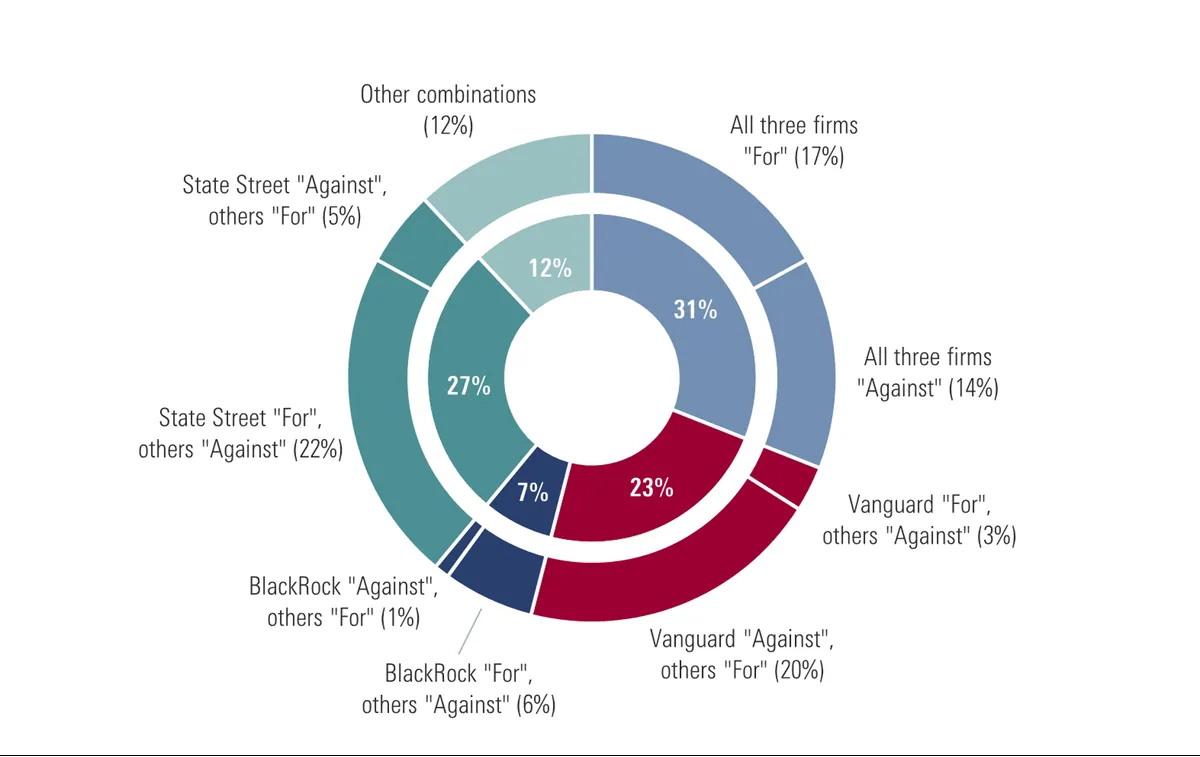

In the broader market, overall support for ESG proposals remained flat at 23%, according to industry tracker Morningstar. However, support for environmental and social resolutions specifically decreased from 19% to 16%.

BlackRock's voting record shows that it supported management positions 88% of the time across more than 169,200 proposals globally, consistent with previous years. The firm also backed the election of board directors 90% of the time. However, it declined to support 128 proposals at 104 companies due to concerns about inadequate disclosure or effective board oversight of climate-related risks.

"In our assessment, the majority of these (proposals) were over-reaching, lacked economic merit, or sought outcomes that were unlikely to promote long-term shareholder value."

This voting pattern reflects BlackRock's ongoing efforts to balance its commitment to sustainability with its fiduciary duty to clients. Since 2017, the firm has been pushing for greater corporate disclosure on climate change risks, launching its first ESG-focused exchange-traded funds in 2018. However, the company has faced criticism for not always aligning its voting practices with its stated climate commitments.

As the world's largest ETF provider through its iShares brand, BlackRock's voting decisions carry significant weight in the corporate world. The firm's annual letter to CEOs of public companies, penned by CEO Larry Fink, often focuses on sustainability issues and sets the tone for corporate governance expectations.