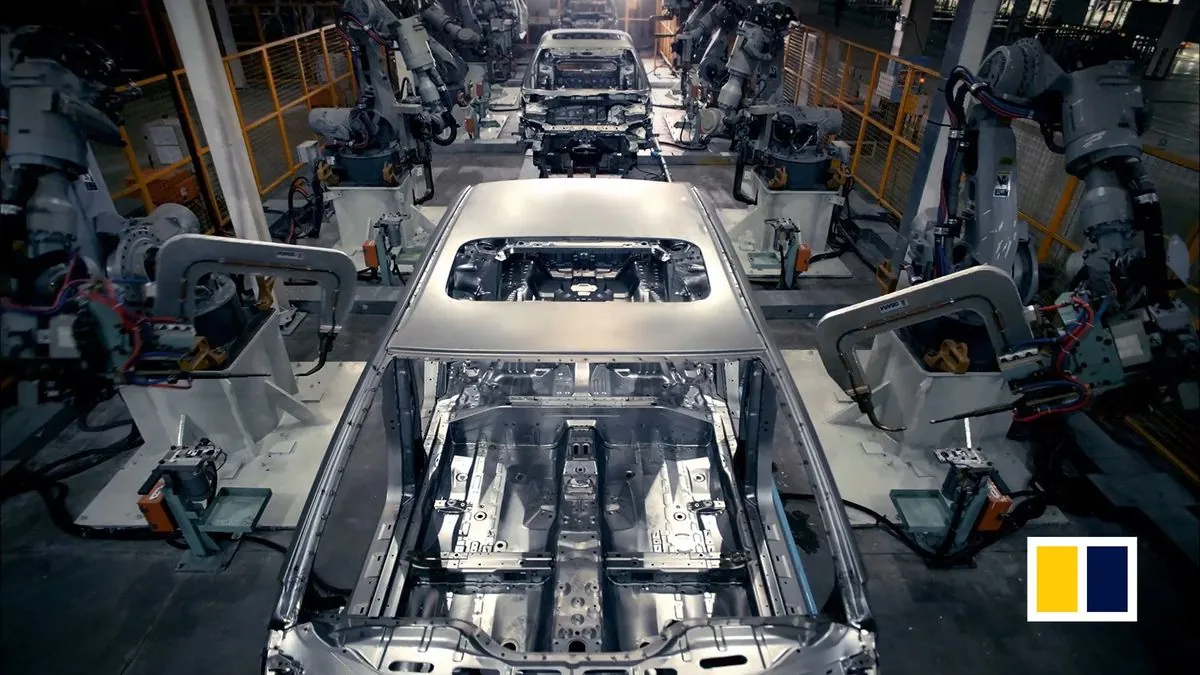

BYD's Hybrid Surge: Opportunities and Challenges in Global Expansion

BYD's hybrid sales outpace electric vehicles in 2024, signaling a shift in strategy. The Chinese automaker faces export opportunities amid growing global demand, but encounters regulatory hurdles and fierce competition.

BYD Co Ltd, China's leading electric vehicle manufacturer, is experiencing a significant shift in its product mix. In the first nine months of 2024, the company sold 1.6 million hybrid vehicles, surpassing its pure electric vehicle sales of 1.2 million units. This marks a notable change from the previous year when electric vehicles dominated BYD's sales figures.

The surge in hybrid sales reflects a broader trend in China's automotive exports. Since 2020, the country's hybrid vehicle exports have doubled annually, reaching over 200,000 units in 2023. This growth is part of China's expanding presence in the global automotive market, with combined exports of electric powertrains totaling approximately 1.5 million in 2023.

BYD's success in the hybrid segment can be attributed to several factors. As the world's largest seller of plug-in hybrids, the company benefits from economies of scale and pricing power. Additionally, BYD's position as the second-largest battery manufacturer allows it to source crucial components at lower costs.

However, BYD's expansion into global markets faces significant challenges. The rise of Chinese vehicle exports has sparked protectionist measures in several countries. For instance, the United States has quadrupled import tariffs on Chinese electric vehicles to over 100%, while the European Union is considering additional tariffs. Turkey has recently imposed strict conditions on hybrid imports, and Brazil, the largest importer of Chinese hybrids in 2023, plans to increase levies to 35%.

The focus on hybrids also raises questions about their role in the green transition. As economies strive to reduce emissions, the use of internal combustion engines in hybrid vehicles may expose this category to regulatory changes.

BYD faces stiff competition from established automakers in the hybrid market. Mercedes-Benz Group AG and Bayerische Motoren Werke AG (BMW) lead the European hybrid segment, while Toyota Motor dominates emerging markets with its pioneering Prius model. These incumbents possess strong local production capabilities and established brand recognition.

Despite these challenges, BYD's hybrid strategy has been well-received by investors. The company's Hong Kong-listed shares have outperformed the benchmark this year, trading at 19 times forward earnings compared to the sector average of 12.

As BYD navigates the complex landscape of global automotive markets, it must balance the opportunities presented by growing hybrid demand with the risks of increased competition and regulatory hurdles. The company's ability to adapt to these challenges will be crucial in maintaining its position as a leader in the evolving automotive industry.

"Our hybrid sales growth demonstrates the market's demand for flexible powertrain solutions. We remain committed to offering a diverse range of environmentally friendly vehicles to meet various consumer needs and regulatory requirements across global markets."