Brazil's Central Bank Clarifies Stance on Interest Rates and Inflation

Brazil's central bank director Gabriel Galipolo refutes interpretations of his recent statements, emphasizing data-dependent approach. Market perceptions shift as policymakers clarify stance on monetary policy options.

Gabriel Galipolo, director of monetary policy at Brazil's central bank, has addressed recent interpretations of his statements regarding interest rates. Speaking at an event in Sao Paulo on August 22, 2024, Galipolo emphasized that the central bank maintains a data-dependent approach and has not been cornered into raising interest rates.

The Banco Central do Brasil, established in 1964, plays a crucial role in shaping the country's monetary and credit policies. As the largest economy in South America and the 9th largest globally by nominal GDP, Brazil's economic decisions have far-reaching implications.

Galipolo reiterated that all policy options remain on the table for the upcoming monetary policy decision scheduled for September 17-18, 2024. He noted that market perceptions have shifted, recognizing the central bank's increased flexibility in decision-making.

"A difficult position for the central bank is not having to raise interest rates. The difficult position for the central bank is dealing with inflation outside the target."

This statement underscores the central bank's commitment to its inflation targeting regime, adopted in 1999. The current inflation target for 2024 is set at 3%, with a tolerance interval of 1.5 percentage points. This approach aims to maintain economic stability, particularly given Brazil's history of hyperinflation in the 1980s and early 1990s.

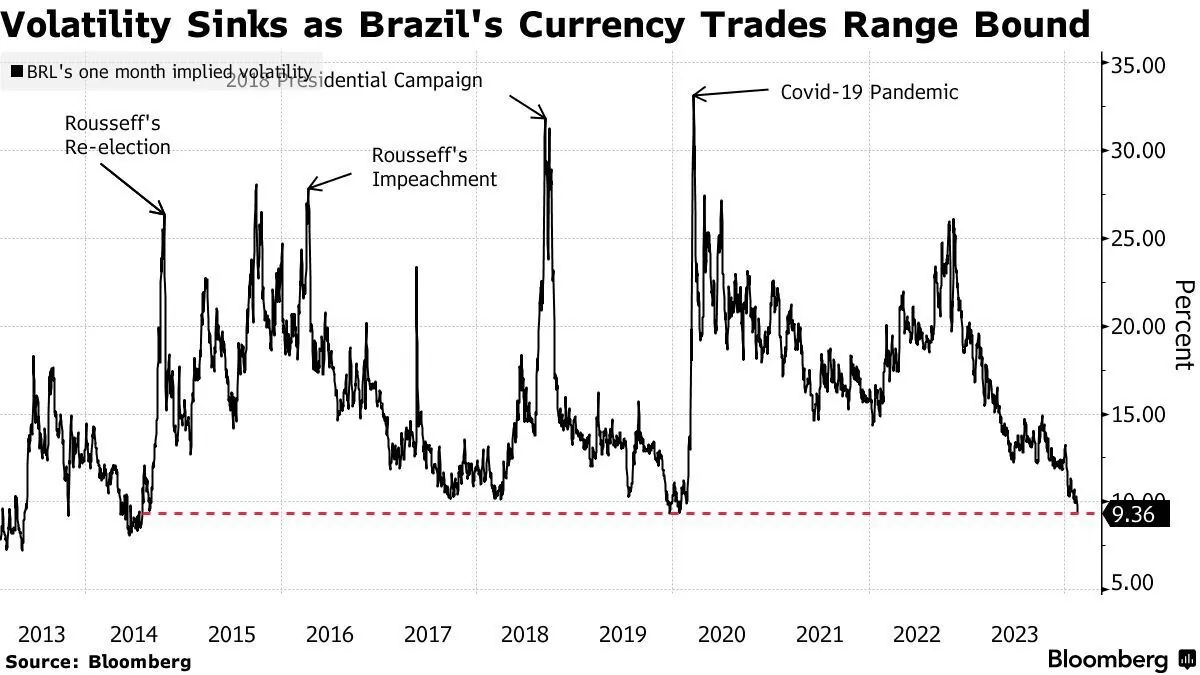

Galipolo's remarks align with recent communication efforts by the bank's rate-setting committee members. These efforts aim to clarify the interpretation of the minutes from the latest rate decision, where borrowing costs were held steady at 10.5%.

Diogo Guillen, the bank's director of economic policy, also spoke at an event in Rio de Janeiro on the same day. He cautioned against overemphasizing the balance of risks as a guidance tool for monetary policy. This clarification comes as the central bank noted more upside than downside risks to inflation in its recent minutes.

The Brazilian real, introduced in 1994 to replace the cruzeiro real, has faced significant challenges over the years. The central bank's management of foreign exchange reserves, among the largest globally, plays a crucial role in maintaining currency stability.

As Gabriel Galipolo is widely seen as a potential successor to Governor Roberto Campos Neto, whose term ends in December 2024, his statements carry significant weight in shaping market expectations. The central bank's formal autonomy, granted in February 2021, aims to shield monetary policy decisions from political interference.

Brazil's diverse economy, with strong agricultural, manufacturing, and service sectors, requires careful monetary management. As part of the BRICS group of major emerging economies, Brazil's economic decisions can have ripple effects across Latin America and beyond.

As the September monetary policy meeting approaches, market participants will closely monitor further communications from the central bank. The Selic rate, Brazil's benchmark interest rate, remains a key tool in the bank's efforts to balance economic growth and inflation control in this dynamic emerging market.